Our Central Banks and Public Policy team have just published the results of the 2019 Central Bank Gold Reserves Survey. The survey gives a fascinating insight into the minds of central bankers and is especially timely since central banks continue to post record-breaking levels of net gold purchases in recent quarters. Some of you might have seen the National Bank of Poland’s announcement a couple of weeks ago that it had bought another 100 tonnes of gold, following its 25.7 tonne purchase in 2018.

This is the second year the World Gold Council has run the survey and I’m happy to see that this year’s survey has achieved nearly double the number of responses than the 2018 survey – 39 central banks responded this year versus 22 last year!

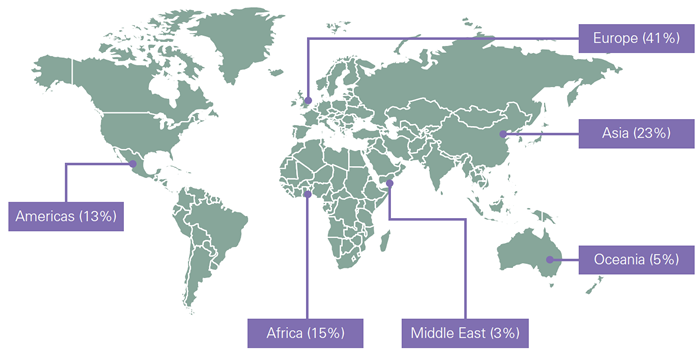

The geographic spread of survey respondents:

The survey signals more buying to come. 11% of emerging and developing country central banks say they intend to buy more gold over the next 12 months. The central bank team tell me there are around 186 central banks in the world (depending on which countries you recognise), of which 155 are in this category, so if we assume this is a representative sample, then I make that 17 central banks. That’s pretty much the same then as the 19 individual central banks that bought (over a tonne) of gold last year.

No advanced economy central banks intend to increase gold reserves. But that makes sense given they still have huge legacy stocks from the Gold Standard and Bretton Woods days. The central bank team tell me that investment guidelines also differ a lot between the two groups. Advanced economy central banks can invest in a much wider category of asset classes, whereas emerging and developing central banks are often confined to just gold, SDRs, IMF balances, highly-rated sovereign debt and deposits. Given the heightened geopolitical and economic risks associated with advanced economy debt at the moment, it is not difficult to see why they are turning to gold. In fact, the survey cites “higher economic risks in reserve currencies” as the most common reason for planned increases in gold reserves.

The views among central banks towards the future of the international monetary system are really interesting. Over three quarters of those surveyed think the renminbi will play a larger role in the coming five years. On top of that, 39% of emerging and developing economy central banks think that gold is an important asset to hold when the international monetary system is undergoing a major change. One doesn’t need to draw too much of a line between these two. Central banks are telling us that the world will likely be less dominated by US dollars and gold will be an important asset to hold in this scenario.

I know the central banks team are working on a research paper with Cambridge University on this, which I am really keen to read (and summarise for this blog) when it comes out. It’s also going to be the theme of their Executive Programme in Gold Reserve Management this year – in which they are aptly partnering with the PBC School of Finance, Tsinghua University in Beijing – so look forward to more on this topic soon.