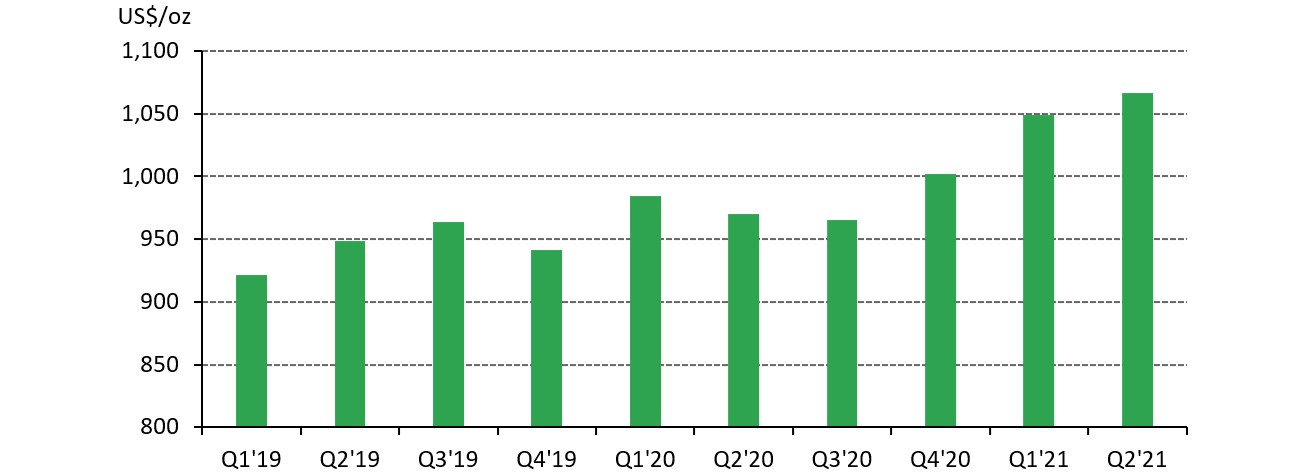

Global average All-in Sustaining Costs (AISC) in the gold mining industry increased by 10% y-o-y in Q2’21, reaching US$1,067/oz. This was also the third consecutive quarter in which AISC has risen. This cost inflation is being driven by several factors, both at the mine site and at the macroeconomic level.

