You asked, we answered: Are fiscal concerns driving gold?

24 June, 2025

Highlights

- Economic and trade policy uncertainties have led to a reallocation of global capital, causing a weaker dollar, rising gold prices, and US Treasury bond yields widening versus other high-grade sovereigns.

- Ongoing fiscal concerns will likely lead to bond market volatility, ultimately supporting the gold market as investors look for alternative safe-haven assets.

Passing of the baton

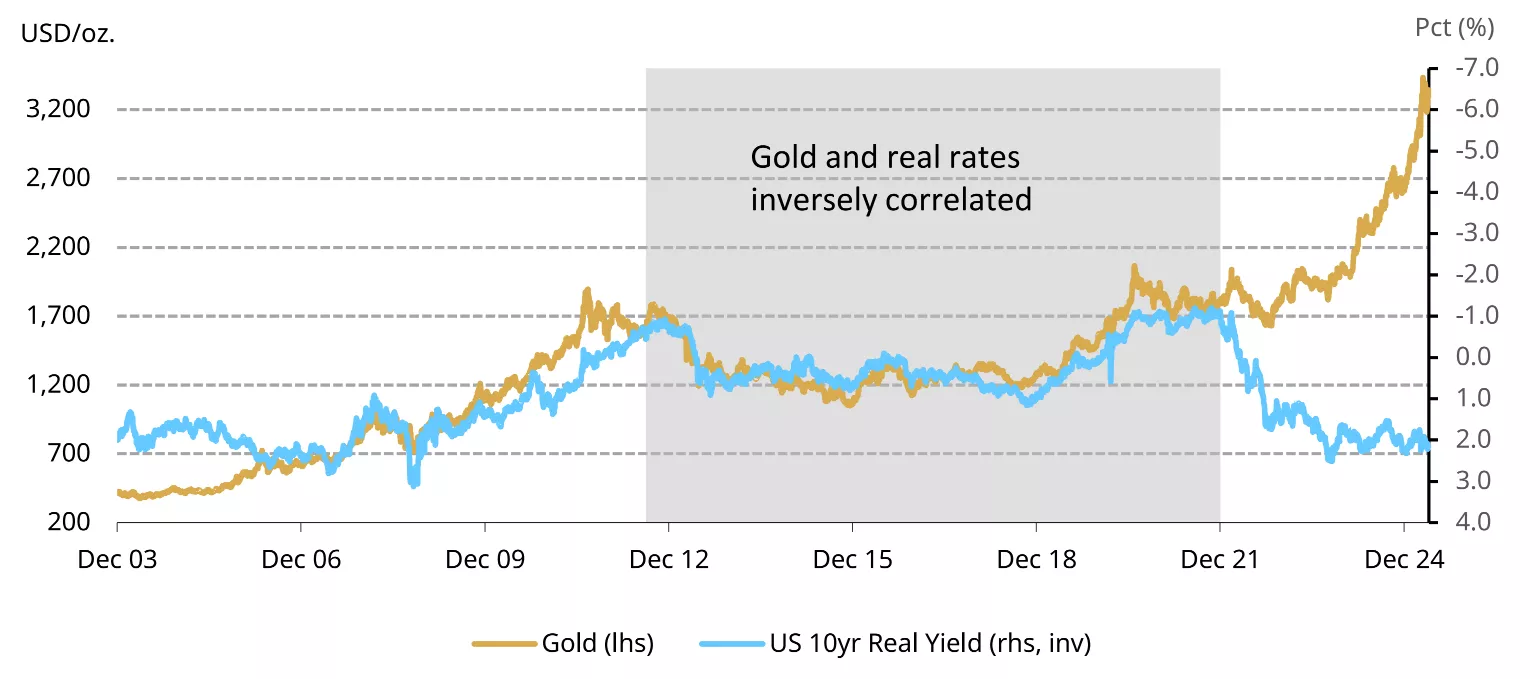

For about a decade, real interest rates were a prominent factor driving the gold price (Chart 1), i.e. gold was inversely correlated with real rates, with gold becoming less attractive as real interest rates rose. Since 2022, however, this inverse correlation has again been counterbalanced by other factors.1 As real rates rose – currently sitting above 2% – gold prices also generally rose, supported this time by investors seeking to mitigate a variety of risks and by central bank buying.

