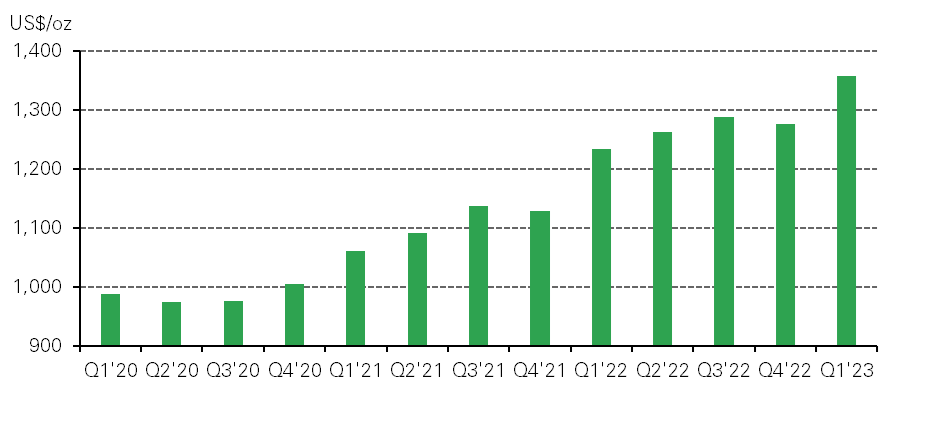

Costs in the gold mining industry resumed their upward trajectory in the first quarter of this year. This followed a short-lived break in Q4’22, when gold miners’ average all-in sustaining costs (AISC) had fallen by 1% q/q. Prior to this, costs had risen for the past three consecutive quarters, stretching back to Q1’22.

In Q1’23, AISC increased by 6% q/q to reach a record quarterly high of US$1,358/oz. This figure represents a 10% increase year-on-year. Rising industry costs since 2020 have been driven by inflationary pressure on all aspects of miners’ input costs, notably labour, fuel and electricity. This was the result of supply chain disruptions and government policies enacted in the wake of the COVID-19 pandemic. These factors were exacerbated by rising oil and gas prices following Russia’s invasion of Ukraine. In addition, regular cyclical factors further elevated costs in Q1’23. Costs are often higher in the first quarter of any year for mines operating in countries that have harsh winters, such as Canada and Russia. Meanwhile, in South Africa production efficiencies are impacted by worker absence during the holiday season, pushing costs higher.

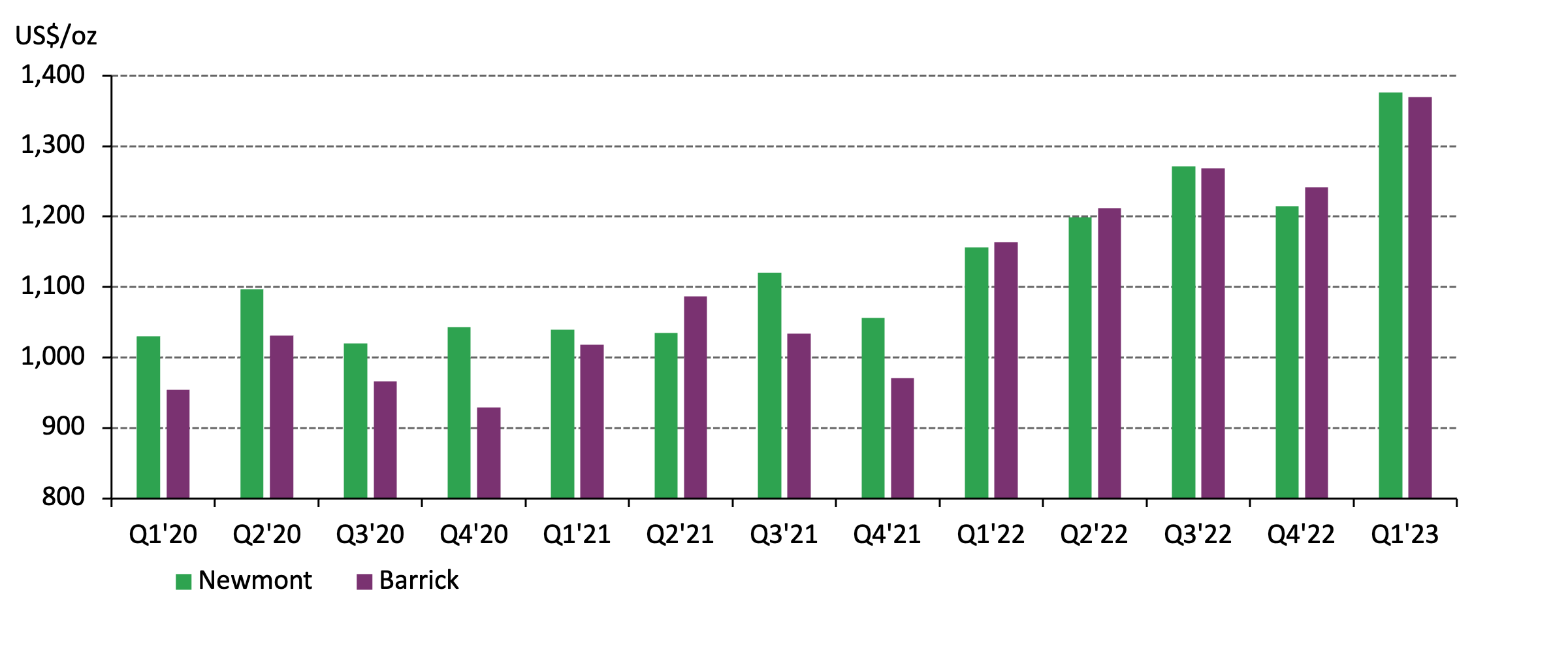

The two biggest gold miners in the world, Newmont and Barrick, both recorded higher than average increases in their AISC. In Q1’23, Newmont’s AISC was up by 13% q/q to US$1,376/oz, while Barrick’s increased by 10% to US$1,370/oz. Alongside the broader effects already mentioned, these increases were also due to a number of mine specific factors. Both companies were impacted by AISC rising at Carlin and Cortez, which are part of the Nevada Gold Mines, a JV between Barrick and Newmont. Carlin’s costs jumped by 39% q/q due to planned shutdowns at the Goldstrike roaster and autoclave, closure of the Gold Quarry concentrator, unusually high levels of snowfall and a fall in average head grades. All of these factors negatively impacted production efficiencies. Meanwhile, Cortez’s AISC increased by 19% q/q. The mine’s costs were also negatively impacted by lower grades and high snowfall in Nevada with additional upward cost pressure from a sharp rise in sustaining capital expenditure related to the replacement of the open pit haulage fleet. Newmont also faced a sharp rise in unit costs at Peñasquito, where AISC increased by 74% q/q. This was largely due to the timing of concentrate shipments leading to a drop in sales volumes. As such, this should be a short-lived cost spike, which will unwind in the subsequent quarter.

Despite both companies suffering cost inflation in the first quarter of this year, they have re-iterated their AISC guidance for 2023. Newmont are expecting annual AISC of between US$1,150-US$1,250/oz and Barrick at US$1,170-US$1,250/oz. This compares to 2022 annual AISC of US$1,211/oz for Newmont and US$1,222/oz for Barrick, indicating that both companies are expecting costs to fall as the year progresses and for annual averages to be relatively flat year-on-year. This aligns with our view for the rest of 2023. We expect AISC to fall from its peak in Q1’23, largely due to lower oil and gas prices eventually feeding through to reduced prices for key cost drivers such as diesel, energy and cyanide.