Monday, 30th March

Good morning. Spot #gold is just below $1620/oz on Monday morning and the bid-ask spread is about $5/oz according to Bloomberg.

The differential between spot #gold and the active Comex future is about $23/oz, showing that this dislocation in these markets continues, albeit off the levels seen early last week.

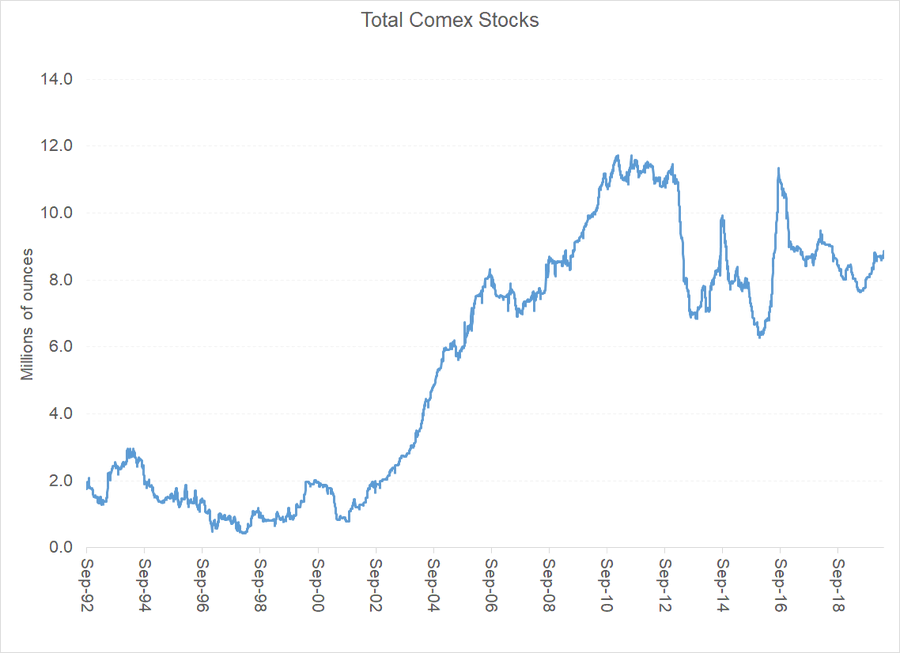

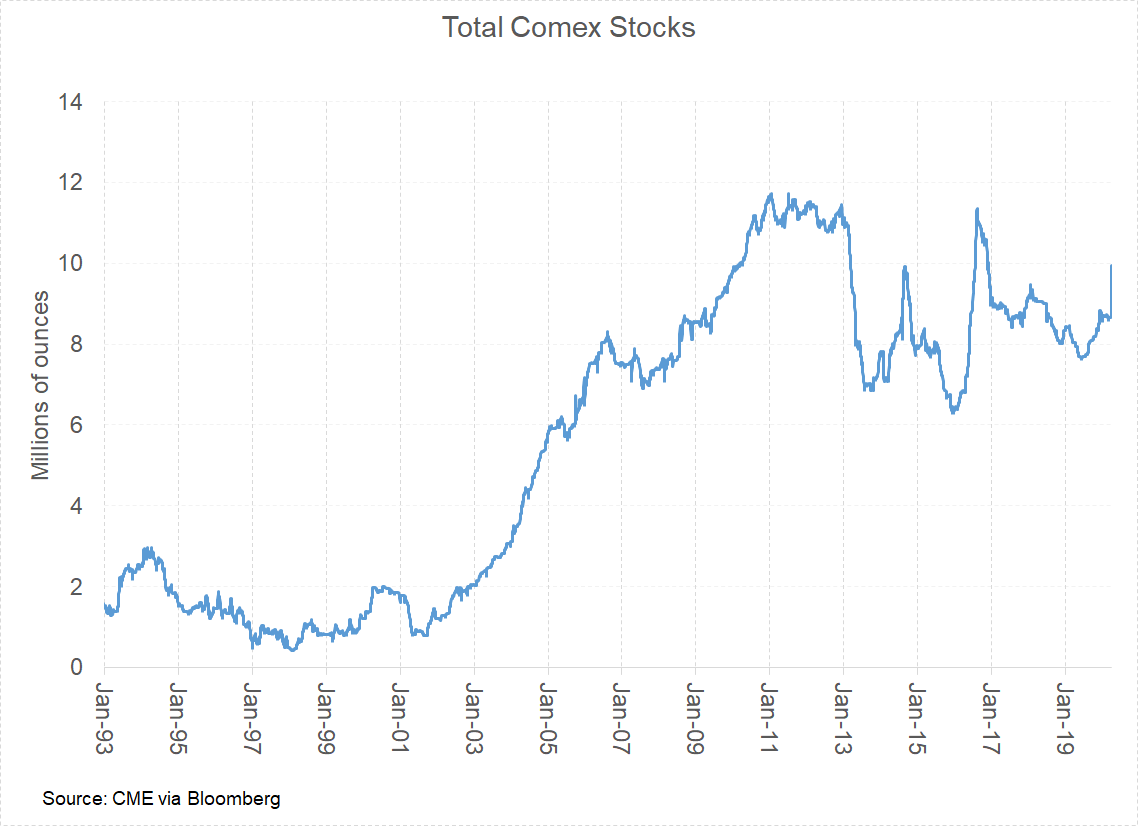

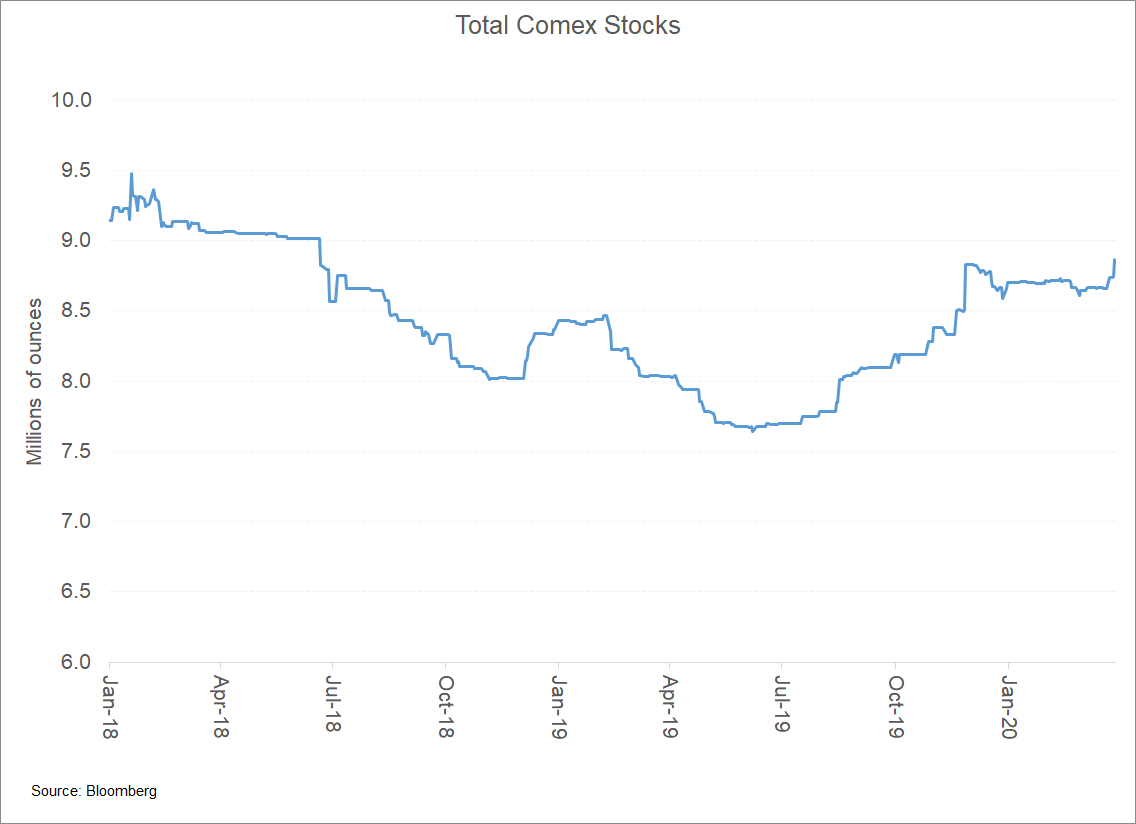

Beacuse of the dislocation between OTC and Comex #gold, I've been thinking a lot about Comex warehouse stocks recently. This is an interesting primer on the topic from @bullionvault: https://bullionvault.com/gold-news/comex-gold-stocks-072420136