Chart 1: Higher opportunity costs counterbalanced by other factors

US 10yr Real Yield and Gold (USD/oz)*

*Data from 31 December 2003 to 30 May 2025.

Source: Bloomberg, World Gold Council

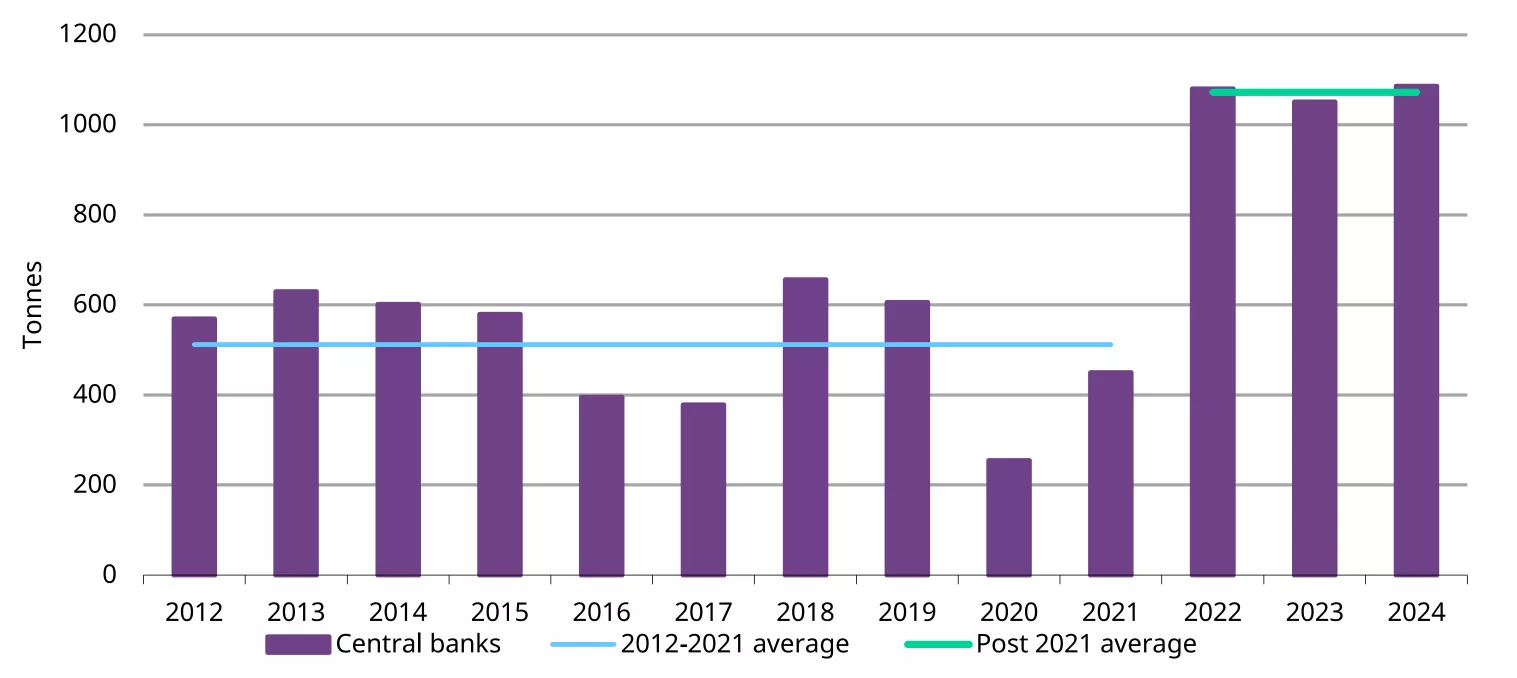

Indeed, central bank buying and the acceleration of those purchases that we have witnessed since 2022 is a big factor in gold’s strength (Chart 2). The reasons for this increased appetite from emerging market central banks for greater gold reserves are multiple, e.g. diversification, geopolitical risks, and gold’s performance in periods of crisis.

