Why we chose to buy gold – aka ‘TIPS on steroids’

14 October, 2020

The first two drivers on our list of gold price factors are US Treasury Bonds and Inflation. It is particularly interesting to review and analyse these in detail, specifically the US Treasury Inflation Protected Securities – bonds commonly referred to as ‘TIPS’. TIPS can tell us a lot about the evolution of the gold price.

TIPS are a special type of treasury bond issued by the US government where the coupon and the principal are protected against inflation. Therefore, the price of those bonds has two different components: a bond component and an inflation component. TIPS go higher when bonds go up or when inflation goes up. Where it becomes slightly tricky is the fact that these two prices tend to be negatively correlated over time making it more difficult to anticipate.

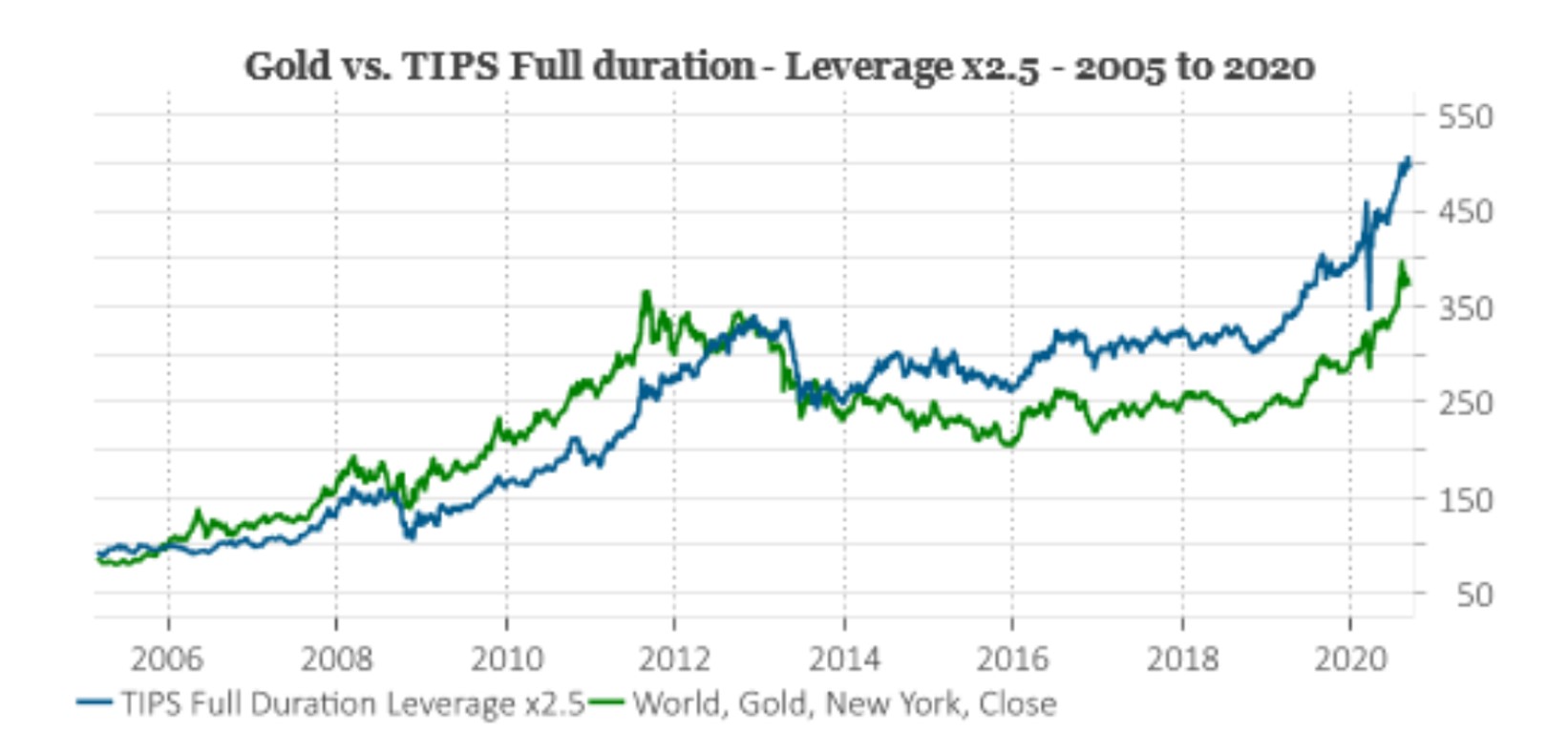

Coming back to gold and TIPS, the chart below highlights how those two assets have performed very similarly over the last 15 years (we adjusted the TIPS to reflect the large divergence in terms of volatility between gold and TIPS by a factor of 2.5x). In short, gold could be seen somehow as ‘TIPS on steroids’. This echoes the argument that gold is a bond and a hedge against inflation.

