The International Monetary System and the Canary in the Goldmine

19 August, 2025

The International Monetary System and the Canary in the Goldmine1

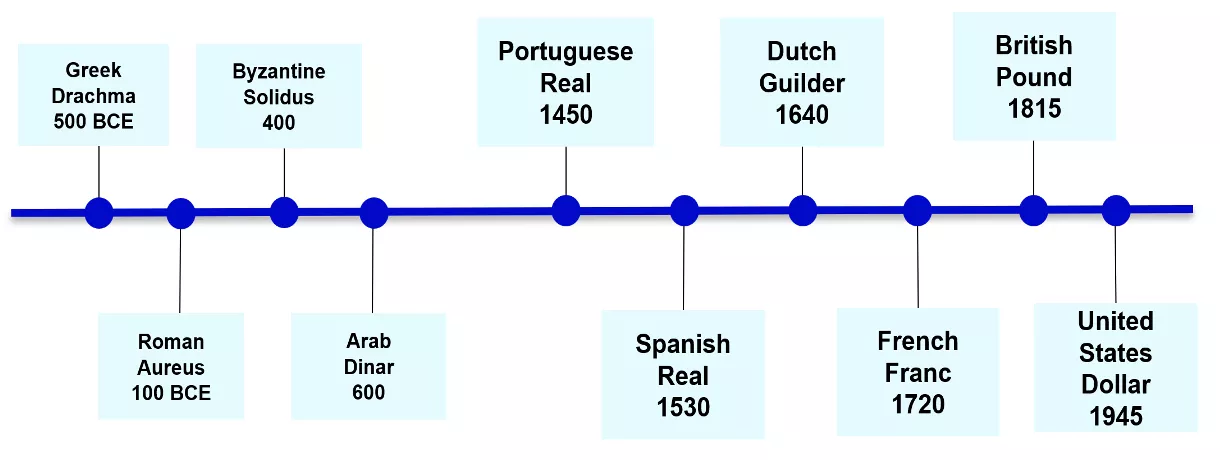

Over history, the world has adopted the currency of the leading country for global payments. The USD is, arguably, the first global currency untethered from precious metals.

For millennia, gold, and to a lesser extent silver, underpinned the value of money—at first directly through the stamping of gold coins, then indirectly with fiat currency “collateralized” by government gold holdings through guaranteed convertibility at a fixed rate. And, throughout history, the dominant international currency has tended also to be the domestic currency of the strongest economic and geopolitical power, which had the military force and the wherewithal to provide “global public goods” – freedom of navigation, enforcement of contracts and rules of international commerce, finance and relations between states; wealth to support its currency as a store of value; and extensive global trade links underpinning the use of its currency as a means of payment.

Chart 1: Rise and Fall of Global Currencies over History

The leading country typically had also a technological edge, supporting both military and economic leadership, which was often deployed to protect commercial, financial and geopolitical stability. The leading power thus offered what is known as “hegemonic stability” and generally presided over periods of peace—such as Pax Romana, Pax Brittanica and, following WWII, Pax Americana.

