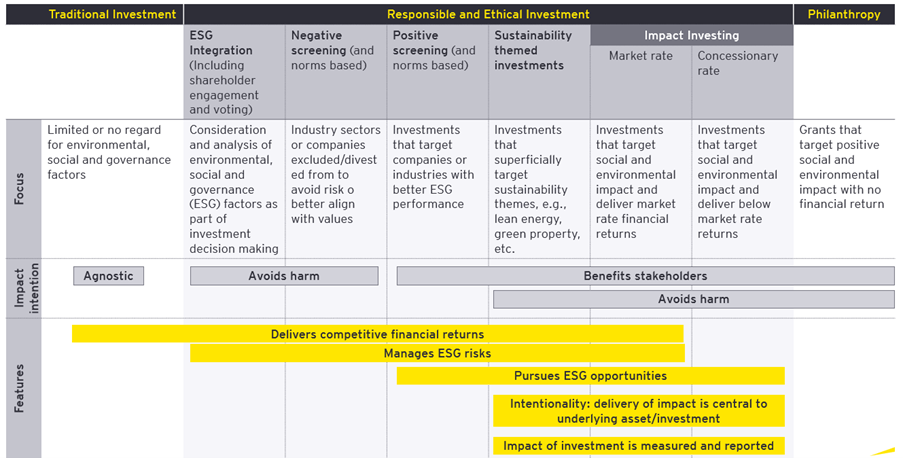

Globally, there’s an increasing shift of funds towards responsible and ethical investments, with 98% of institutional investors already screening environment, social and governance (ESG) performance when making investment decisions. A barrier for mining and metals companies is that, by definition, they are unlikely to be considered a mainstream impact investment. With this growing movement towards impact investing, EY and the World Gold Council recently co-hosted a webinar to discuss whether gold mining companies have the attributes of an impact investment, and what they could do better or differently to fit the description.

