As inflation continues to bite, the risk of stagflation has not disappeared. As a reaction, gold has been attracting attention from Australian investors due to its historical superior returns during such periods.

The potential bumpy road ahead

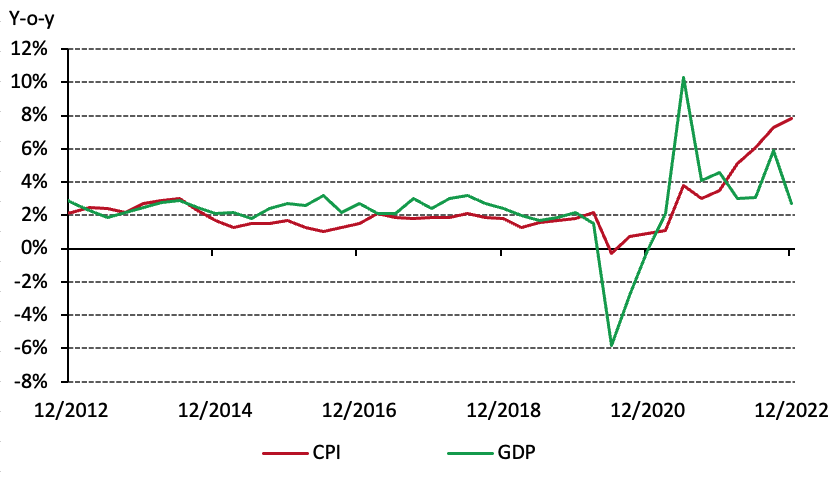

Markets may be vulnerable to negative shocks this year, notably stagflation. In Q4 2022, the CPI rose 7.8% y-o-y, the fastest pace in 32 years.1 (Chart 1). As the RBA noted in its February meeting, while inflation rose higher than expected, wage growth continued to pick up – this could in turn put further pressure on inflation. Additionally, the central bank dialled down its growth projection further, to 1.5% over 2023.2 Slower global growth and tighter financial conditions were cited as main concerns.