Source: Nutmeg, MacroBond

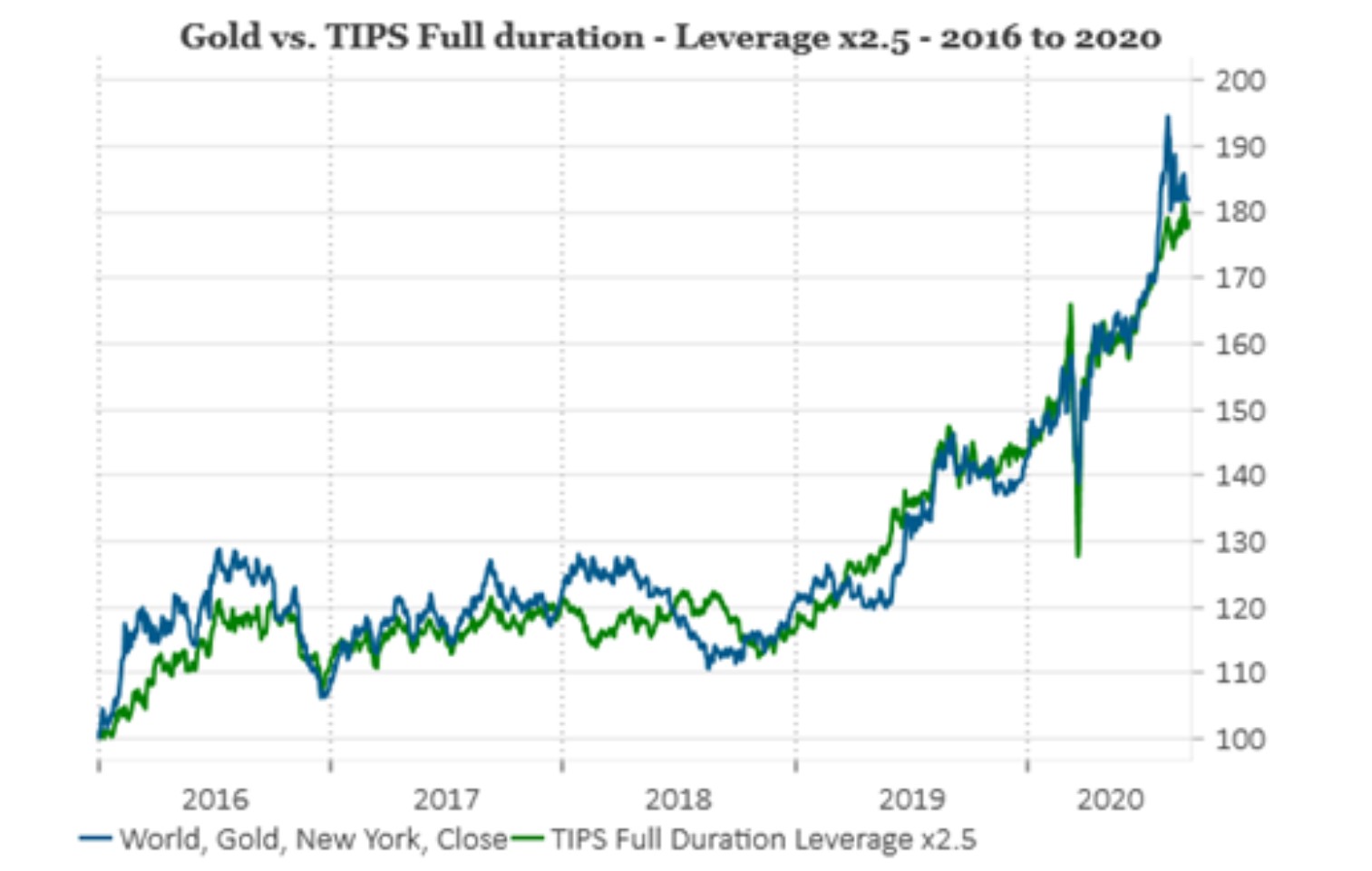

Using only the last five years, the performance of the two asset classes is even more similar and there is strong evidence that gold is close to an equivalent version of US treasury inflation protected bonds.

Source: Nutmeg, MacroBond

Gold & Nutmeg portfolios

The inflationary risks described above informed our recent call to add gold to some of our portfolios. However, this call should also be seen in the context of the other assets we hold. Nutmeg has moved back to a neutral equity position because economies look to be on a recovery path, government policy is firmly pro-growth and covid problems now seem to have a better ‘risk-reward’ outlook.

That better ‘risk-reward’ comes from the likelihood any future lockdown will be local and partial rather than general. In addition, news about several effective covid vaccines is likely to break in the next couple of months; a necessary step before normalisation can really set in.

But, as ever, risks are not absent. Apart from the ongoing risk to the post-shutdown recovery, there is US election risk as well as geopolitical and oil price risks to consider – not to mention Brexit risk.

In order to structure portfolios that mitigate these risks, asset allocators usually turn to the US dollar, government bonds (such as TIPS) or gold. Yet, as we have detailed, government bonds are at extreme level vs. history, to the point where many are negative yielding – this means that if held to maturity an investor will not receive their capital back. The dollar has also become expensive and even gold has risen over 25% in 2020.

Normalisation in a post-covid-vaccine environment would further increase risk of “reflationary” factors in economies and markets. Neither the $ nor government bonds would perform well in this setting but gold can still play a role here. This is because gold is a multifaceted financial asset. It can continue to play its role as an inflation-protected-bond proxy but can also play its ‘commodity price’ role if real yields and inflationary expectations do begin to normalise. Finally, it can play its role as systemic hedge if there are structural interruption to markets via geopolitical crisis.

So, even though gold has appreciated significantly already, its enhanced diversification characteristics, compared to government bonds and the US-dollar, make it a sound addition to multi-asset investment portfolios. Nutmeg has moved to replace its (positively performing) position in US inflation-protected-bonds (TIPS) to add small gold positions across relevant portfolios in order to benefit from gold’s enhanced diversification potential.

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance.