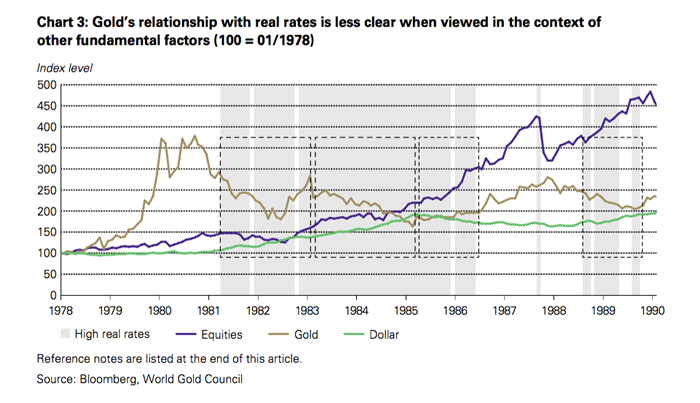

As the US economy starts to show signs of rebalancing, paving the way for monetary policy normalisation, we explore the misconceptions surrounding the relationship gold has with real interest rates. We demonstrate that higher real rates are not unconditionally adverse for gold, as the effect of other factors needs to be considered. Thus, gold’s portfolio attributes are not compromised by a return to a normal interest rate environment. In addition, we find the influence US real interest rates have on gold has receded over the last few decades as demand has shifted from West to East.