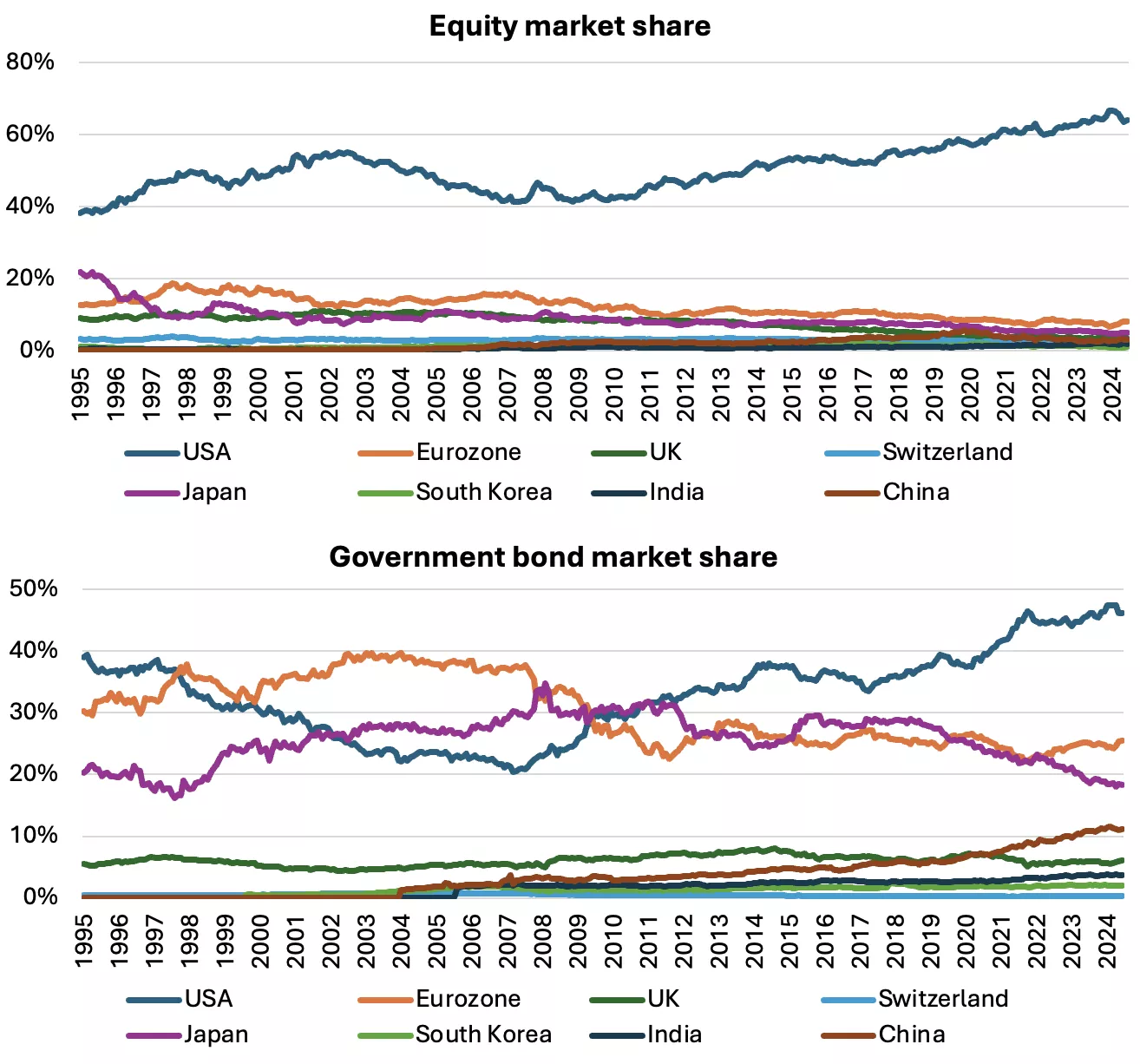

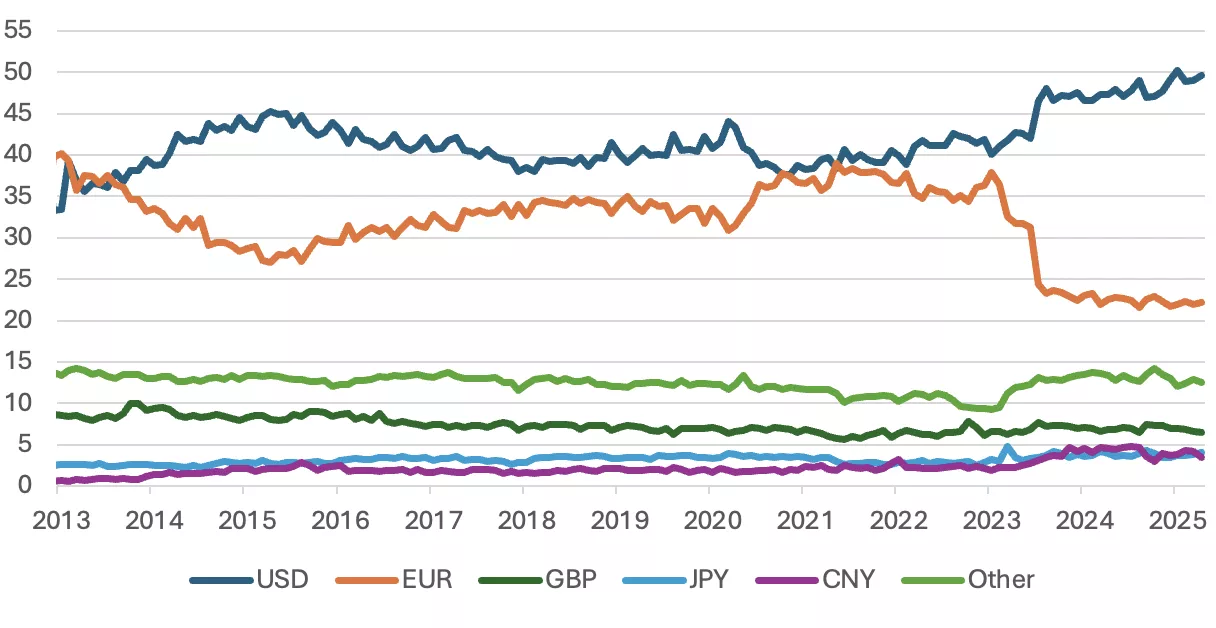

Despite external challengers and internal debt dynamics, the USD still dominates global capital markets investments and cross-border payments

The recent backlash against the USD has arisen more for geo-political rather than economic reasons. The size and complexity of US capital markets towers over other countries with high levels of both public and private investment in USD financial assets. And, while the US share of global trade has declined, the USD still represents about half of all cross-border payments facilitated by SWIFT.

Chart 2: The US dominates global capital markets, with the divergence rising until most recently

Source: MSCI, Refinitiv, Invesco, monthly data as at 31 May 2025.

Chart 3: USD represents about half of all cross-border payments facilitated by SWIFT

Source: Society for Worldwide Interbank Financial Telecommunication, Macrobond, Invesco. Monthly data as at 07 June 2025.

The attempts to unseat the USD have been more political or opportunistic than economic in nature and no alternative to the USD yet exists. Russia responded to the suite of sanctions by not only seeking to diversify into other currencies including monetary gold but also by advocating for an alternative BRICS' currency. As this has floundered, China and other countries have continued to diversify reserves into gold as a protective measure. The ECB has taken a different approach, seeing in the recent decline of the USD an opportunity for the Euro’s role as a global currency to strengthen but faces strong headwinds.2

Supplanting the role of the USD is not imminent as the Chinese government does not necessarily want to cede control over its currencies and European national governments do not have political support to cede further control to the EC. While China is successfully ramping up the use of its currency for bi-lateral trade settlement, the use of the RMB as a global currency would entail freedom of capital flows and the running of balance of payments deficits, neither desired by the government. Europe has no such restrictions on capital flows but suffers from a fragmentation of financial markets and fiscal authority. And, while the ECB expects to launch a central bank digital currency (CBDC) in the near future, this is more likely initially to be used in intra-European trade than between two third-party countries. Finally, the BRICS currency initiative collapsed due to lack of consensus and support amongst its members.

