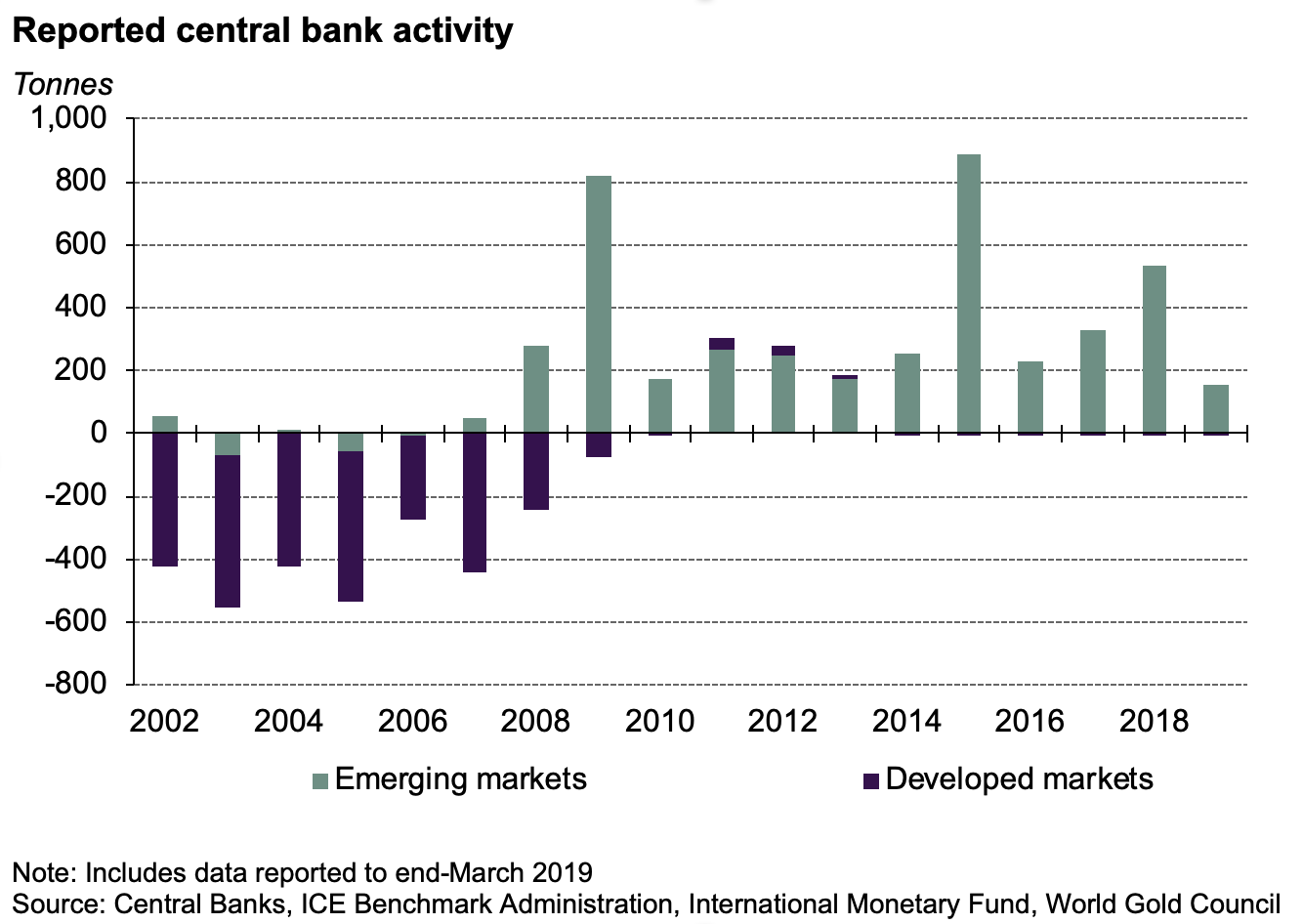

It’s no exaggeration to describe central bank buying in 2018 as stellar. At 651.5t, it was the highest level of demand for 50 years and deservedly grabbed all the headlines. But we also noted other telling attribute of central bank buying in 2018: more banks were doing it.