Chart 2: Central banks coming into the market in unprecedented levels

Annual central bank net purchases, tonnes*

*Data from 2012 to 2024.

Source: Metals Focus, World Gold Council

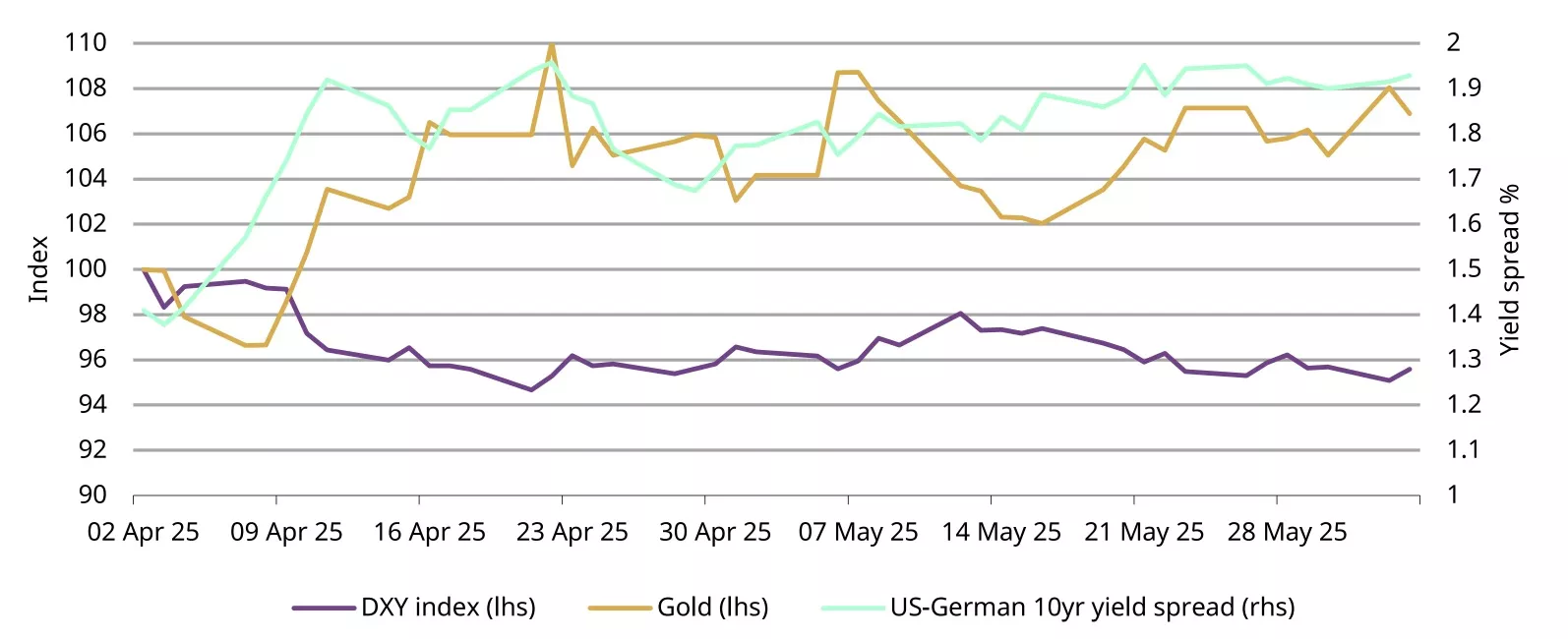

More recently, consumer confidence and business investment intentions have been affected by economic and trade policy uncertainty. This in turn has triggered a reallocation of global capital out of the US with global investors seeking out alternative safe-haven assets to US Treasuries. The consequences have been a weaker dollar, rising gold prices, and US bond yields widening versus other high-grade sovereigns, e.g. Germany (Chart 3).

