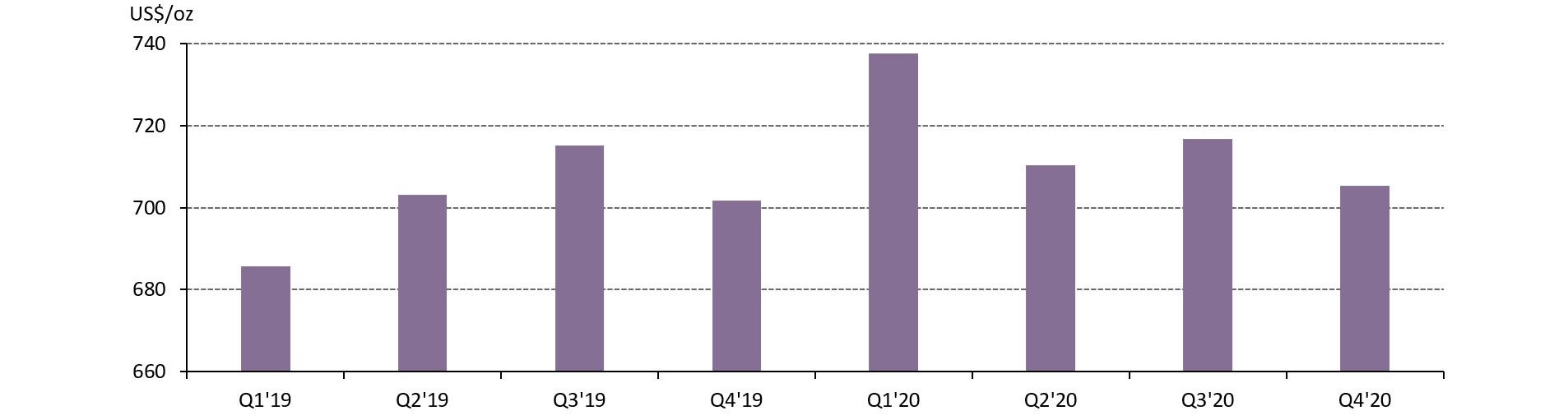

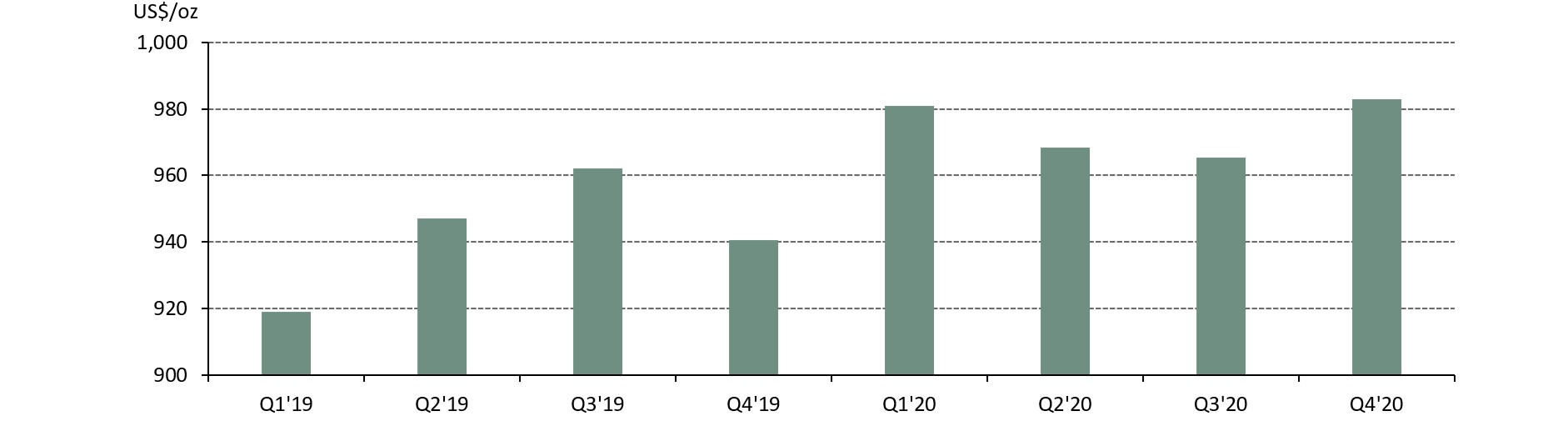

During Q4 2020, All-in Sustaining Cost (AISC) in the gold mining industry averaged US$983/oz, up 1.8% from the previous quarter. AISC increased even though average Total Cash Costs (TCC) declined by 1.6% q-o-q. This suggests that higher AISC was driven by rising sustaining capital costs rather than mine site operating costs.

Sustaining capital expenditure pushes AISC higher in Q4'20

17 March, 2021

Source: Metals Focus Gold Mine Cost Service

The falling TCC was largely a result of continued easing of COVID-19 disruptions on mining operations. The impact of the pandemic on gold output was concentrated in Q2 as miners in several countries were forced to temporarily halt operations from mid-March. While most of these restrictions were lifted by the end the quarter, the ramping-up of some mines to full capacity continued into Q3 leading to constrained output and higher costs at these operations. By Q4, the vast majority of gold mines were back to operating at full capacity, leading to a drop in average operating costs q-o-q. A small increase in average grade, from 1.38g/t in Q3 to 1.40g/t in Q4, alongside a price driven fall in royalties, also contributed to the decline in TCC q-o-q.

Higher sustaining capex pushes AISC up 1.8% q-o-q in Q4'20.

Source: Metals Focus Gold Mine Cost Service

The rise in AISC was driven by increased sustaining capital expenditure, which rose by 22% q-o-q to US$274/oz. This shows that miners are now investing greater amounts of capital to maintain existing production capacity. The increased level of capital expenditure has been made possible by the higher gold price, which significantly boosted margins in 2020. That said, margins did ease back in Q4 as a result of a 1.9% q-o-q drop in the gold price and higher AISC, however they remain very healthy. The average AISC margin (gold price minus AISC) in Q4 was US$893/oz, with even the 90th percentile of the cost curve achieving an AISC margin of US$433/oz.