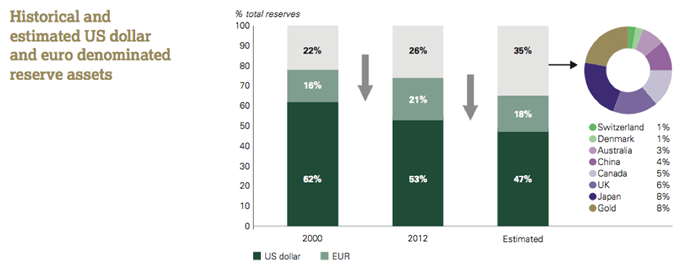

Emerging market central banks have large official reserves that have increased six fold from US$2tn to US$12tn in the past 12 years.

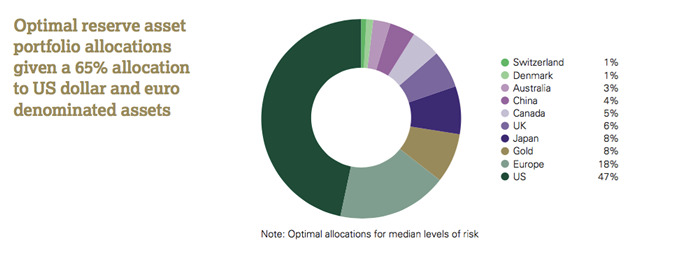

With concentrated positions in US dollars and euros, they have been focused on rebalancing into other currencies. This process is already well under way with the US dollar and euro component declining from 78% to 74% in the past 12 years. Meanwhile the share of “other” currencies has tripled in absolute terms since just 2008. Assuming this trend continues and US dollar and euro allocations reach 65%, the World Gold Council research finds gold would play a prominent role in the remaining 35% of assets.

As central banks look to reduce US dollar and euro exposure, there is an important role for traditional reserve assets like gold to playalongside alternatives such as Chinese, Canadian, Australian, Swiss, and Danish denominated assets. Renminbi, gold, and Australian assets emerge in this study as the most important assets for diversification. However, when accounting for market size, gold’s presence in the optimisation analysis was prominent at a full 8%, surpassing the weightings for Chinese and Australian assets.