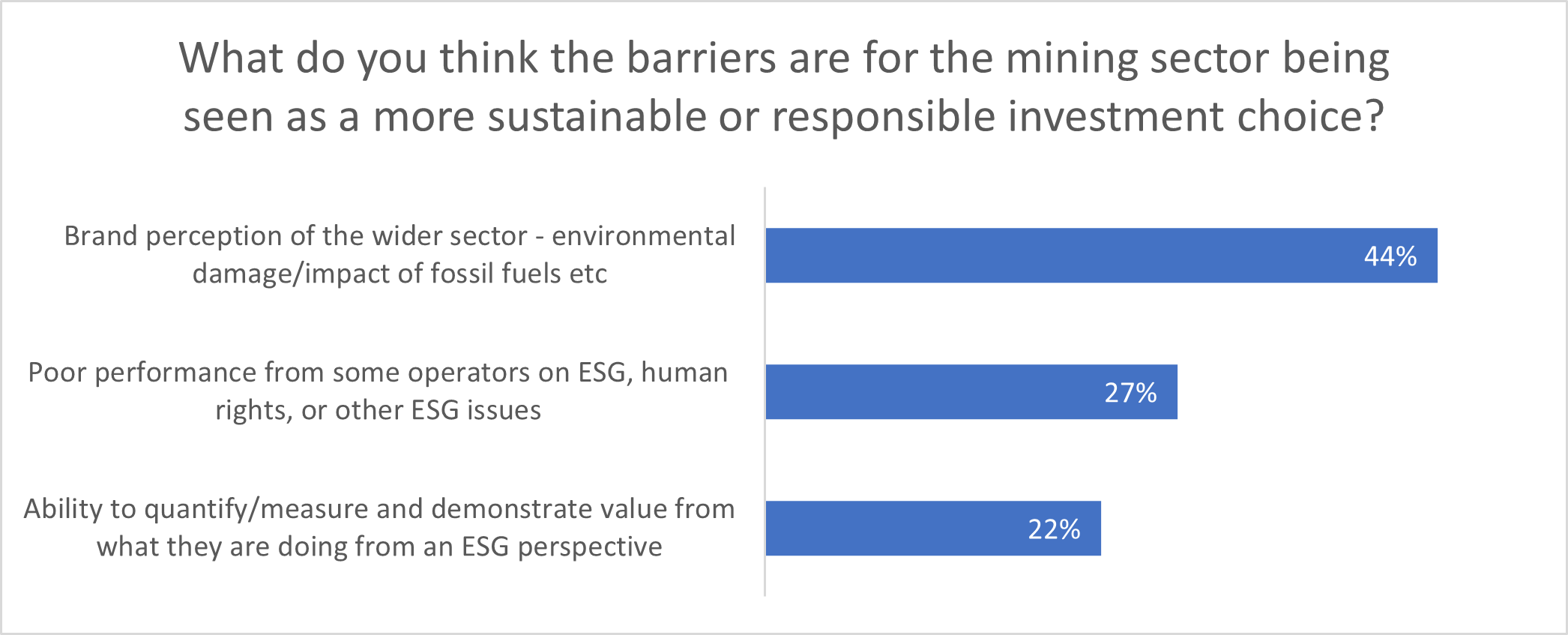

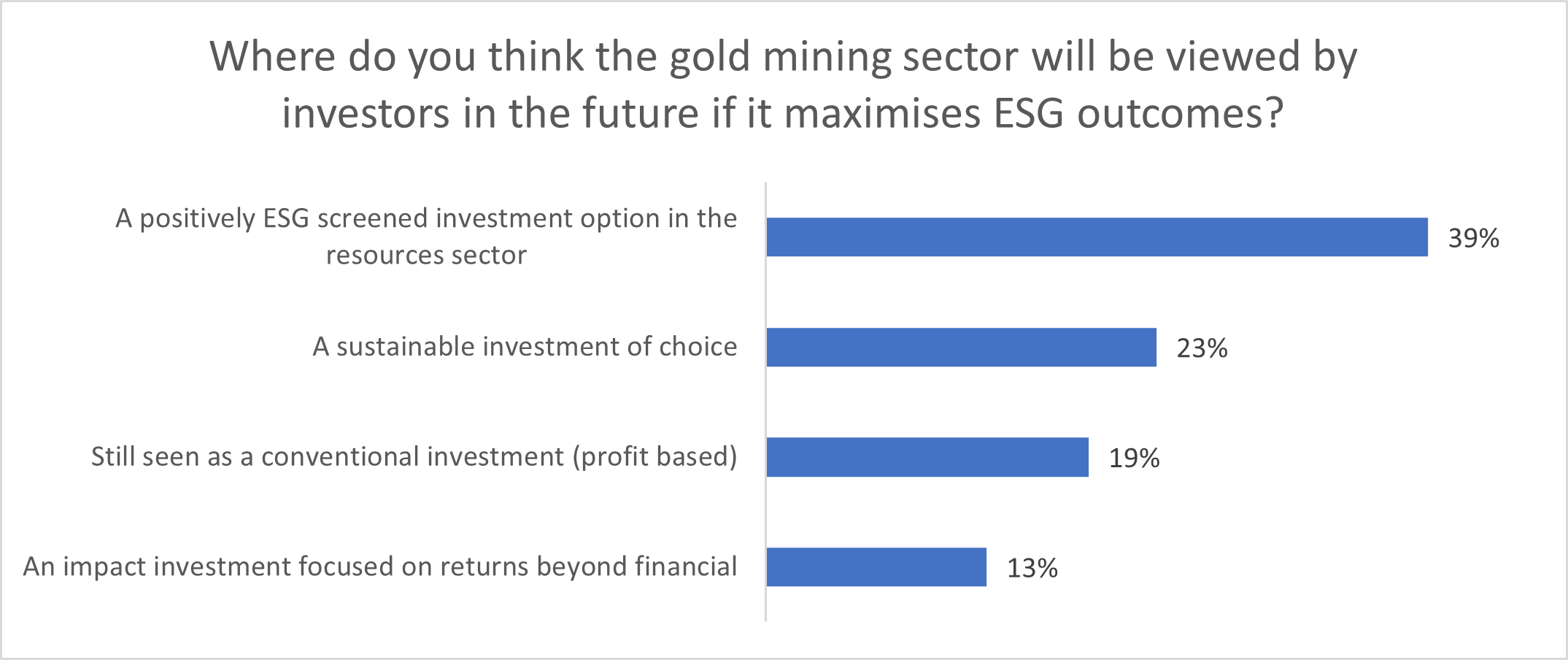

Panellists Catherine Raw, Evy Hambro, James Bevan and Matt Bell, along with moderator David Harquail, shared the view that it’s currently hard for the industry to claim to be an impact investment. That said, its contribution to local economies and communities can be an accelerant for change if done the right way. One welcomed approach from the investor community includes the World Gold Council’s Responsible Gold Mining Principles, which offers shared expectations of improved standards.

There’s no doubt the sector recognizes that engagement with stakeholders and communities is critical to help build a better tomorrow — and secure the capital needed to drive transformation in the recovery of COVID-19 and beyond. In fact, license to operate (LTO) was ranked number one for the third consecutive year in the EY Top 10 business risks and opportunities report. Now, gold companies must act purposefully in order to build a strong LTO, effectively disclose metrics and maintain on investors’ radars.