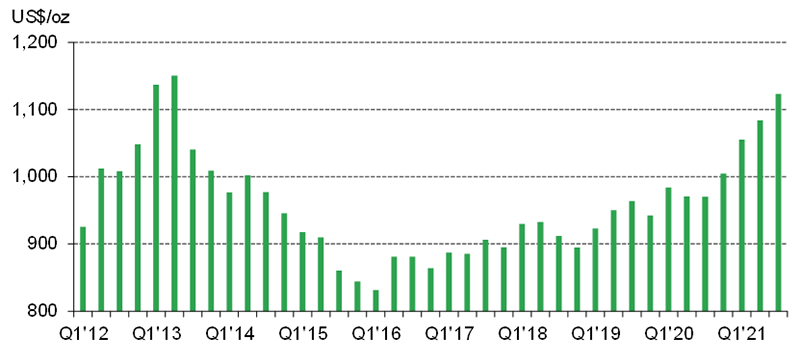

All-in Sustaining Costs (AISC) across the gold mining industry averaged US$1,123/oz in Q3’21, a rise of 4% q-o-q and the highest level since 2013. This is the fourth consecutive quarter of cost growth, with the average AISC up a significant 16% since the corresponding quarter in 2020.

Gold miners’ AISC reach their highest since 2013

2 December, 2021

AISC in Q3’21 were at their highest since Q2’13*

Inflationary pressure on input costs was the primary driver behind this escalation. This is pushing up the cost of major contributors to total operating expenditure such as labour, fuel, electricity and consumables. In some jurisdictions, such as Western Australia, travel restrictions relating to COVID-19 continue to limit the availability of workers. This has created a tight labour market and added additional upward pressure to costs in these regions.

Meanwhile, foreign exchange rates against the dollar, for several major producers, have weakened q-o-q. The average Q3 exchange rate for the Australian dollar, Canadian dollar and South African rand weakened by 5%, 3% and 4%, respectively, against the US dollar. This would have suppressed costs in US dollar terms in these countries, although the effect was not enough to offset the impact of rising local inflation. In addition to operating cost rises, capital expenditure has also been increasing. This has come from a combination of the inflationary factors mentioned above, combined with higher industry margins, which has allowed miners to allocate more funds to sustaining capital expenditure.

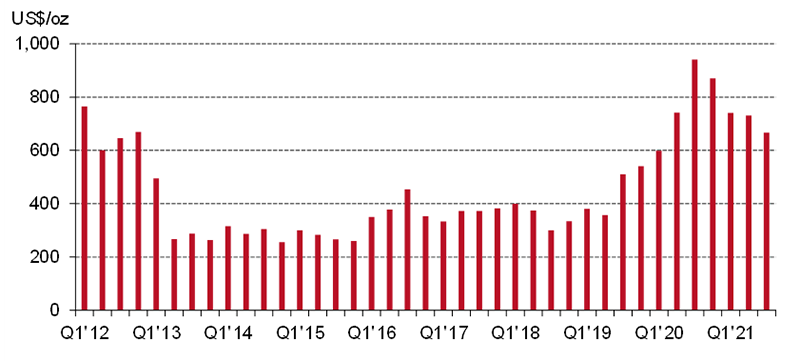

AISC margins are falling but still historically high*

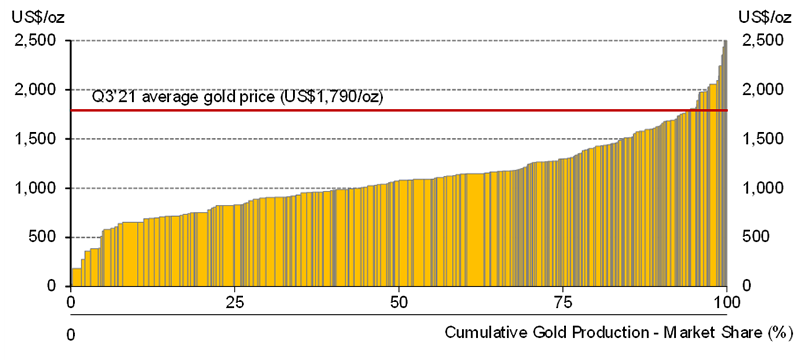

Rising costs are leading to declining margins for many gold miners, however they still remain at historically high levels. In Q3’21, the industry average AISC margin (gold price minus AISC) fell by 9% q-o-q to US$667/oz. This is the lowest margins have been since Q1’20, however prior to this they had not been above this level since Q4’12. Despite rising costs and lower margins, the gold mining industry remains in a healthy position at current gold prices. This is more apparent when looking at the industry cost curve for Q3’21, which shows that only 6% of production originated from mines with AISC above the gold price.