In Q2 2009, central banks became net buyers of gold for the first time in two decades and have continued to purchase since then. Gold’s lack of credit risk and market depth, and the fact that it is almost universally permissible in the investment guidelines of the world’s central banks have made it an increasingly attractive investment alternative.1 In addition, the deteriorating credit quality of government debt has been a catalyst for rising gold demand. Emerging-market central banks, which own on average approximately 4.6% of foreign reserves in gold – well below the 22% allocation of their developed-market counterparts – have begun increasing their gold allocations. In 2012, as in years prior, a diverse group of central banks added to their gold reserves, including the central banks of Brazil, Russia, Mexico, Korea, the Philippines, Iraq, and Kazakhstan.

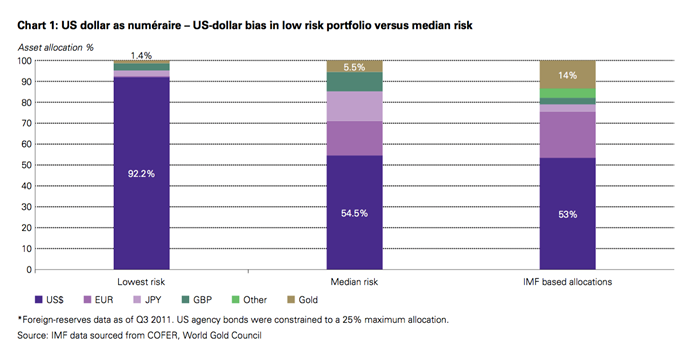

As these institutions picked up gold purchases, a natural question followed: what level of gold reserves is appropriate for emerging-market central banks? To answer this, we conducted a statistical analysis to determine optimal gold-allocation ranges for a foreign-reserve portfolio.3 The study considered this question from multiple perspectives: it examined the appropriate allocation to gold when reserves are measured in US dollars and compared that to optimal allocations when foreign reserves are measured from a local-currency perspective. The study concentrates on nine different emerging-market currencies, including the Indian rupee, Singapore dollar, Brazil real, and Thai baht. Changing the numéraire, or currency in which assets are measured, is an important consideration since emerging-market central banks report their reserve asset performance in their domestic currency. As such, measuring foreign reserves in local currencies may be the most relevant benchmark for some of these institutions.

Our analysis shows that, when foreign reserves are measured in US dollars, optimal allocation to gold ranged between 4.6% and 7.0% for medium levels of risk, depending on portfolio mix. More importantly, we found that through the lens of local emerging-market currencies, optimal gold allocations were significantly higher than those from the US-dollar analysis. When viewed from a local perspective, optimal gold allocations increased to a range between 8.4% and 10.0%, almost four percentage points higher than the allocations suggested from a US-dollar perspective. This higher allocation to gold is not the result of gold’s price appreciation over the past decade, as we used a conservative nominal price return of 4% for the analysis – compared to a historical 13.5%. Rather, it is a by-product of gold’s low correlation to other assets, similar volatility across currencies, and a negative correlation to the US dollar.

As central banks reallocate their reserves and adjust their gold holdings to more optimal levels, we are likely to see a continuing trend of central-bank purchases. A four percentage- point increase to gold reserves among emerging-market central banks, based on the optimal allocations found in this study, could translate into an additional 6,000 tonnes of gold demand from the official sector.