Chart 3: “Liberation day”!

Gold, DXY and US-German 10yr yield spread

*Data from 2 April 2025 to 3 June 2025.

Source: Bloomberg, World Gold Council

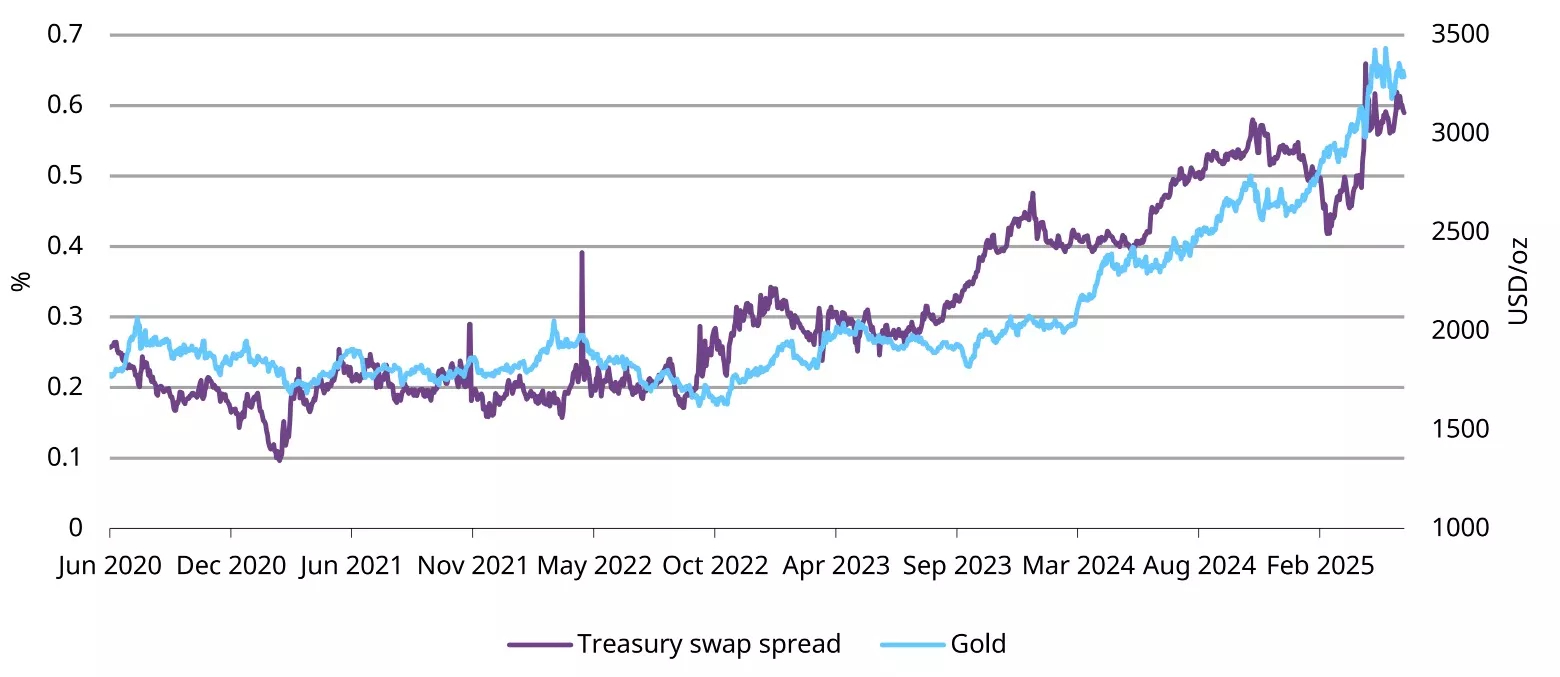

More broadly, we believe fiscal concerns have been one of the factors supporting the gold market (Chart 4). For example, the difference between the yield on a US government bond and the fixed rate of an interest rate swap has been pushed up – a potential sign of fiscal concerns.2 In other words, we are witnessing investors' inability or unwillingness to absorb debt issuance or sales by other bond holders at prevailing prices, in turn exerting upward pressure on bond yields, pushing the US Treasury swap spread higher.