Global average AISC rises for the third successive quarter

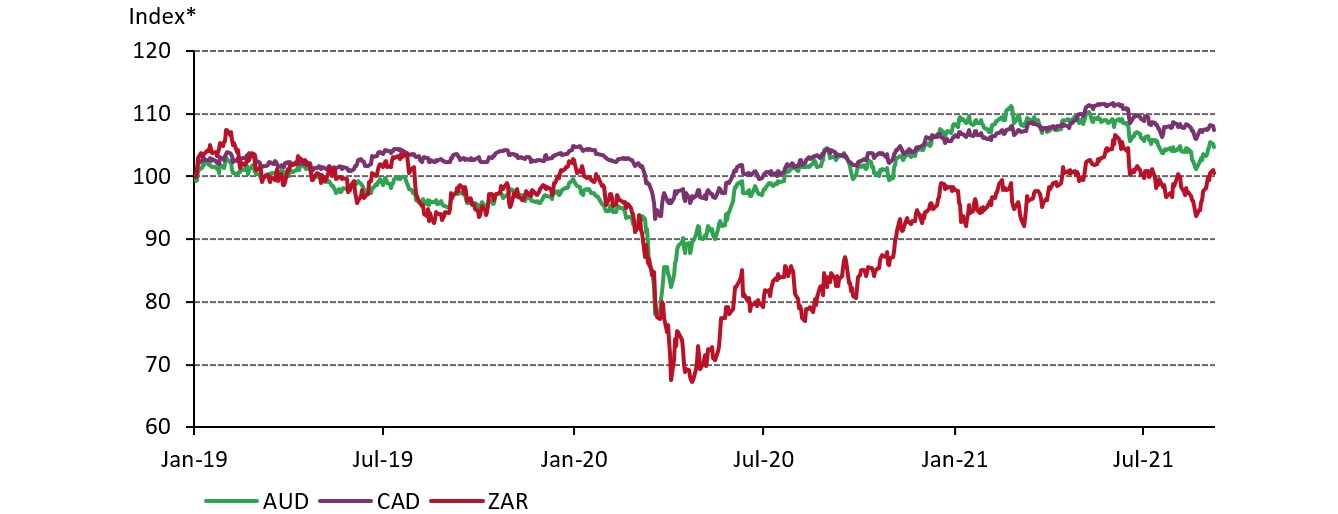

Exchange rate movements have had a significant impact on costs. The local currencies of several major gold producing countries have strengthened against the US dollar year-on-year. The average quarterly exchange rates in Q2’21 for the Australian dollar, Canadian dollar and South African rand showed that they had strengthened against the US dollar by 15%, 11% and 21%, respectively, compared to the same quarter last year. This exchange rate effect has pushed mine site costs up on a US dollar basis, as most of these costs are recognised in local currency terms.

Many producer currencies have strengthened against the US dollar since Q2.20

Gold production in Q2’20 was the most heavily impacted by mine stoppages related to the pandemic. However, steps relating to the on-going pandemic, such as testing of workers, additional PPE and quarantine procedures, had not yet been fully adopted by the industry. These measures are now widespread, and, alongside associated additional costs, have added to AISC in Q2’21 compared to the same period last year.

Meanwhile, labour costs have also risen over the past year. This is due to rising demand for skilled workers as commodity prices have incentivised project development, combined with travel restrictions relating to the pandemic limiting the availability of staff and contractors.

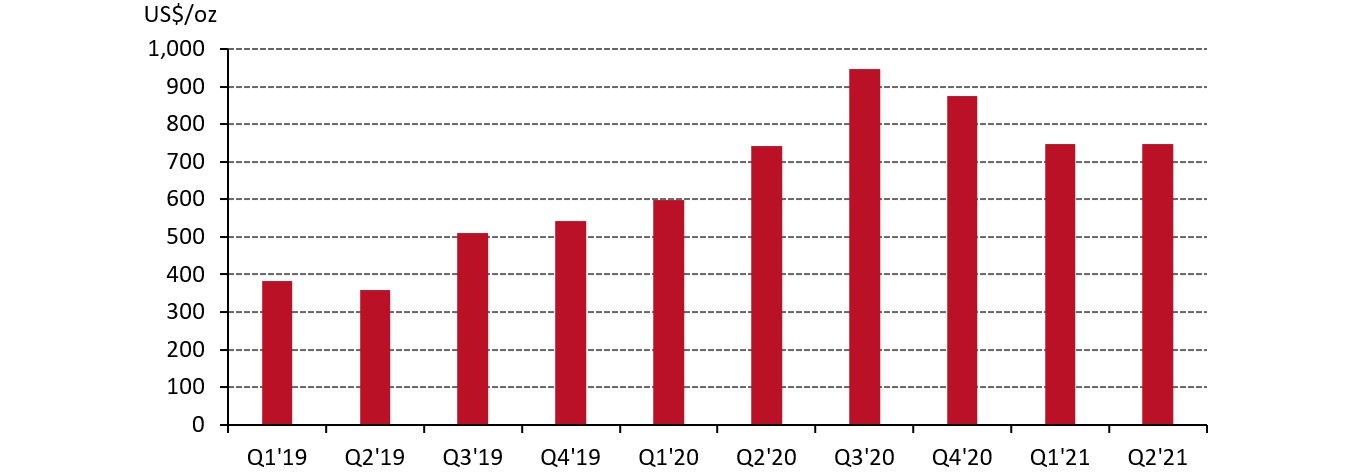

Despite rising costs, the average AISC margin (the gold price minus AISC) in Q2’21 remained almost flat year-on-year at US$748/oz due to a 6% rise in the average quarterly gold price. Margins remain significantly higher than before the pandemic due to the sustained higher gold price. For comparison, the average AISC margin in 2019 was US$451/oz. These higher margins have increased cashflow for gold miners allowing them to lift sustaining capital expenditure at their operations, further contributing to the rise in AISC year-on-year. Meanwhile, the higher gold price has allowed lower grade material to be incorporated into mine plans, pushing average grades down and putting upward pressure on unit costs. In Q2’21, the average head grade of 1.34 g/t was 5% lower than the corresponding quarter in 2020.

Global average AISC margins remain high despite rising costs

With most of these dynamics unchanged in the current quarter, combined with some strengthening of the US dollar against local producer currencies, it is likely that cost inflation across the industry will slow in Q3’21 and so AISC will remain relatively flat or even drop marginally quarter-on-quarter.

To see this data, please click here.