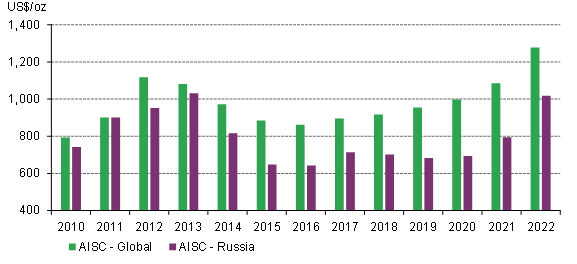

In 2022, average all-in sustaining costs (AISC) in the gold mining industry reached a record high, rising by 18% y-o-y to US$1,276/oz. This was 14%, or US$160/oz, above the previous record set in 2012.

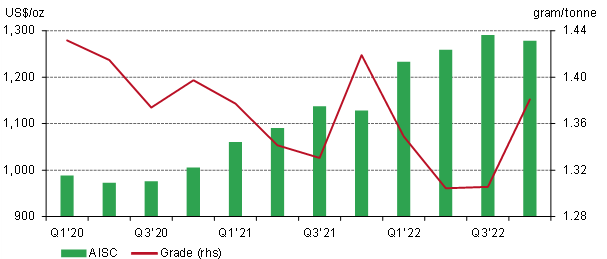

Following the onset of the COVID-19 pandemic in 2020, miners’ costs have been pushed higher by disruption to global supply chains and government policies implemented in response to the pandemic. Meanwhile, elevated gold prices incentivised some higher cost production to come online, putting further upward pressure on industry average costs. This situation was then exacerbated by Russia’s invasion of Ukraine in February 2022 and the subsequent rise in oil and gas prices. This led to rising diesel and other energy costs for gold miners as well as increased prices for key consumables, such as cyanide and explosives. Additional cost pressure came from tight labour markets in several major gold producing nations, leading to increased staffing costs.

Sanctions imposed following the invasion of Ukraine have resulted in significant cost escalation for Russian gold miners compared to the rest of the world. Russian miners have been faced with a sharp rise in domestic inflation and increased logistics costs due to supply chain disruptions. As a result, the average AISC for Russian producers in 2022 increased by 28% y-o-y to US$1,018/oz. This is still less than the global average, but to put it into perspective, the highest gold production costs have been in Russia since 2013.