Chart 4: Gold rising alongside US fiscal concerns

US 10yr Treasury swap spread and gold (USD/oz)*

*Data from 30 June 2020 to 30 May 2025.

Source: Bloomberg, World Gold Council

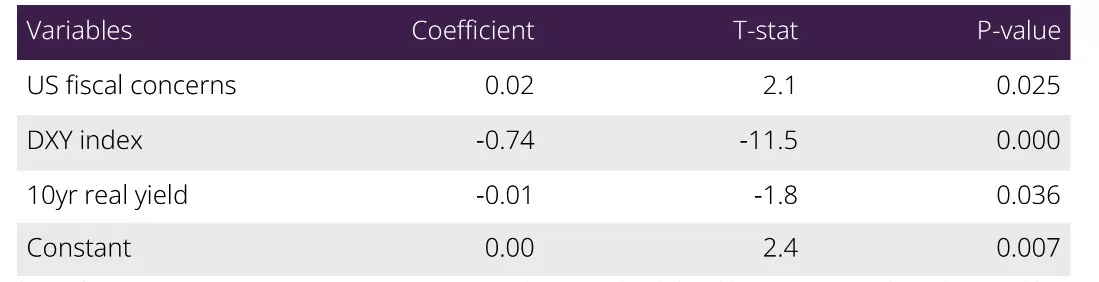

Our simplified analysis points out that the differential between US Treasuries and swap rates, which we believe is at least partly linked to US fiscal concerns, is statistically significant in explaining movements in the gold price (Table 1). In practical terms, when fiscal concerns increase – reflecting worries over US government debt sustainability or deficits – investors may seek the relative safety of gold, driving its price higher.3

Table 1: As US fiscal stress has increased, investors have sought out gold

Regression of gold returns on fiscal stress, DXY index and 10yr real yields*

* Data from 15 June 2022 to 15 June 2025. Regression analysis using log daily gold price returns as dependent variable.

Independent variables are: fiscal stress (US 10yr Treasury swap spread), DXY index and US 10yr real yields.

