World Gold Council research has analysed the gold sector’s carbon footprint and the opportunities for the industry to contribute to climate change mitigation, with an emphasis on the progress being made by gold mining companies as they transition to a low carbon future. Whilst the COVID-19 pandemic and its economic consequences are currently all-consuming, attention must not be diverted from ESG performance and commitments to tackle the climate crisis. Any further delays in implementing change will be damaging and costly, suggests the World Gold Council's John Mulligan.

As we struggle to see past the trauma and damage of the Coronavirus crisis and consider the path to medical, social and economic recovery, we also need to prepare for a future in which major disruptive and destructive events will likely become more frequent and severe unless we act immediately and at scale. Emerging from the pandemic, we must remain mindful that there is no more pressing challenge facing humanity than that of climate change. This has clearly been on the mind of UN Secretary General António Guterres who recently commented that, despite the coronavirus, the world must not forget the “deeper environmental emergency” facing the planet.1

2020 is a pivotal year with regard to our ability to meet the core objective of the Paris Agreement on Climate Change (to maintain the global temperature at ‘well-below two degrees’ above the pre-industrial average). The lockdowns imposed by the pandemic have derailed some of these plans, with the postponement of COP 26 being an obvious casualty, but there is also a hope they may be quickly put back on track, with renewed commitment and vigour.

Numerous commentators have been emphatic in suggesting that the pandemic, and our responses to it, might have taught us some valuable lessons, not least as the lockdown demonstrated how quickly a change in human activity can result in environmental improvements. But many perceive that the recovery process from COVID-19 shocks may also represent a potential catalyst for economic transformation in support of climate mitigation. An editorial in the leading science journal Nature2 asserts, “The coronavirus has shown us what happens when there’s a large shock to the world economy. That’s why efforts to combat climate change must not slow down.” And economics professor Wendy Carlin (from University College London), commenting in the Financial Times,3 argues: “We now have another opportunity for a fundamental shift… Covid-19 along with climate change could be the driving forces of our age to transform economic thinking, policy and the choices people make.”

But we need to learn these lessons in a hurry and grasp the opportunities as soon as we can. The climate science is irrefutable and deeply alarming. Atmospheric CO2 reached a high of over 415 parts per million in May of last year, a level not seen for 3 million years. 2019 was the hottest year on record. Wildfires raged across Siberia, Alaska, California and Australia and these fires are getting larger and more intense. Sadly, these fires also further exacerbate climate change – all that carbon literally goes up in smoke! The global rise in the frequency and severity of floods is also directly correlated with rising global temperatures.

Climate-related impacts threaten ecosystems, accelerate extinction trends and soil erosion, and contribute to greater food and water insecurity. They are also a very major threat to public health, increasingly the likelihood of famine, and infectious and non-communicable diseases.

To achieve net zero carbon emissions by around 2050 will require radical changes across all corners of the economy and society, including the restructuring of energy, land use, transport and buildings, with unwavering support from governments, businesses and individuals. These changes represent very substantial transition risks and some sectors will undoubtedly struggle to adapt.

In the World Gold Council’s recent report, Gold and climate change: current and future impacts,4 we presented evidence that the gold supply chain, and gold mining in particular, might be in a constructive position to embrace these changes and make a positive contribution to achieving net zero carbon targets. Overall, gold’s carbon footprint is relatively small, estimated at under 0.3% of annual global greenhouse gas (GHG) emissions. The vast majority of these emissions are generated by the mining and milling of gold and, more specifically, from the electricity and fuels used in powering these processes.

Fortunately, there are already a range of options, increasingly accessible and cost effective, to allow gold miners to move away from fossil fuels and decarbonise both their electricity and transport needs Many gold mining companies are already moving in this direction and our research indicates how, over the coming years, renewable energy sources, such as wind, solar and hydro power, and complementary technologies might prove more cost effective for miners than the existing carbon-intensive options.