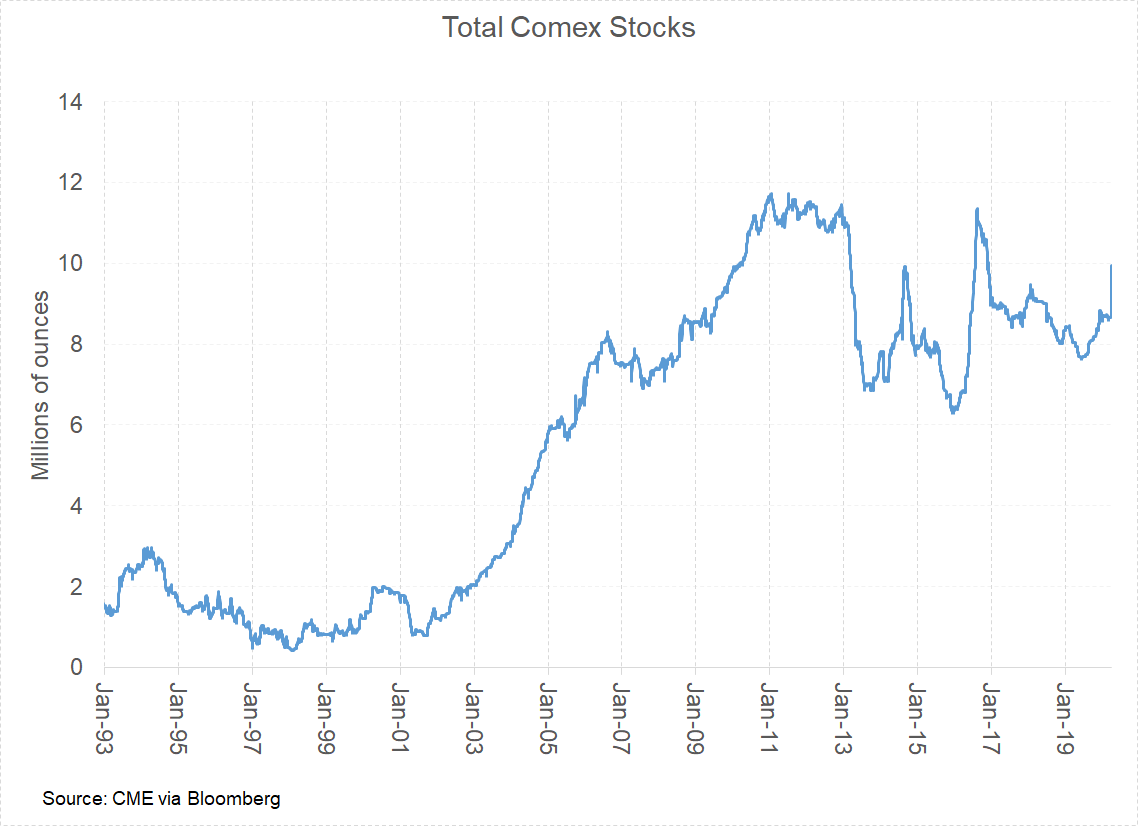

This is one chart I've reconsituted on my WFH laptop, showing total Comex #gold stocks back to 1992. As you can see, stock levels are much higehr than they were in the late 1990s, when the net spec position was predominantly short.

