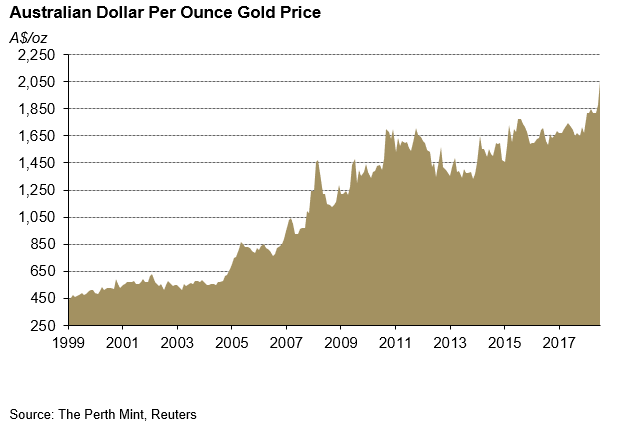

For Australian precious metals investors 21 June was a momentous day, with the price of gold topping A$2000 per ounce for the first time ever.

The chart below plots the rise in the price of the yellow metal since since the start of the year 2000, with gold rising from under A$450/oz over this time frame. This equates to a return of more than 8% per annum to any investor astute enough to have invested at the turn of the century.

The latest rally that pushed gold beyond A$2000/oz represented the culmination (for now) of a move that began in earnest back in September 2018. The gold price has climbed approximately 25% in AUD terms over the past nine months, compared with the 20% gain we’ve seen in the USD gold price over the same time period.

There are many global factors that have driven this rally, including:

- The sharp correction in risk assets during Q4 2018, which reignited demand for gold as a safe haven asset.

- A continued plunge in global bond yields in 2019 as the pool of negative yielding debt rises back above US$12 trillion

- A recalibration of interest rate expectations in the United States, with many economists now expecting the Federal Reserve to cut rates in July

- Continued concerns regarding the US-China “trade war”, as well as escalating geopolitical tensions in the Middle East

Why Has Australian Dollar Gold Outperformed?

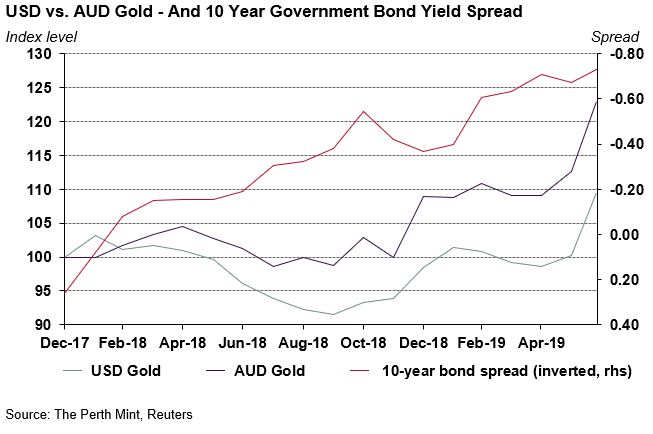

The bond market gives a clear explanation why gold priced in AUD has outperformed over the past 18 months.

Since the end of 2017, the Australian 10-year government bond yield has dropped from over 2.65% to below 1.30%. The move dwarfs the decline in US 10-year yields seen over the same time period, which fell from 2.41% to 2.01%. Unsurprisingly, this has led to a fall in the AUD/USD exchange rate, and the outperformance of AUD gold.

The outperformance is captured in the following chart which plots the performance of gold in each currency, with both rebased to 100 for easier comparison.

The chart also shows the spread between US and Australian 10-year government bond yields, which was sitting at +0.26% back in December 2017, but had plunged to -0.73% by late June 2019.

The reason for the sharp fall in bond yields is a continued deterioration in the Australian economy, which on a per capita basis fell into recession at the end of 2018.

The most significant driver of this weakness has been the correction in residential property prices in Sydney and in Melbourne, which are both down more than 10% since their 2017 peak.

This decline has been driven by multiple factors, including more cautious lending from Australian banks, a notable uptick in dwelling supply, and a sharp retraction from foreign buyers who now account for just 3.5% of demand for established properties, down from a peak closer to 10% back in 2013.

The negative wealth effect from this house price decline has impacted everything from unemployment to retail sales to wage growth, while the associated decline in housing turnover is dragging down state government budgets.

Will the Outperformance Last?

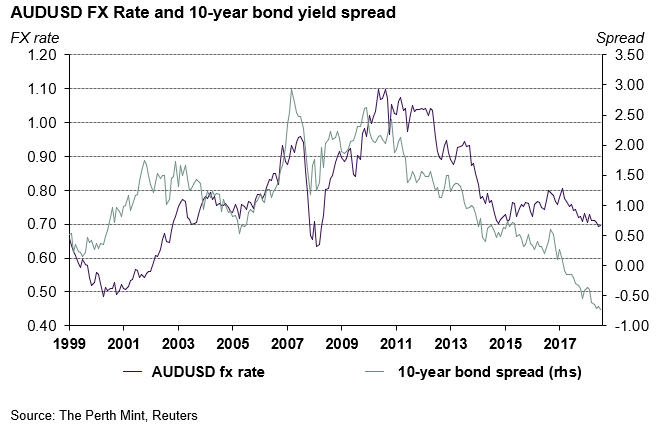

The chart below, which plots the AUD/USD FX rate, as well as the spread in 10-year bond yields between the United States and Australia since the turn of the century, suggests there is a meaningful chance of further significant falls in the value of the AUD.

In early 2001, when the AUD/USD FX rate was below US$0.50, investors could earn over 5.25% in an Australian government 10-year bond, a premium to the 4.91% US 10-year treasuries were offering at the time.

Today the Australian dollar sits closer to US$0.70, despite the historically unusual territory we find ourselves in, with investors now earning almost 40% more if they choose to lend to Washington instead of Canberra for the next 10 years.

In time, we’d expect the current yield differential to exert downward pressure on the AUD, especially if Australia’s terms of trade, which are back near the levels seen at the peak of the resources boom in 2011 were to falter.

Pressure on the local currency may be exacerbated if the Reserve Bank of Australia (RBA) − which this week cut the local cash rate to a new all-time low of just 1% − continues to ease monetary policy in the coming months in its efforts to stimulate growth.

The bottom line is that while the AUD gold price is high, it’s entirely justified why it is trading above A$2000/oz. Whether it’s a faltering local economy, a fragile property market, negative yield differentials, low and falling rates or a weakening currency, there are many good reasons why astute investors typically allocate 5-10% of a diversified portfolio to gold. The strategic case for gold as strong as ever.