Source: Bloomberg, World Gold Council

The US’s precarious fiscal position

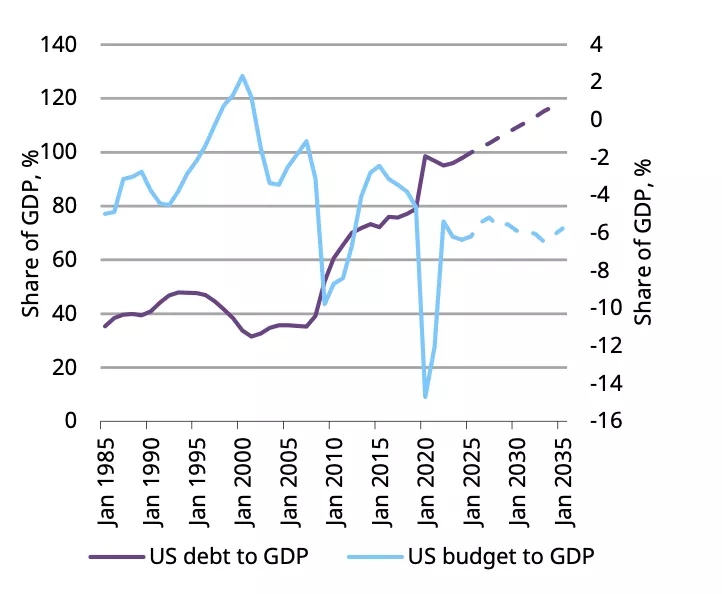

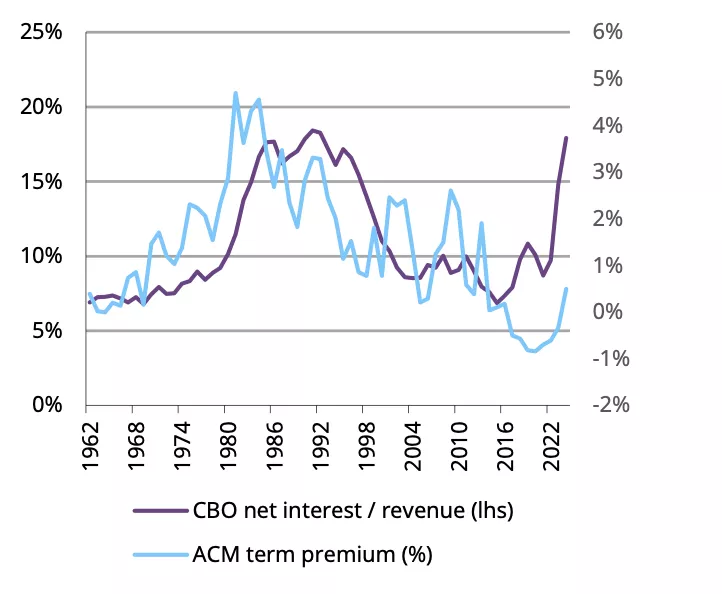

The gold market is likely to continue to be supported by US fiscal issues as the bond market will remain sensitive to US debt sustainability considerations. Indeed, the last two decades of relaxed fiscal policies (Charts 5 & 6) and shifts in the demand structure have now put the US in a precarious position.

Chart 5: Fiscal loosening started in 2001

US debt to GDP, US budget to GDP, and respective forecasts from the CBO*

*Data from 1985 to 2024, projections thereafter.

Source: Congressional Budget Office, Bloomberg, World Gold Council

Chart 6: Is the only way up?

US govt interest payments vs. 10yr term premia*

*Data from 1962 to 2024.

