Monday, July 19 marked an eagerly anticipated milestone for the UK. ‘Freedom Day’ as it was dubbed, officially closed the chapter on over a year of local COVID-19 restrictions. But it arrived amidst soaring cases of COVID-19 worldwide – the UK included. Concern over the new variant strains has not only put a dampener on the reopening in the UK, but perhaps the global economic recovery.

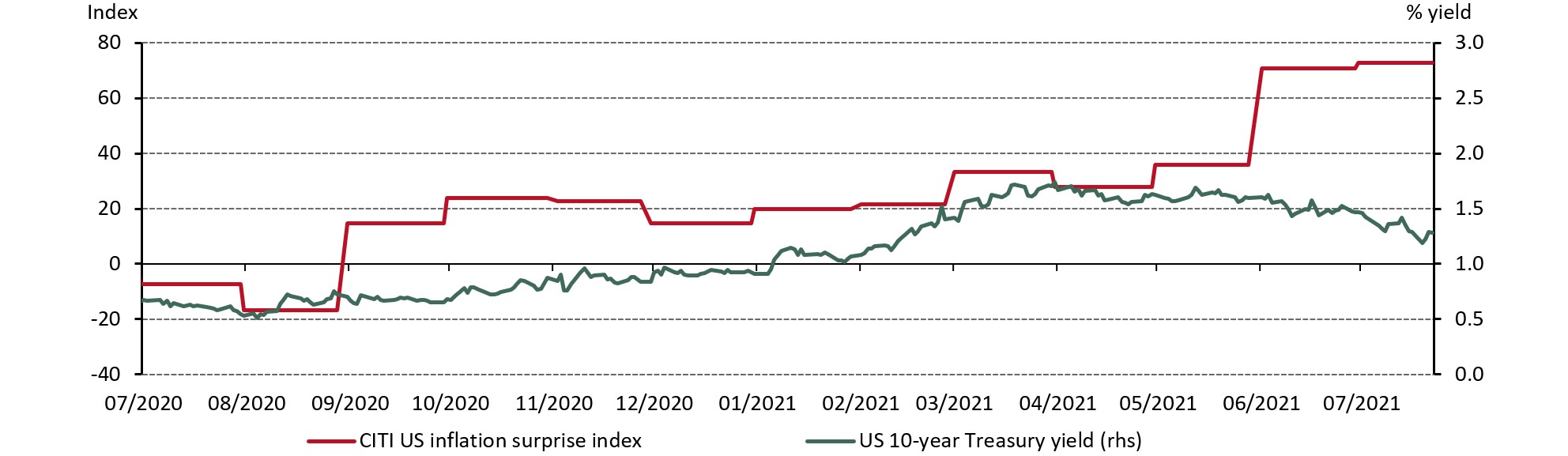

This was evident in the concurrent sharp sell-off in risk assets and falls in bond yields. The Dow Jones index in the US experienced the biggest drop in 8 months, and the Stocks Europe 600 posted a year-to-date record drop. The US 10-year Treasury yield briefly dipped below 1.2%, in a typical flight-to-quality move, continuing the fall from the March peak to a 5-month low. The falling 10-year yield has been particularly notable in the presence of a continuous rise in inflation signals in the US (Chart 1); a development also echoed in other countries.

Chart 1: US 10-year Treasury yield falls even as inflation continues to positively surprise*

*as of 22 July 2021

Source: Bloomberg

Dramatic market fluctuations leave investors, consumers and the media speculating about what happened and why. For us, the focus is what will happen next and how that may impact gold and by extension, portfolio allocation strategy.

Our strategic advantage in looking ahead is QaurumSM (our interactive online analytics tool, powered by our proprietary Gold Valuation Framework). Notably, one of the scenarios from the Q2 release addresses the prospect of New Variants hamstringing the global economic recovery.

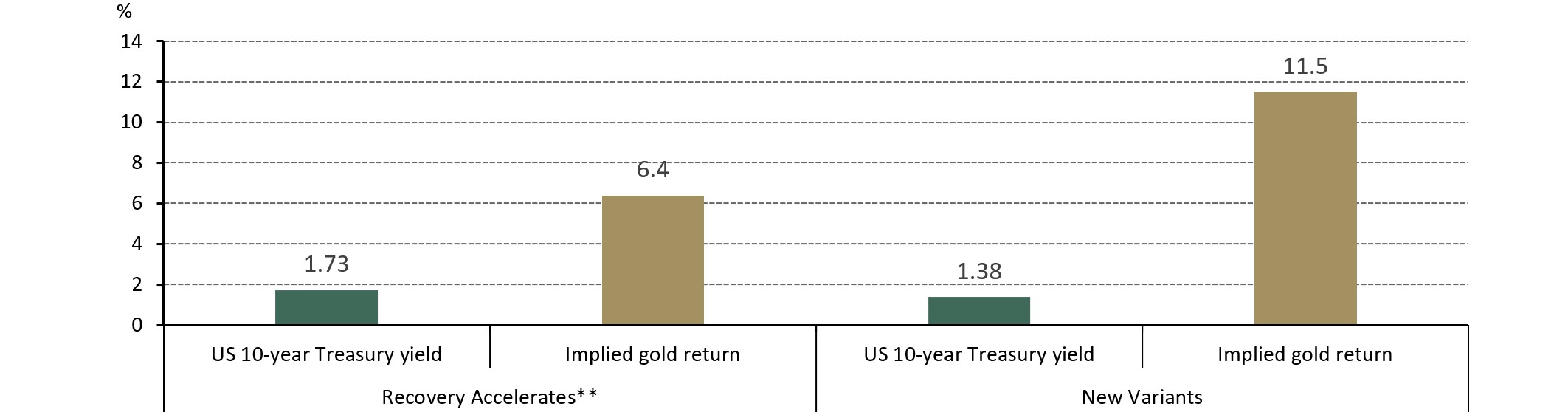

The scenario depicted under New Variants is characterised by a protracted period of restrictions that negatively impact both equities and bonds in 2021, with the former (US equities) dropping 5% in 2021 alone under the New Variants scenario. US Treasury yields see the weakest trajectory here compared to other published scenarios, with the 10-year averaging just 1.38% and the 3-month only 7 bps in 2021.

Chart 2: Oxford Economics scenario-based US 10-year yield forecasts and Qaurum implied gold returns for 2021*

*Based on Oxford Economics scenarios from their Global Economics Model (updated as of 27 May 2021) and calculations using the Gold Valuation Framework methodology available through Qaurum. Returns represent implied average y-o-y changes. A detailed description of these scenarios and their implications can be found at Goldhub.com. Qaurum, is customisable and users can modify any of the variables included on the available hypothetical scenarios to best reflect their own view on the global economy.

**Corresponds to Oxford Economics ‘Baseline’ scenario.

Source: World Gold Council

Given the importance of yields in our model in the near term – transmitted via various categories of investment demand – the New Variants scenario suggests an implied return of 11.5% for gold in 2021. The current y-t-d 10-year Treasury yield stands at 1.44%. Without a material move higher, the 10-year yield could end up averaging at a level similar to that forecast in the New Variants scenario rather than the more elevated 1.73% as suggested by Oxford Economics Baseline scenario (chart 2), suggesting upside to Baseline returns as a rising yield proves less of a headwind. This would perhaps give those investors who were expecting yields to punish gold in 2021 some pause and brighten prospects in H2.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither WGC nor Oxford Economics provide any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.