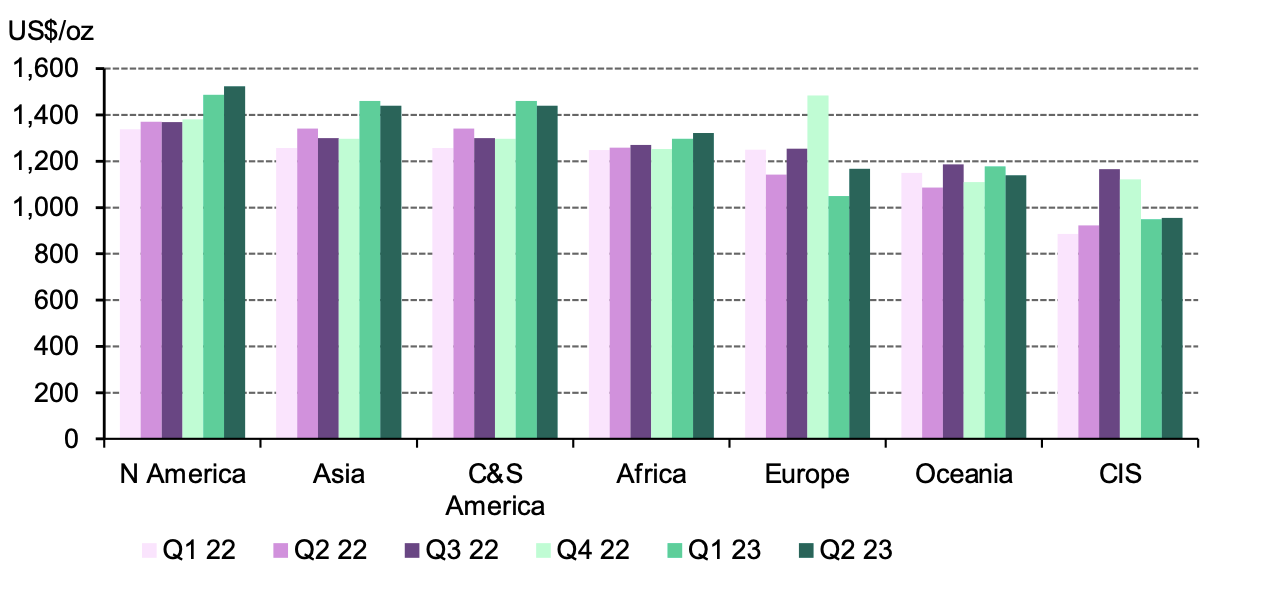

In Q2’23 the gold miners’ global average all-in sustaining cost (AISC) continued to climb, rising to US$1,315/oz. This represents an increase of 1% q/q and 6% y/y, maintaining the overall upward trend which began in Q1’21. There were some distinct regional variations in AISC in Q2’23. Europe recorded the largest increase in average AISC for the quarter, up 11% q/q to US$1.167/oz. In North America average AISC rose by 3% q/q to US$1,523/oz, while in Oceania the average AISC fell by 3% q/q to US$1,139/oz.

Regional variation in AISC

AISC consists of adjusted operating costs plus a gross all-in sustaining cost component. Adjusted operating costs are production costs incurred at the mine-site plus royalties and taxes per ounce of gold sold. Over the last year, it is these mine-site costs, such as labour, fuel and electricity, which have come under significant inflationary pressure. In Q2’23, global average adjusted operating costs fell by 3% q/q to US$963/oz, suggesting that input cost inflation is beginning to ease.

The gross all-in sustaining cost component includes corporate general and administration, reclamation and remediation costs, exploration and sustaining capital expenditure. In contrast to adjusted operating costs the global average gross all-in sustaining cost component increased by 11% q/q to US$352/oz, as costs rose across most regions.

In North America, the average AISC was impacted by a fall in the average grade of 7% q/q to 1.1g/t. This, coupled with an 18% q/q increase in the gross all-in sustaining cost component to US$436/oz, outweighed the fall in adjusted operating costs. At Nevada Gold Mines, the Barrick and Newmont joint venture in the US, the gross all-in sustaining cost component for Cortez increased by 41% q/q to US$501/oz as sustaining capital expenditure increased due to the ramp-up of the new open pit truck fleet. At Newmont’s Peñasquito in Mexico, the gross all-in sustaining cost component rose by 105% q/q to US$1,256/oz as operations were suspended following the labour strike.

In Oceania, the fall in average AISC in Q2’23 was driven by lower adjusted operating costs. However, the average gross all-in sustaining cost component increased by 19% q/q to US$299/oz. At Newcrest’s Cadia Valley operation in Australia the gross all-in sustaining cost component rose by 20% q/q to US$560/oz. Sustaining capital expenditure increased as work on the PC1-2 and PC2-3 underground block caves continued and exploration expenditure also rose. At Newcrest’s Lihir mine in Papua New Guinea the gross all-in sustaining cost component surged by 228% q/q to US$593/oz due to far higher sustaining capital expenditure from the procurement of a mobile fleet and the continuation of the Phase 14A expansions.

The increase in European average AISC was partly influenced by a slight fall in grade, but primarily by an increase in the gross all-in sustaining cost component, up 11% q/q to US$278/oz. At Agnico Eagle’s Kittila in Finland, the gross all-in sustaining cost component rose to US$321/oz from US$255/oz in Q1.23. Higher sustaining capital expenditure on underground shaft development and an increase in the volume of exploration drilling contributed to this rise

Looking ahead, there may be some easing of the global average AISC in the near term. However, persistent inflation, ongoing impact both of Russia’s invasion of Ukraine on fuel and energy costs and also from the potential regional escalation of the Israel-Gaza conflict on oil prices are all risks that could keep input costs elevated, impacting both the adjusted operating cost and the gross all-in sustaining cost component.