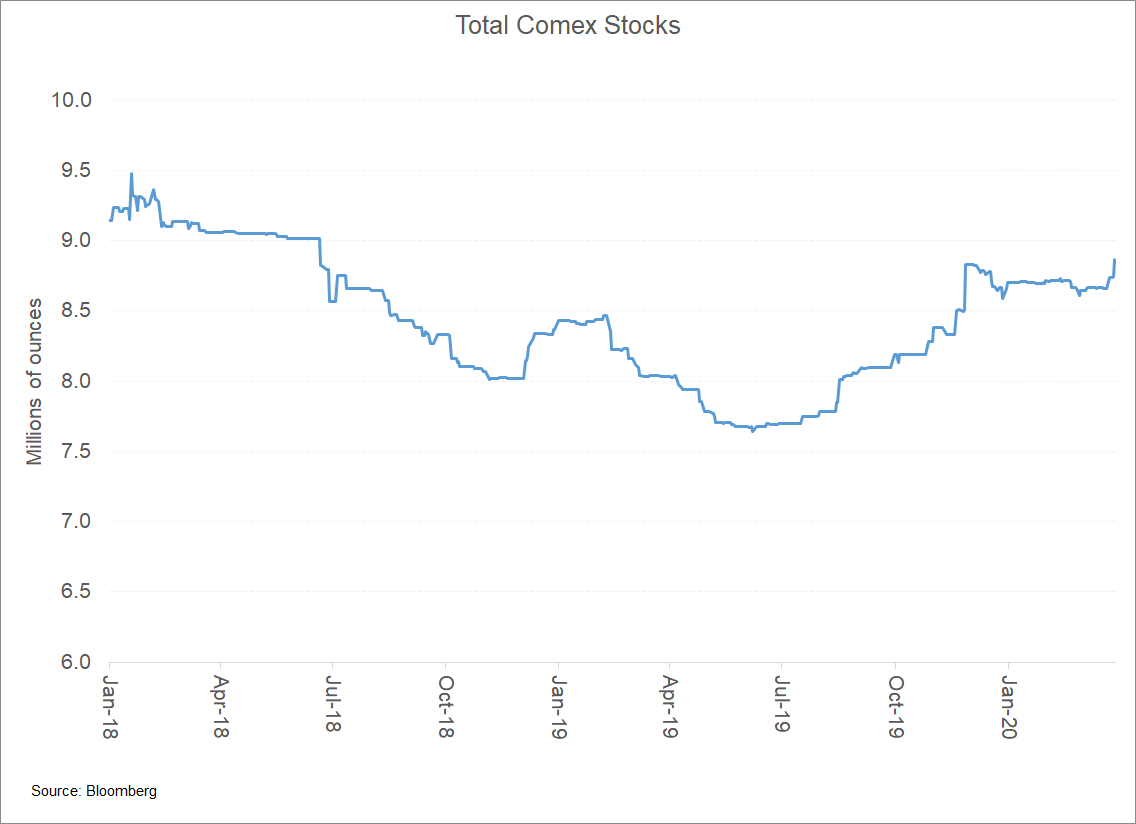

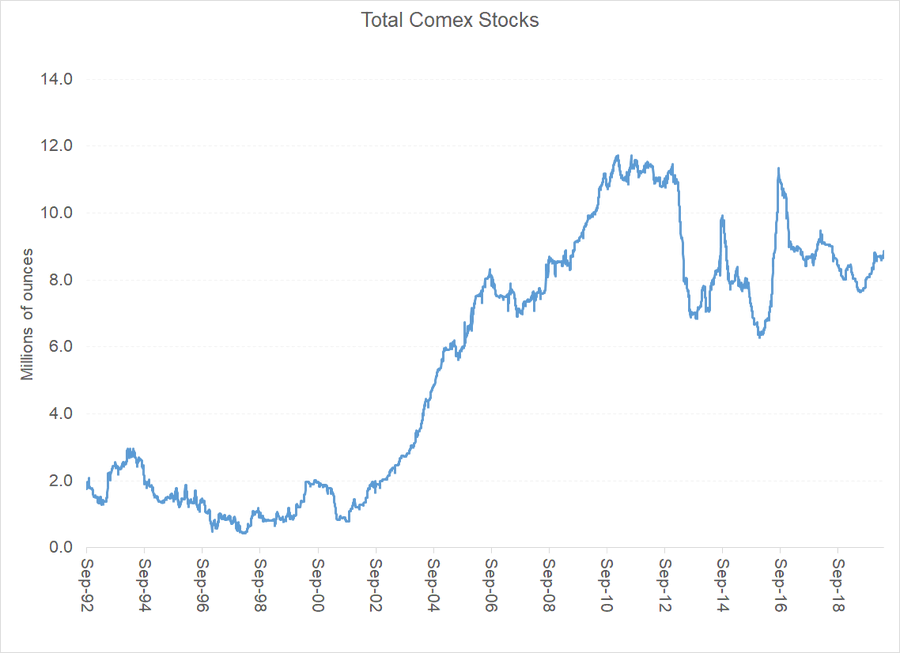

Zooming in on the last couple of years, I will be updating this chart regularly to see whether gold gets shipped into the Comex warehouse system to take advantage of the high premium to the London OTC market. NB: 200koz has entered the system over the past week. More to come?

Tuesday, 31st March