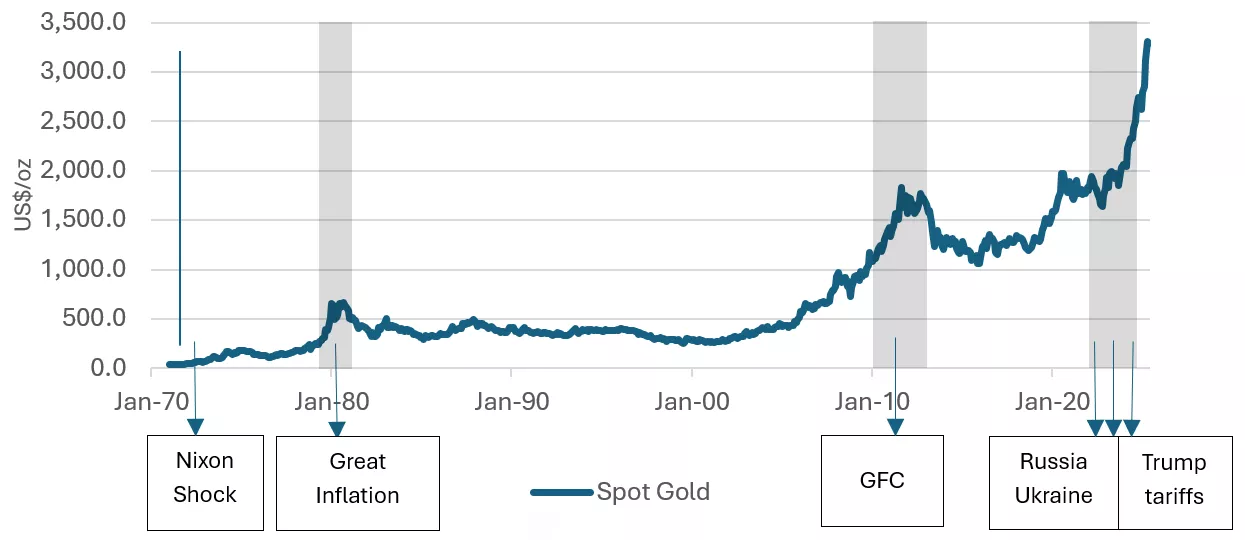

US tensions from both external and internal forces have thus been diverted to the gold market as reflected in its unprecedented rise in price since the USD was delinked from gold

The USD was, arguably, the first global currency untethered from a precious metal and held solely on the basis of trust in the issuing country. Trust in the USD was first tested in 1971, when President Nixon severed the convertibility of the USD to gold in the face of a level of foreign claims that exceeded the domestic gold stock. From 1971 to 1973, the gold price increased from $40/oz in 1971 to $108/oz as the price adjusted to underlying demand and supply variables. Since, the USD regained and until now, has retained the world’s trust based on the “full faith and credit” of the US, despite intermittent challenges and corrective actions.

Chart 4: The gold price has acted as a barometer of stress emanating from the US

The gold price run-up since 2022, however, may be signaling a pivot in the existing international monetary system and the start of a transition, albeit gradual, from a US-centric to a more multi-polar system. The recent price rise coincided with the Russia invasion of Ukraine and subsequent severing of a large part of Russia’s access to its USD and EUR foreign currency reserves, as well as to the western led financial system, including the SWIFT global payments system. Subsequently, the new Trump Administration reversed the US government’s traditional support for a free global trading system, multi-lateralism and a strong dollar, weakening the currency and contributing to demand for gold. Finally, the Administration has shown ambivalence to the US traditional role as “keeper of the peace”. These actions have spurred both central bank purchases of gold to diversify foreign currency reserves and private investor interest to protect against the risk of tariffs and, potentially, stagflation.