Emerging markets dominate central bank gold-buying bonanza

10 May, 2019

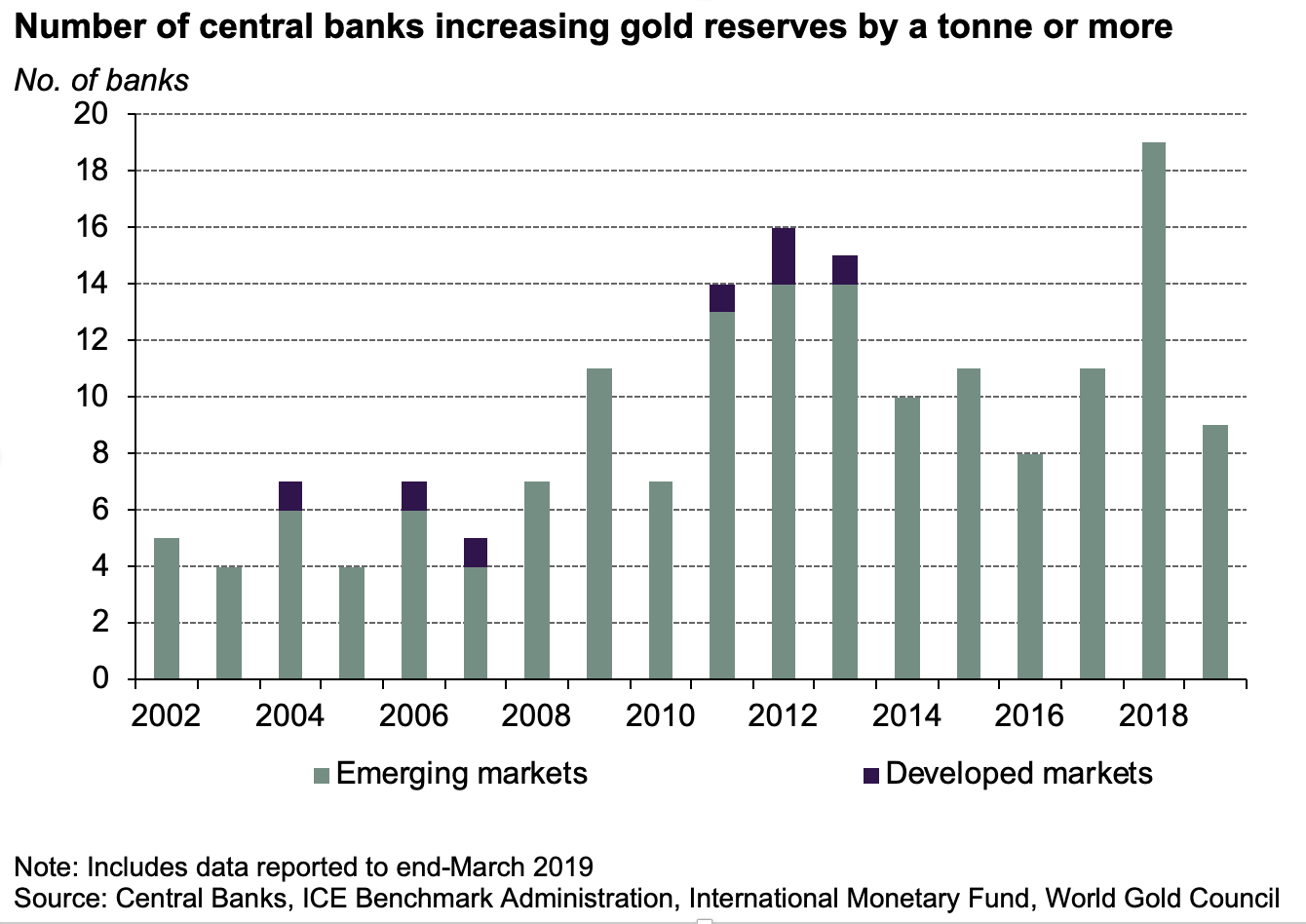

Since 2002, the number of central banks reporting growing gold reserves – by a tonne or more – has steadily increased. What’s more striking is that those who have reported growing reserves are almost entirely from emerging market (EM) central banks. (Although it is worth noting that while developed market central banks haven’t been significant buyers in recent years, they haven’t sold in large quantities either.)

This difference in behaviour might be stark, but it isn’t all that surprising. Looking at the latest (end-March) data for the top 100 official gold holdings, EM banks hold, on average, just 135t of gold. That’s equivalent to 11% of their total reserves. Contrast this to developed market (DM) central banks who, on average, hold 26% of their reserves in gold – around 725t.

Taking a longer-term view, EM central banks have reportedly bought over 4,300t (net) since 2002, while their DM counterparts have seen gold reserves shrink by almost 3,000t over the same period. Yet, collectively, DM central banks still own more than twice as much (21,000t vs 9,200t).

The latest COFER data shows that US dollars still account for an outsized portion of global reserves, with much of this likely in the hands of EM central banks. 1 Given the serious question marks around the global macroeconomic growth outlook as well as the challenging political landscape across key markets like Europe, it is reasonable for EM central banks to want to minimise risk by reducing this exposure.2 Furthermore, other factors such as a political desire to de-dollarise or anticipation of potential turbulence from a less US dollar-centric international monetary system might also be informing EM central bank attitudes towards gold.

So far in 2019, nine – solely EM – central banks have reported an increase in their gold reserves of a tonne or greater. While this might ebb and flow over the rest of the year, we believe that the number of central banks who increase gold reserves is likely to remain high (in a historical context), as is the amount of gold they choose to purchase.

Find our latest central bank statistics.

1data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4

2www.gold.org/what-we-do/official-institutions/case-gold