The primary mission of central bank reserve management is to ensure that reserves are adequate and available during times of need. Therefore, safety and liquidity are key investment factors. Sovereign wealth funds (SWFs), on the other hand, focus more on return as their mission is to invest revenues from government surpluses to generate wealth for present and future generations. Therefore, SWFs’ investment guidelines are more flexible, letting them take more risk and invest in a broader range of asset classes to obtain higher returns. Since the Global Financial Crisis, where low and negative interest rates have become the new normal, this flexibility has made SWFs more important for their country’s wealth management.

While central banks voluntarily report their international reserves including gold to the International Monetary Fund each month, SWFs have no global reporting obligations. However, some funds comply with the Santiago Principles, a set of voluntary guidelines that aim to promote transparency.1 As a result, SWFs differ greatly in the disclosure and level of detail of their investment activities. This is true for their gold holdings as well. Unique among SWFs is the State Oil Fund of Republic of Azerbaijan (SOFAZ) because it not only publishes its audited financial statements in its annual report but also reports all other relevant financial information including gold holdings every quarter on its website. SOFAZ also clearly states its policy on gold investments in its website.2

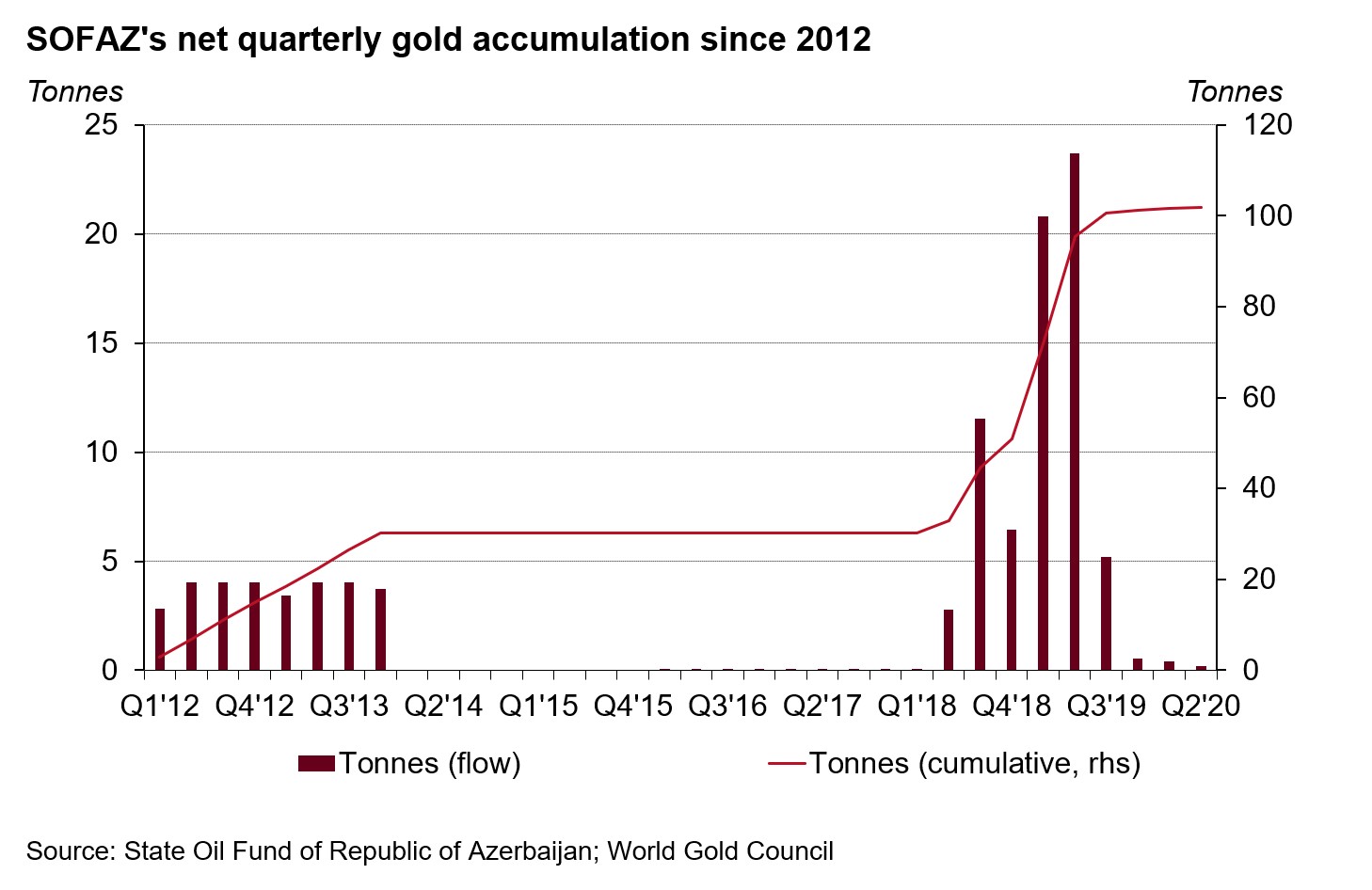

SOFAZ began buying physical gold – London Good Delivery bars – in 2012, in accordance with the amendments made to the Investment Policy of the Fund for the purposes of diversification. After a four-year hiatus, SOFAZ resumed its gold accumulation in Q2 2018, followed by an amendment to its 2019 investment policy to extend the gold allocation limit from 5% to 10%, along with maximum upper deviation of 3%. As of Q2 2020 the amount of gold included into SOFAZ's investment portfolio has reached 101.8 tons or 13.6 % of total AUM.