Source: Congressional Budget Office, Bloomberg, World Gold Council

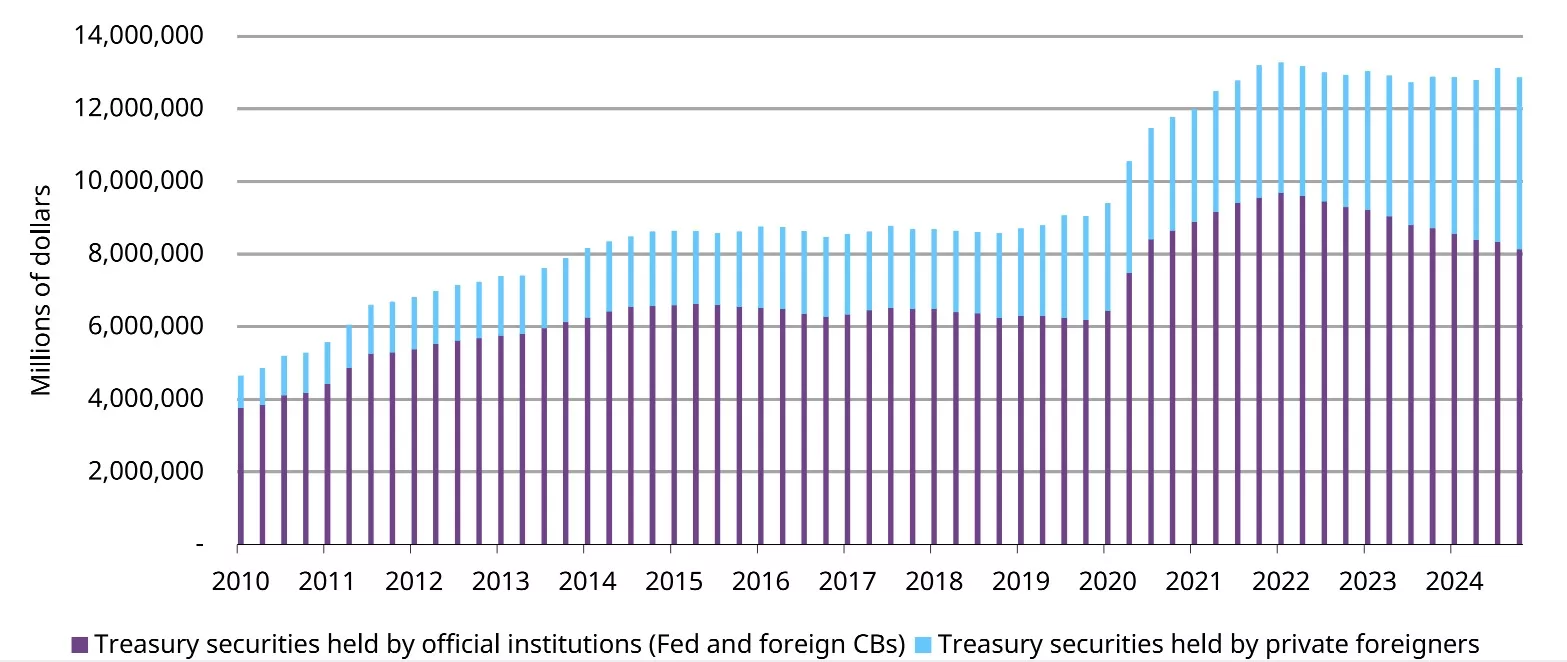

Demand for Treasuries from the Fed and foreign official institutions, which are least return sensitive, is falling (Chart 7). By contrast, foreign private investors are now the largest non-official holders of Treasuries and foreign private investors are likely to be the most price-sensitive category of investors as they are likely to have global mandates and therefore compare Treasuries with government bonds in multiple jurisdictions.

Chart 7: Treasury demand is becoming more price sensitive

Treasury securities held by official institutions and private foreigners*

*Data from 01 January 2010 to 31 December 2024.

