I recently participated in a panel discussion on ‘mining and the energy transition’ and, shortly beforehand, was having a brief conversation with the panel’s host, a well-known and well-reputed commodity analyst, who commented, “we never think of gold in relation to climate and energy”. I might have taken some offence at this, given that the subject has been a primary focus of my working life for some years now, but of course I didn’t – indeed, I wasn’t at all surprised.

But it certainly reminded me, again, that there is plenty of work to do to ensure that the World Gold Council’s programme of research and engagement on gold and gold mining’s relationship to climate change is more widely known and understood. And part of that work involves acknowledging the obstacles to be addressed.

Gold means very many different things to different people – whether it be as an item of iconic beauty, a safe and reliable investment, a symbol of success and achievement, or an industrial material with remarkable physical qualities. Indeed, its virtues as an asset are, to a large extent, dependent on this multiplicity of uses, and the wide range of motivations for purchasing gold, that make it such a potent diversifier. Driven by so many different factors, it is therefore less correlated with mainstream assets and market cycles. But this diversity, and the cultural and emotional values people often attach to gold, alongside its rich but often difficult and turbulent history, also mean that adopting a clear-sighted, data-led view of gold does not always come naturally, even to many of those close to the industry. Assumptions and legacy perceptions can be difficult to overcome, but they need to be considered if we are to change the lens through which gold is viewed.

When it comes to climate issues and prospects, the view is clear, although often alarming too; the science is now incontrovertible and the need for mitigating action is desperately urgent if disastrous climate impacts are to be avoided. The world must move away from activities and choices that generate high levels of green-house gases (GHGs) and, first and foremost, it must wean itself off fossil fuels.

We are now in a far more comfortable position to answer some of the key questions on gold and climate-related risks, and the possible contribution the industry might make in the transition to a Net Zero economy

This is now widely recognised by policy makers and investors across the world, and the direction of travel (towards a decarbonised economy) is clear, even if the route and time of arrival are far less so. But does gold have a meaningful role to play on this journey and can it contribute to this transition? Simply put, does gold matter and can it make a difference in the face of climate change?

These or similar questions started to be put to us on a more regular basis some years back when investors of scale – particularly, pension funds and sovereign wealth funds – suggested that, before we started to discuss the role gold might play as a strategic portfolio asset, they would like to hear more regarding gold’s ESG credentials and, specifically, its climate impacts. Such questions, now commonplace in our conversations with investors, led us to examine our own understanding of climate change and its likely impacts on gold as an asset and the wider gold supply chain. We started by seeking out further data and insights, including from academia and climate and sustainability specialists.

Fast forward a few years, and we are in a far more comfortable position in being able to answer at least some of the key questions on gold and climate-related risks, and the possible contribution the industry might make in responding to the global transition to a Net Zero economy.

We have, for example, arrived at a better understanding of gold’s overall carbon footprint. It is not large, at around 0.3% of annual global emissions, but neither is it insignificant, particularly when you consider the emissions intensity of gold on a volume basis. This then led us to drill down and examine the specific sources of emissions, almost all of which emanate from the gold mining process and, more specifically, mining’s use of electricity, as generated at mine sites or purchased from local grids. Knowing this allowed us to define a high-level pathway for the gold mining sector to decarbonise production by summarising the various options open to it to achieve emissions reductions in line with established climate targets - that is, as defined by the Paris Agreement, and refined and re-asserted by the IPCC1 and SBTi.2