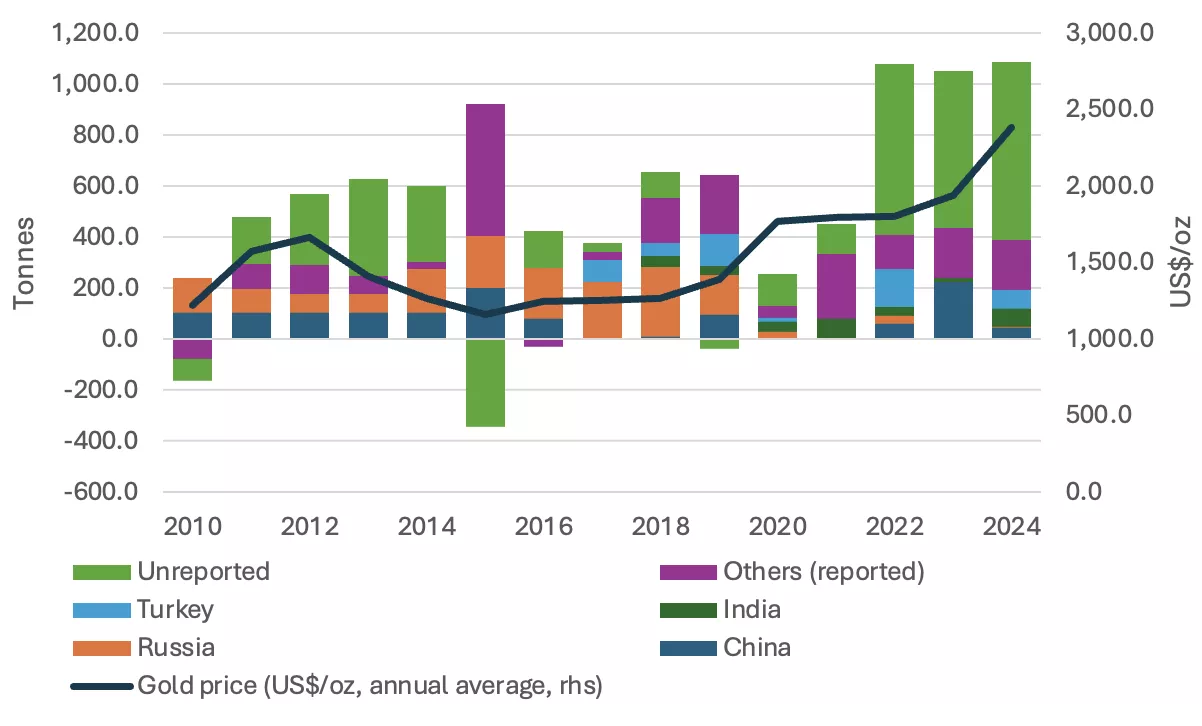

Chart 5: Emerging market central banks have sought to diversify USD foreign currency reserves by increasing purchases of gold

Source: ICE Benchmark Administration, IMF, respective central banks, World Gold Council