Chart 1: Australia’s inflation kept soaring while GDP growth is set to weaken*

Inflation implications

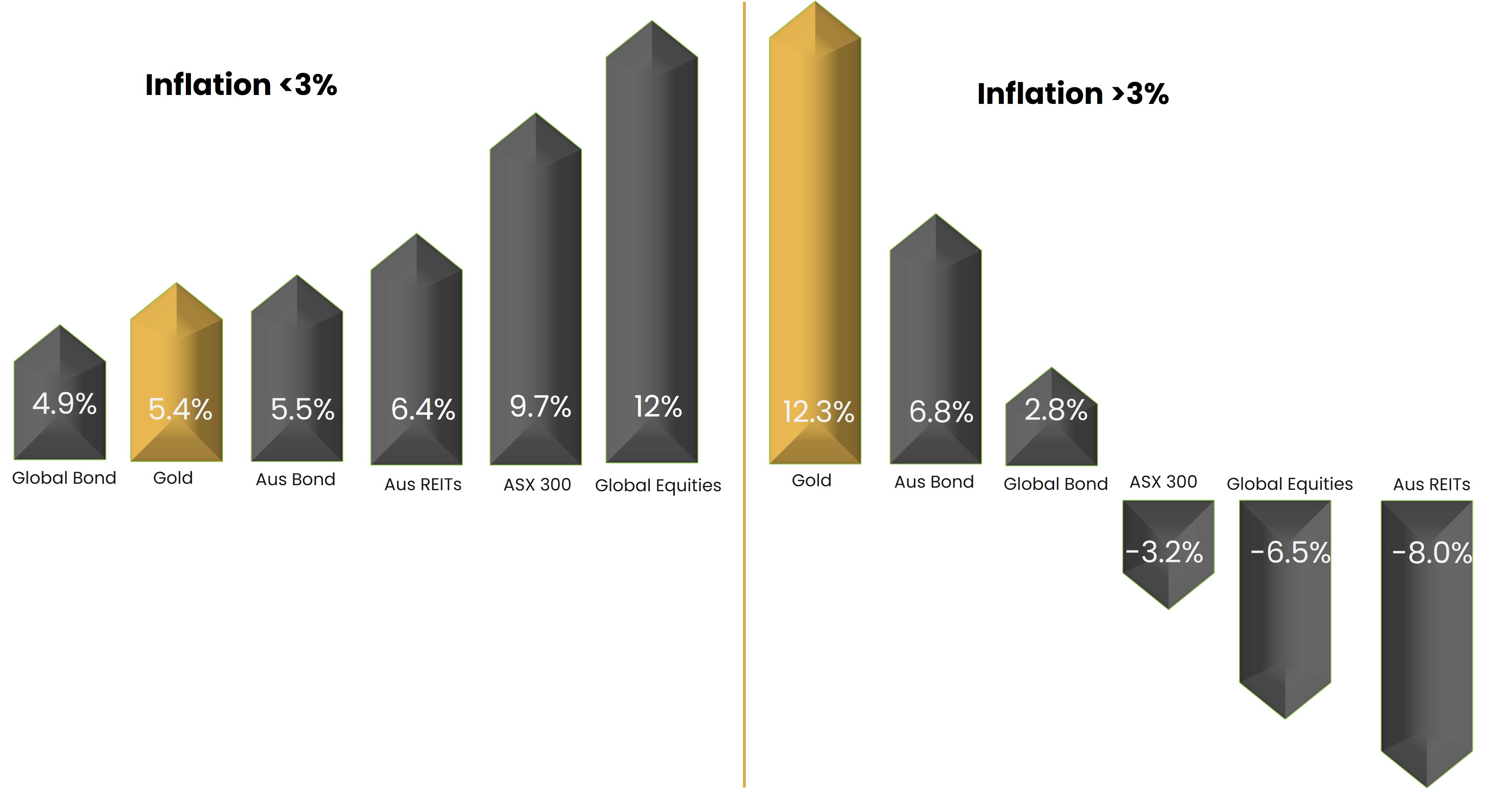

Elevated inflation can, broadly speaking, create issues for investors. The correlation between bonds and equities tends to rise during high-inflationary periods (as evidenced in our investment update). Gold, on the other hand, has long been considered a hedge against inflation, and historical data confirms this (Chart 2). Also, gold’s annualised return of 7.6% in AUD over the past 20 years has outpaced the Australian and world CPIs.3

Chart 2: Gold has historically performed well in periods of high inflation

Major asset returns in AUD as a function of quarterly inflation*

And should stagflation arise?

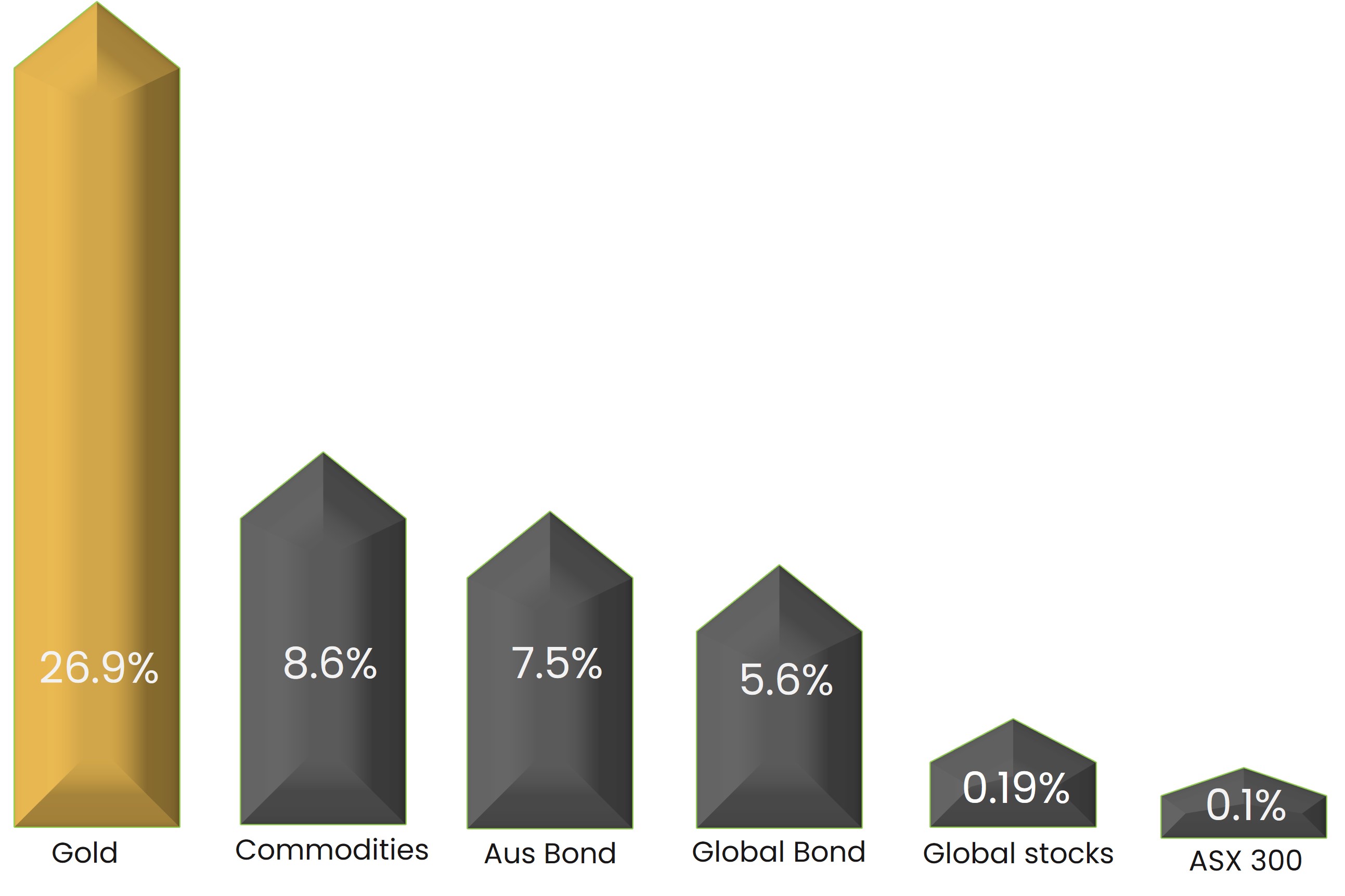

It poses significant challenges to super portfolios as it can severely disrupt financial markets and hamper the performance of major assets. Historical data shows that gold has benefited investors with attractive returns during such periods (Chart 3).

Chart 3: Gold, in AUD, has delivered superior performances during stagflation periods in Australia*

The 2023 headwinds for supers are not set to ease up. Against this backdrop, gold may have a significant role to play over the coming year and beyond to help protect portfolio performance and deliver upon member expectations.