Good morning. Gold slightly lower on Tuesday morning, last around $1615/oz, but very much within its consolidation range of the past week. OTC bid-ask spreads a little tighter today at about $2.50 according to Bloomberg.

The difference between spot (OTC) #gold and the active Comex future remains wide at about $22-23/oz.

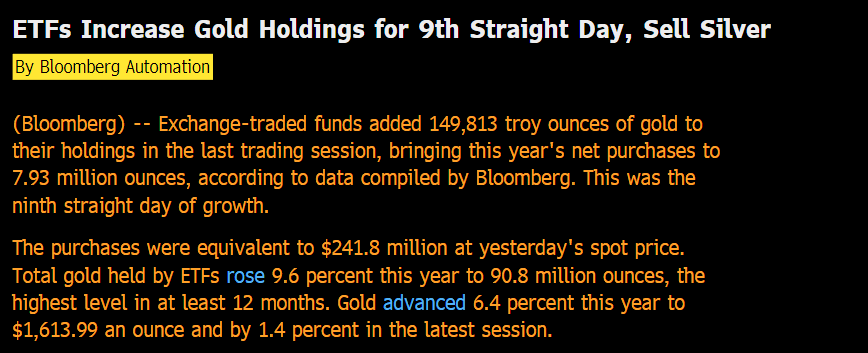

Bloomberg's robots report further #gold purchases by ETFs yesterday, making that 6 days in a row.

