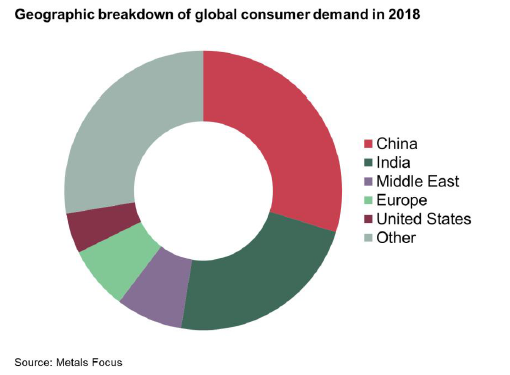

We will soon be launching two regular blog posts– monthly updates on India and China by Mukesh and Ray, our analysts in Mumbai and Shanghai. These monthly posts will provide a snapshot of the health of these two global heavyweights, which together account for around half of annual global consumer demand.

Weaving together publicly available data – such as exchange turnover, deliveries, imports and exports, and price premia – and qualitative on-the-ground insights, the updates will give a sense of how the physical market in each country is doing at a point in time. They are designed to complement the broader insights we already share on the goldhub blog. Alongside our weekly overview of price movements and macroeconomic developments, and our comprehensive write-ups on gold-backed ETFs and central banks, they will help investors form a more rounded perspective on the global market.

The updates will not be a rigorous assessment of demand across the countries’ respective jewellery, retail investment or technology markets. Trade data, for example, are renowned for needing to be taken with a pinch of salt and should not be interpreted as representing consumer demand: round-tripping can often inflate trade stats and unofficial flows – smuggling to you and I – are absent from the analysis.

A fuller assessment of the state of the market requires more in-depth analysis, the type conducted by Metals Focus when compiling the supply and demand numbers on our behalf. Metals Focus build upon desk-based analysis with extensive field research and industry surveys to arrive at credible demand estimates. This in-depth process behind our demand and supply numbers is explained in our brief animation, expertly voiced over by Gold Demand Trends lead author, Louise Street.

So, in summary, Ray’s and Mukesh’s posts will provide higher-frequency colour and insight on the world’s two largest gold markets and will, we hope, help investors form a more rounded perspective of the global market. But they are not intended be a definitive demand estimate. Arriving at those numbers is a more complex task. For more detail on how supply and demand numbers are arrived at, please see our methodology note.