The sovereign debt problem of the eurozone that surfaced in late 2009 made clear that the global financial crisis and economic recession are not over. In early May 2010, European leaders agreed to set up a financial stability mechanism, with a commitment to provide liquidity close to $1 trillion in total.1 While this action took some by surprise, it certainly sent a strong signal to the market and helped extinguish the fire in the government bond markets – at least for the time being. Yet these fire-extinguishing operations were too late to prevent the development of a crisis that is essentially a eurozone banking crisis. The banking sector is now under close scrutiny and a large number of eurozone banks have been forced to take stress tests; the results and the information disclosure that they imply will be important for the future of the eurozone.

Since 2001, gold has outperformed many asset classes and is back in vogue, especially since the onset of the financial crisis of 2007 because investors view it as an alternative to fiat money or complex financial papers that are difficult to price.

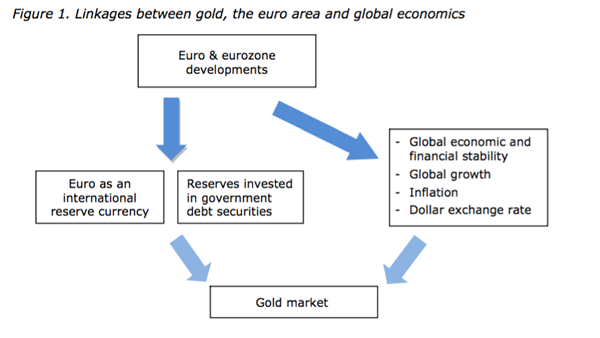

The main purpose of this report is to analyse the implications of potential eurozone developments for the gold market. To this end, we address issues directly related to current eurozone conditions and explore possible scenarios for the eurozone economies in the near future.

- The economics of gold

- Stylised facts

- Gold correlations

- The eurozone and the euro

- The state of the eurozone

- The euro as a reserve currency and government debt

- Scenario-building: Driving factors and forces

- Possible scenarios for the eurozone

- Eurozone dream scenario

- Muddling-through scenario

- Double-dip scenario

- Doomsday scenario

- Implications of the scenarios

- Conclusions