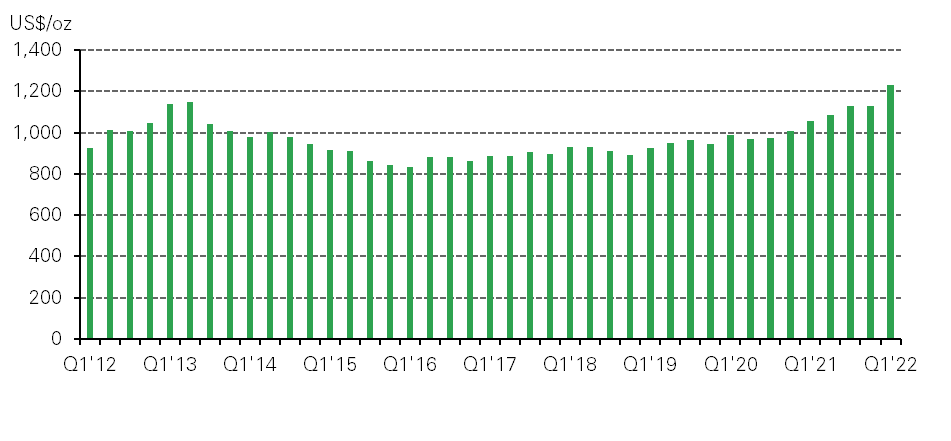

In Q1’22, all-in sustaining costs (AISC) increased by 9% q-o-q to reach US$1,232/oz – their highest level on record back to 2012. This was primarily driven by inflation of miners’ local input costs such a diesel prices, electricity tariffs, wage rates and consumable prices. This was exacerbated by a 4% q-o-q drop in average head grades1, which fell to 1.35g/t, alongside the strengthening of several local producer currencies to the US dollar over the period, which increases US dollar costs recognised in local currencies. These rising costs led to a 3% q-o-q contraction in average industry AISC margins, which fell to US$646/oz. That said, the decline was mitigated by a 5% q-o-q rise in the average dollar gold price. Margins in the gold mining industry have now fallen by 31% from their peak of US$938/oz in Q3’20. However, they still remain relatively high historically due to the continued strength in the gold price. For comparison, margins averaged $338/oz between 2012 and 2019.

Average AISC reached a record high in Q1’22

Source: Metals Focus Gold Mine Cost Service

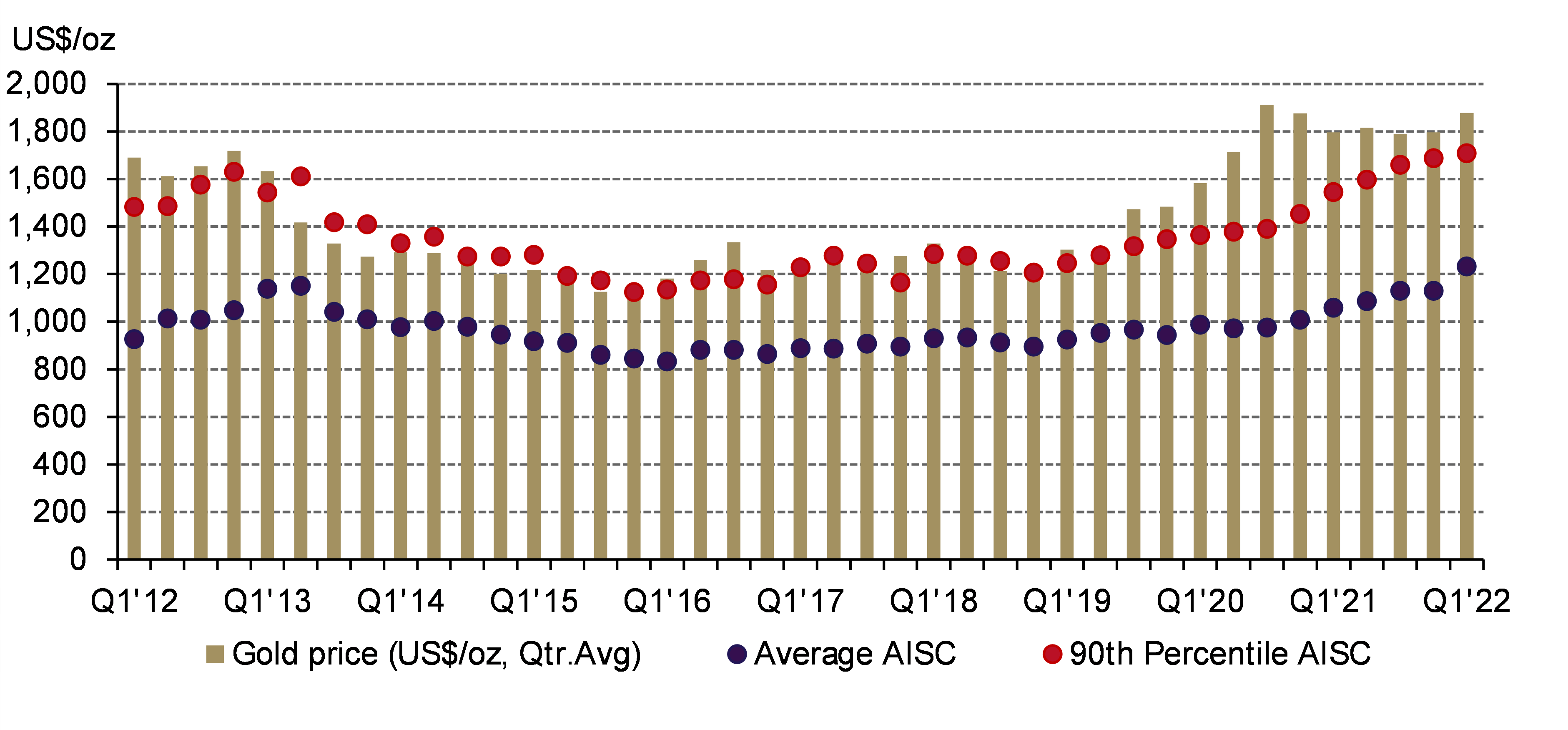

The Q1’22 AISC for the 90th percentile of the cost curve increased by far less than the average, rising by only 1% q-o-q. This is likely the result of the highest cost producers now facing some pressure to reduce costs, or at least limit cost escalation, as the cost of production for these mines pushes up towards the gold price and margins are squeezed. As a result, margins for this portion of the industry have fallen by 67% since reaching a peak of US$522/oz in Q3’20 and are likely to come under further pressure moving forward. Russia’s invasion of Ukraine began on 24th February and therefore the ramifications of this on miners’ costs were limited in Q1’22. However, the subsequent rise in oil and gas prices will eventually feed through to even higher diesel and electricity prices for miners, which will put further upward pressure on costs in Q2’22 and beyond. There will be some respite from a strengthening US dollar relative to local producer currencies, however this will likely not be sufficient to offset rising inflationary pressure on input costs and we therefore expect AISC to have risen again in Q2’22. This, combined with a relatively flat gold price quarter-on-quarter, will lead to industry margins being reduced further and so higher cost producers are likely to come under greater pressure.

90th Percentile AISC continues to rise towards the gold price

Source: Metals Focus Gold Mine Cost Service, Bloomberg