Source: Board of Governors of the Federal Reserve System, World Gold Council

Full-blown fiscal crisis unlikely and unnecessary for gold support

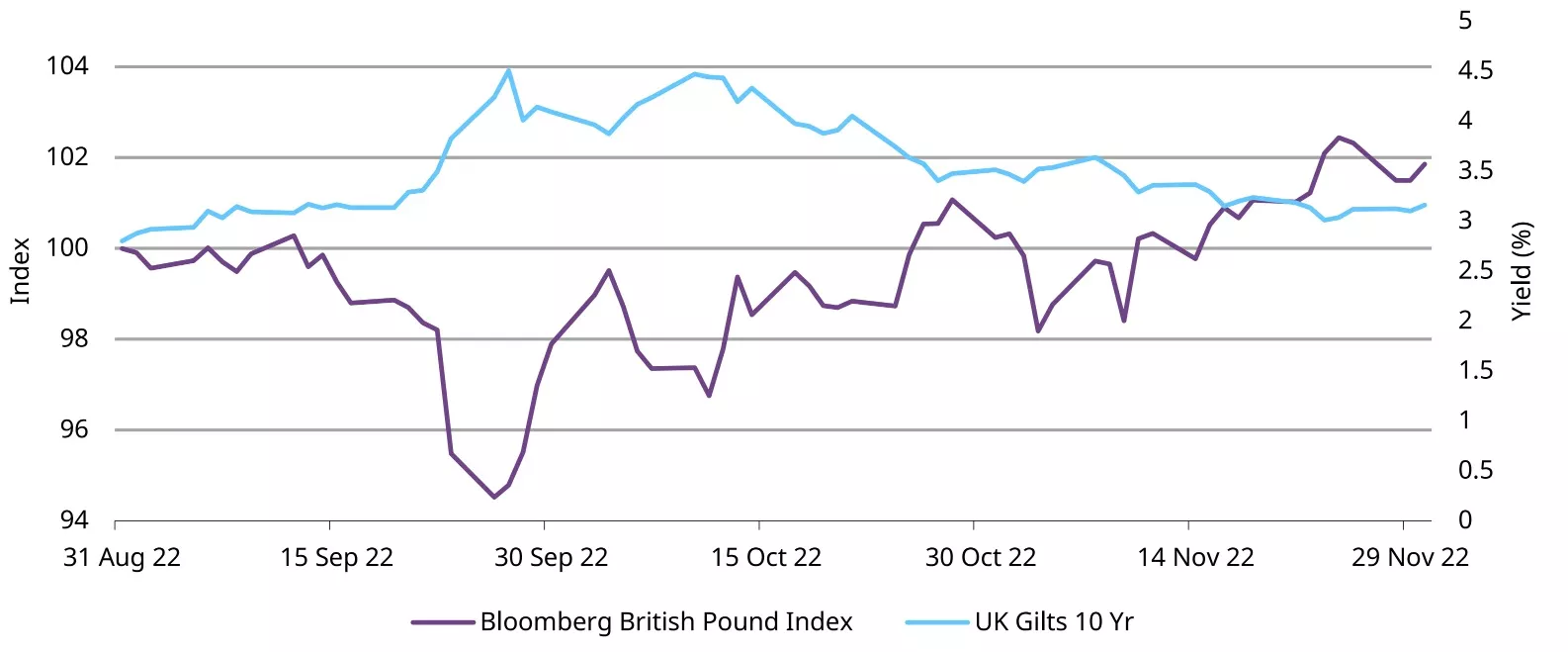

All of this does not mean a full-blown crisis is imminent. Such a crisis would require a short-term trigger – such as a debt-ceiling miscalculation resulting in a technical default – that exacerbates the existing long-term destabilising trends. Rather, the more likely outcome is a series of rolling mini-crises as political objectives and bond market expectations collide. In fact, when it comes to fiscal sustainability, perceptions matter as much as policy. If leaders give the impression that their commitment to long-term fiscal discipline is weakening – or that they are determined to force through policies that will weaken the fiscal position – then the reaction in bond markets is usually quick and severe. But this is generally short-lived as the government backs down in the face of market pressure and central banks can also step in to prevent yields rising too quickly (and they will always do so if those moves in yields threaten financial stability) as we witnessed in the UK 2022 mini-crisis (Chart 8). And as fiscal concerns come to the fore, gold – an alternative safe-haven asset – should remain supported.

Chart 8: UK 2022 mini-crisis

Bloomberg British Pound index and 10yr UK Gilt yield*

*Data from 31 August 2022 to 30 November 2022.

Source: Bloomberg, World Gold Council

Conclusion

The interest rate environment and geopolitical tensions undoubtedly play a significant role in driving the gold price but they are not the sole factors. Recently, we believe that fiscal concerns have also had a say. And while there is a strong belief that the US Treasury market will never lose its safe-haven status, a major crisis, while unlikely, is not impossible. However, the more likely outcome is a series of rolling mini-crises as highly indebted sovereigns like the US are confronted with market-imposed limits on fiscal largesse. This uncertainty and resulting market volatility are likely to give additional support to the gold market.

Footnotes

1Gold Mid-Year Outlook 2024: “The relationship between gold, real interest rates and the US dollar is not “broken” as some market participants may think.”

2BIS: Negative interest rate swap spreads signal pressure in government debt absorption

3A more detailed analysis would be needed to better assess the accuracy of the US Treasury swap spread as a direct proxy for fiscal issues, as well as its direct impact on the gold market. For example, we would need to test how this factor fits into our more comprehensive Gold Return Attribution Model – whether directly or indirectly – and if its effect persists once we have controlled for other factors.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.