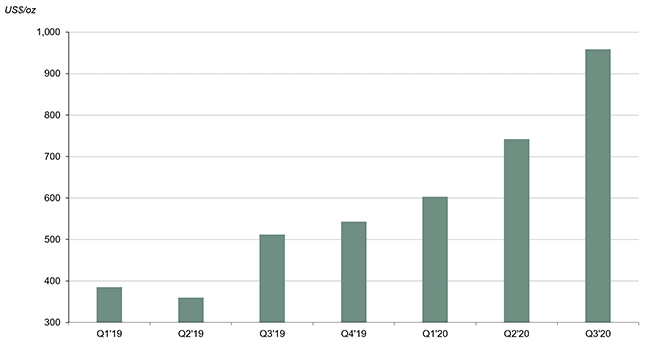

Despite a challenging year due to the COVID-19 pandemic, gold miners are now benefiting from significantly higher margins resulting from a continued focus on operational and cost efficiencies combined with a strong gold price.

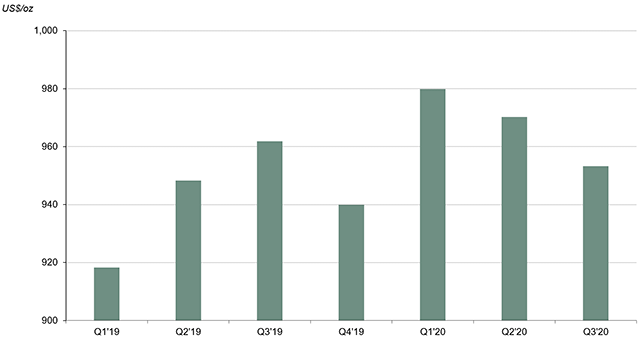

In Q3’20 the global average All-in Sustaining Cost (AISC) was US$953/oz, a 2% drop from the previous quarter. This decline was largely a result of mines returning to normal production rates following significant disruption in Q2’20 from COVID-19 lockdowns. Countries including South Africa, Peru and Mexico implemented policies that required mines to temporarily halt operations in an attempt to control the spread of the virus. This led to a 10% y/y drop in global output in Q2’20 and also pushed costs higher during ramp down and re-start phases between closures periods. The last of the these countrywide restrictions were lifted at the end of May and most mines returned to normal production rates in Q3’20. As a result unit costs were lower and global production for the quarter dropped by a more modest 3% y/y.