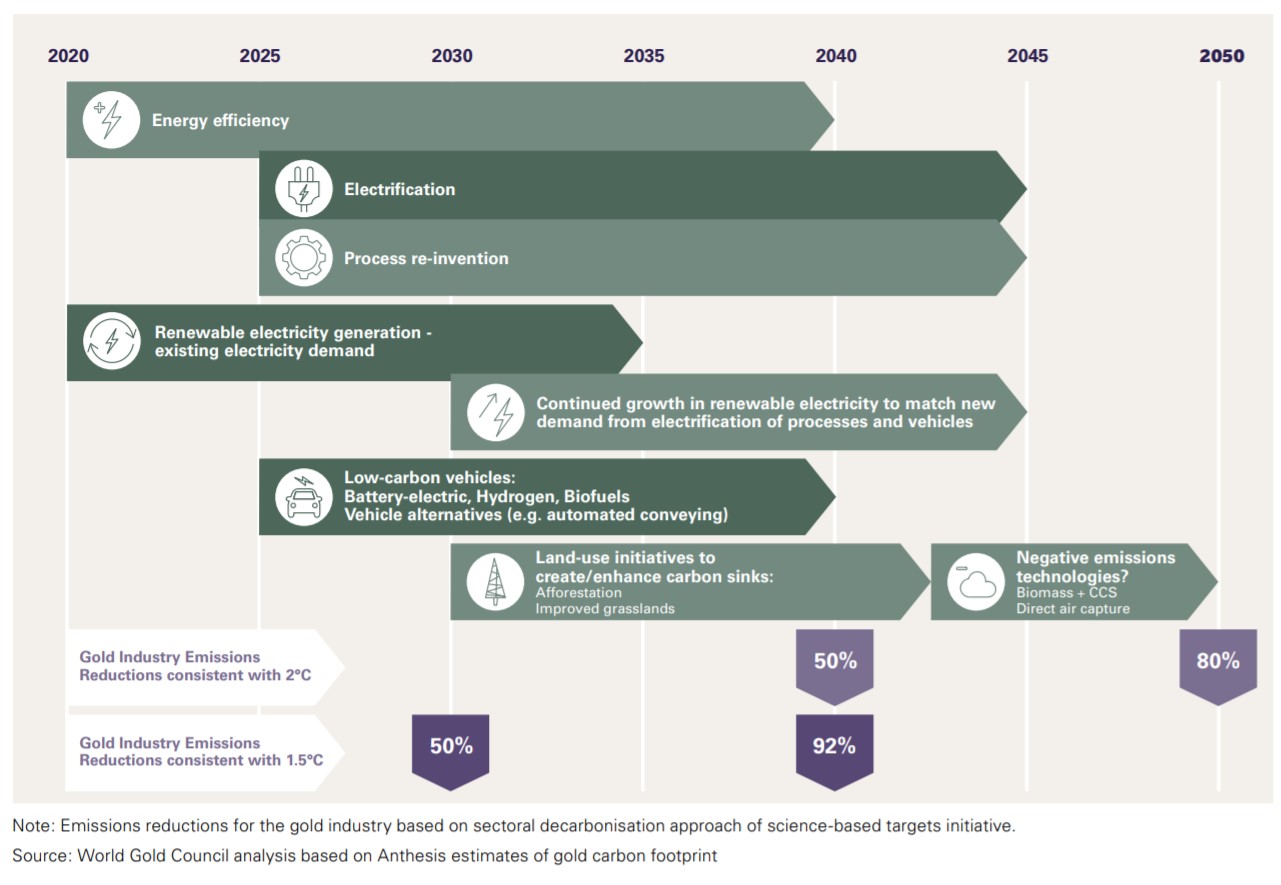

An illustrative potential emissions reduction and transition pathway for gold mining

These are no longer peripheral issues, bracketed with philanthropic CSR programmes and narrow sustainability specialisms. They are now key factors in determining how sectors are funded and how assets are selected by investors.

I think it is time for the gold mining sector to embrace the fact that consideration of climate-related risks is now a mainstream issue, core to business interests and increasingly at the heart of basic asset evaluation and selection processes. Acknowledging this new reality, gold miners can grasp the opportunity to demonstrate sectoral leadership through taking concerted action to further reduce their emissions and impacts, in line with science-based targets, to help curb the current climate trajectory and its destructive consequences.

However, in addition to the question of how a company or sector might impact climate change, a key issue for potential gold investors – and, indeed, investors in all asset classes - is how climate-related risks and future scenarios are likely to impact the value of their investments and the performance of their portfolios.

Mercer, the world’s largest world's largest institutional investment advisory firm, has been proposing that investment strategists integrate climate change risks into their asset allocation models for a decade or so.5 More recently, the Task Force on Climate-related Financial Disclosures (TCFD) has been prompting organisations to implement effective climate-related financial reporting, emphasising the importance of transparency in evaluating climate-related risks to support efficient capital-allocation decisions. Only two years after its launch, nearly 800 organisations, including global financial firms responsible for assets of over US$118 trillion, have declared their support for the TCFD and its objectives.

This trend among institutional investors is mirrored by shifts in the regulatory environment and rising pressure from activist shareholders wishing to influence the environmental and climate policies of public companies.

With this in mind, the World Gold Council’s research on climate change seeks not only to identify a credible path for the gold mining sector to move towards carbon neutrality, but to also offer insights into how gold’s value as an asset might be impacted by climate risks.

And, among the lessons emerging from the pandemic, is the need for protection or ‘insurance’ against the economic and market response to such crises.

Surveying the investment landscape in the wake of the damage inflicted by COVID-19 lockdowns, the asset that stands out, having again demonstrated its resilience and reliability as a safe store of value in troubled times, is gold. As the majority of mainstream assets plummeted recently, gold’s value rose to 7-year highs.

This robust performance may have something to teach us when we consider how to protect our investments from the ravages of future crises. Our analysis suggests that gold is likely to prove relatively resilient in the face of a range of climate-related physical and transition risks, particularly in comparison to the vulnerability of many other asset classes.

As we emerge from the pain and damage of the COVID-19 crisis, there is therefore some cause for optimism for the gold sector, not least in the constructive role it may play in the transition to a net zero carbon future and the stabilisation of the environment.

But there is no cause for complacency. As former UN climate chief Christiana Figueres recently said when asked if the pandemic had changed her view of the future: “The big lesson learned from the pandemic, for both the health crisis and the climate crisis, is that delay in responding is always costly.”

The message is clear; now is the time to act.

Footnotes

1 https://www.bbc.co.uk/news/science-environment-52370221

2 Climate action and poverty alleviation must go hand-in-hand, Nature, 22 April 2020

3 Covid-19 is resetting the way we talk about the economy, Financial Times, 23 April 2020

4 https://www.gold.org/goldhub/research/gold-and-climate-change-current-and-future-impacts

5 See, for example, Investing in a Time of Climate Change; The Sequel (2019), Mercer.