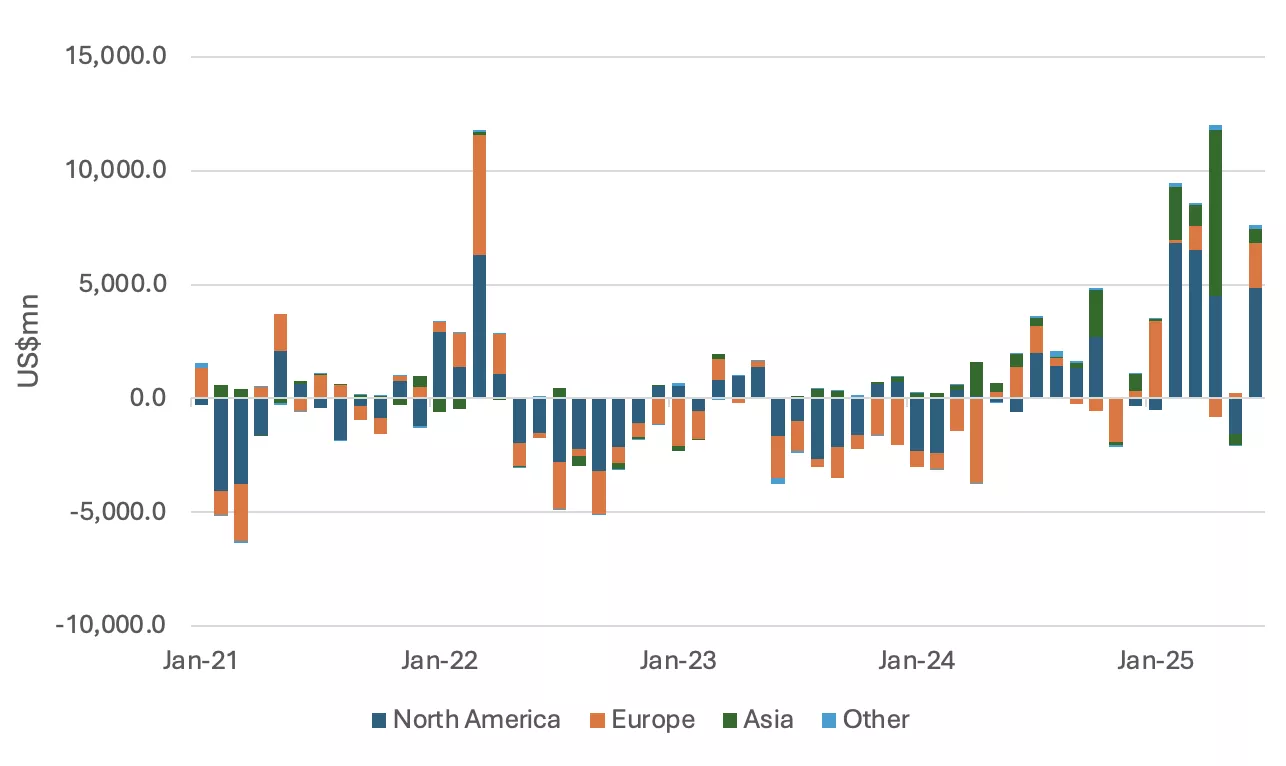

Private investment demand for gold has also increased, partly due to concerns that a global increase in tariff barriers could lead to “stagflation”-- an economic scenario in which gold vastly outperformed other financial asset classes over the past half-century. Demand for gold Exchange Traded Funds (ETFs) spiked following Trump’s “Liberation Day” announcement on April 6th and has remained largely sustained throughout July, with a net outflow in May coinciding with the announcement of a China-US “entente”, which has yet to come to fruition in concrete terms.

Chart 6: Net investment in gold ETFs spiked following the “Liberation Day” tariff announcements

The price of gold is likely to continue to be supported by geo-political concerns over the USD and the Trump Administration’s policies

The recent run-up in the price of gold has coincided with deteriorating trust in the US due to its deployment of sanctions and, more recently, access to markets to further domestic policy objectives. As part of the Administration’s policy of “America First”, the Administration is also walking away from its commitments under various international treaties created in large part by the US in the post WWII period. Despite the Administration’s erratic modulation of its more extreme statements, trust has been eroded simply by a lack of policy predictability.

At the same time, there is no credible challenger or contender who is able to provide the world with a currency with the depth and quality of markets to replace the USD. The recent run-up in the price of gold is likely signaling the start of a transition from a hegemonic to a more multi-polar system but a transition that is likely to occur only gradually and in stages. While the size of the US economy exceeded that of Great Britain in the late 19th century, the USD only emerged as the world’s preeminent currency fifty years later. During this transition and period of uncertainty, the demand for gold is likely to remain buoyant as it reassumes its historic role as a safe store of value and nobody’s liability.

Footnotes

1This post is an abbreviated summary of Arnab Das and Jennifer Johnson-Calari, “The Canary in the Goldmine: What the Price of Gold Reveals about the Role of the USD and the International Monetary System, Institute of International Affairs, Rome, July 2025. See https://www.iai.it/en/pubblicazioni/c03/canary-gold-mine

2Christine LaGarde, “This is Europe’s Global Euro Moment”, Financial Times, June 16, 2025.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.