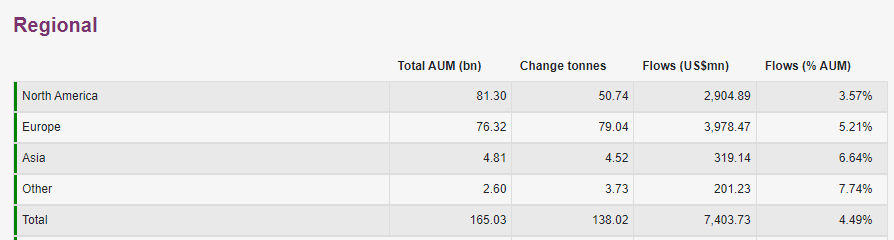

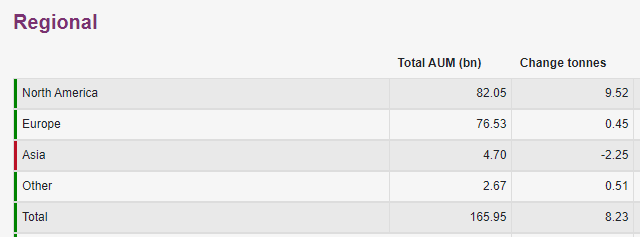

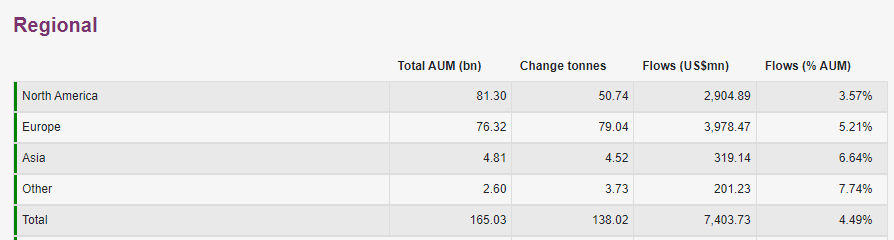

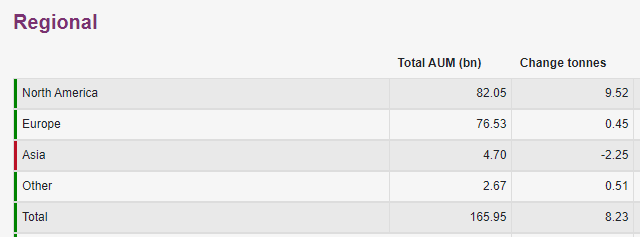

Month to date inflows into the global #gold backed ETFs show net purchases of about 138 tonnes. Slightly more into European-listed funds than into the US. All regions have seen inflows this month.

Wednesday, 1st April

Good morning. Wednesday's early European trading sees #gold just below $1590/oz, $20/oz above Tuesday's low. The sell-off yesterday surprised me: I'm not sure what was behind it, although some are attributing it to quarter-end rebalancing.

Spot bid-ask spread a still-wide $3/oz.

The differential between Comex #gold and the OTC price has narrowed over the past 24 hours and stands at about $10-12/oz. Compared to the widest level of $75/oz last Tuesday, the market appears to be returning to normal, although there's still some way to go.

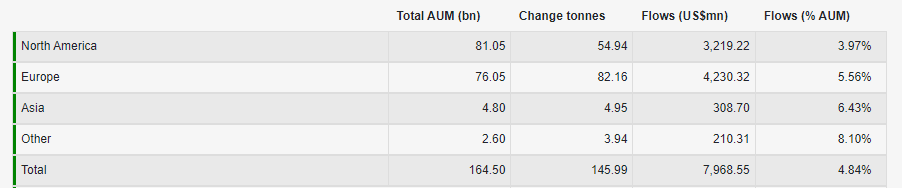

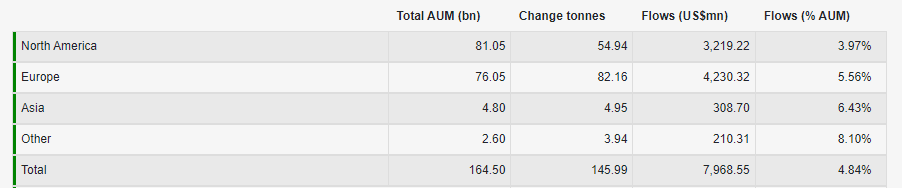

I haven't seen the automated Bloomberg estimate, as its too early, but our own database indicates further #gold inflows into the ETFs we track, taking monthly net purchases to about 146t or $8bn. This is a provisional total - our comprehensive report will be out in a few days.

This may explain the narrowing of the #gold EFP. Comex total gold inventories have increased sharply over the past few days indicating that the Comex premium has attracted some physical flows, despite the logistical complications.

Thursday, April 2

Gold is trading just below $1590/oz on Thursday morning, more or less unchanged on the same time on Wednesday. The spot bid-ask spread has come into about $2/oz according to Bloomberg.

The differential between spot #gold and the active #Comex future remains around $13/oz.

Comex total #gold inventories continue to build as this chart demonstrates.

Its been one of the quickest increases on record with 1.2 million ounces added since 25 March.

High Comex premiums attracting metal into New York despite suppy and logistics challenges.

Friday, April 3

Good Morning. #Gold is about $1610/oz in early European trading, in the middle of the range that its been in all week. The spot bid-ask spread is about $2/oz according to Bloomberg.

Comex #gold continues to command a wide premium to the loco London OTC price, currently around $18/oz this morning.

Another 500koz or about 16 tonnes of #gold was received by the Comex inventory system yesterday taking the total to 10.5 million ounces.

This is about 1.8 million ounces more than at the start of last week.

The high Comex premium is attracting deliveries.

#Gold held by exchange traded funds increased by 150koz yesterday, the ninth successive day of increase according to Bloomberg's robots.

Month to date the bulk of the #gold inflow into ETF has been seen into the US-listed products. Minor outflows have been seen in Asian-domiciled products.

Read more from John Reade on Twitter