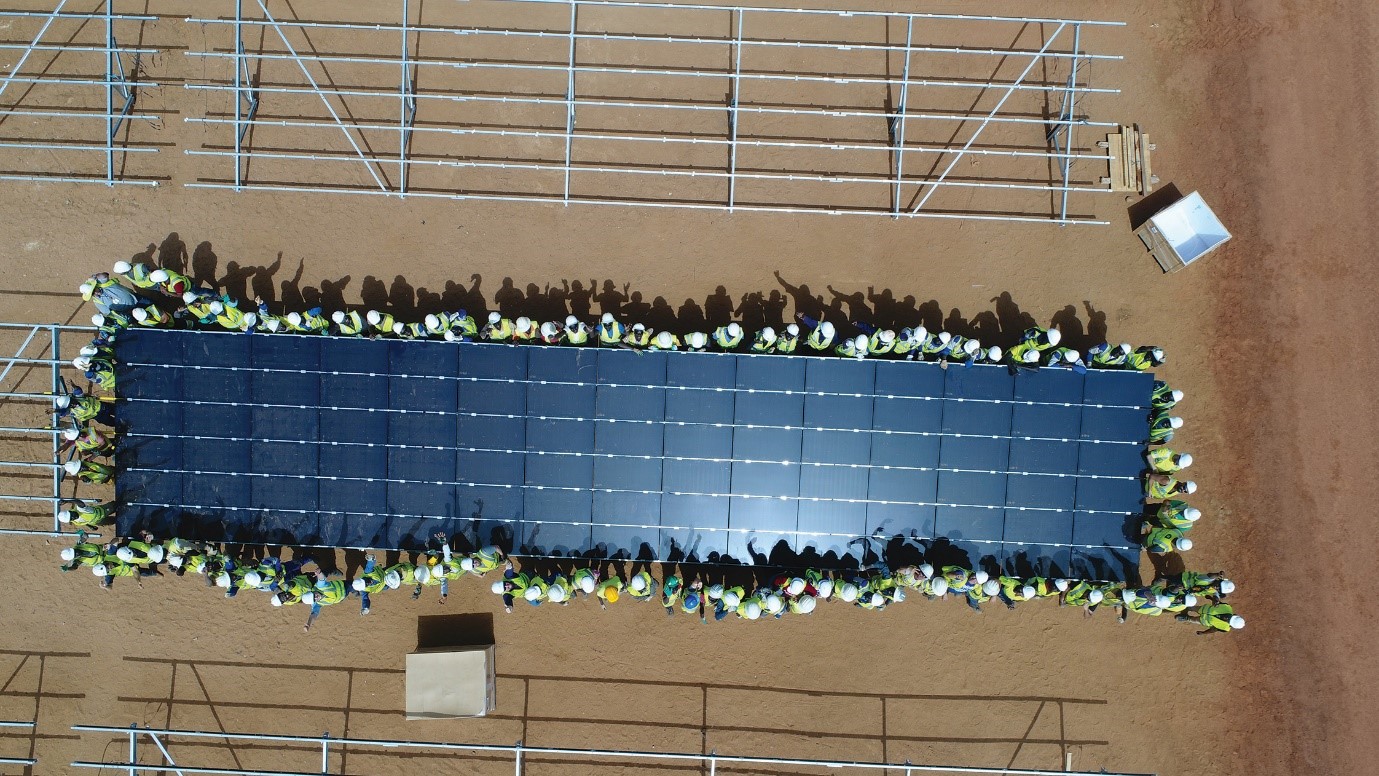

The most significant of these options – the ‘low-hanging fruit’ for near-term sectoral decarbonisation – is the ability to reduce and eventually remove fossil fuel-generated electricity from gold mining’s mix of power sources. The increased accessibility and affordability of renewable energy sources is key to enabling gold miners to achieve this shift, and falling costs and developing technologies should continue to expand the solutions available for more companies to embrace the opportunity to reduce emissions.

To gain a more detailed understanding of this opportunity, we then applied our analytical magnifying glass – or, to be precise, Wood Mackenzie’s – to what decarbonising gold mining electricity might look like in practice, ‘on the ground’. We analysed over 150 gold mines in 31 countries (that is, 57% or so of global listed production) and the power choices and trends at these locations. This allowed us to measure the emissions reduction impacts of specific actions – substituting fuels with renewable energy sources at varying rates, as part of phased ‘hybrid’ solutions - and the shifts in the wider energy landscape, as the emissions intensity of grid power also falls.

As with all sectors, there will be challenges and obstacles on the pathway to Net Zero, but there is a relatively clear opportunity for gold mining to decarbonise which we believe will open up further opportunities and offer beneficial impacts to a wider set of stakeholders

Quantifying the likely impacts of these factors, in tandem with the projected reserve depletion and fall in production at older, higher emission mines, led us to conclude that gold mining’s ability to reduce its emissions at a scale and rate aligned with Paris climate targets is well within reach. While, as with all sectors, there will be challenges and obstacles on the pathway to Net Zero, our findings suggest there is a relatively clear opportunity for gold mining to follow a fairly well-defined route, with a range of options and solutions along the way. And it is an opportunity that we believe will open up further opportunities and offer beneficial impacts to a wider set of gold’s stakeholders.

It is perhaps also worth noting that shifting to cleaner energy sources can have beneficial impacts beyond decarbonising the mine site. I have written and commented on this elsewhere, but it is worth reiterating: this is not purely about future climate targets and emission reduction numbers; it is also, in many instances, about bringing clean power to locations and communities that would not otherwise have access to it. Indeed, many remote communities may not have reliable access to electricity at all, unless they are able to invest in diesel-powered (high emission) generators. As gold mining brings cleaner power to more mine sites, it can make that power accessible to local populations beyond the mine, for instance via micro-/mini-grids, often implemented in collaboration with local partners. This not only has the potential to support a more just energy transition but can have some very real and potentially substantial development impacts – supporting, for example, better food preservation, medical provision, and wider business and entrepreneurial growth.

This is not purely about future climate targets and emission reduction numbers; it is also about bringing clean power to locations and communities that would not otherwise have access to it.

Moving from the mine to the market, very significantly and quite unusually, gold’s downstream uses, including as an investment asset (in the form of bullion or bullion-backed instruments such as the ETFs), are not associated with further GHG emissions of any notable scale. This means that by decarbonising mining’s electricity, the industry can go a long way towards decarbonising gold production which, effectively, decarbonises gold as a product and an investment. The prospect of ‘Net Zero gold’ thus becomes an eminently achievable possibility.