Q2 gold demand flat, H1 down 10%

Strong consumer demand recovery and Q2 gold ETF inflows were not enough to offset heavy Q1 outflows.

Gold demand (excluding OTC) for Q2 was virtually in line with Q2 2020 at 955.1t (-1%). That took H1 demand to 1,833.1t, down 10% y-o-y.

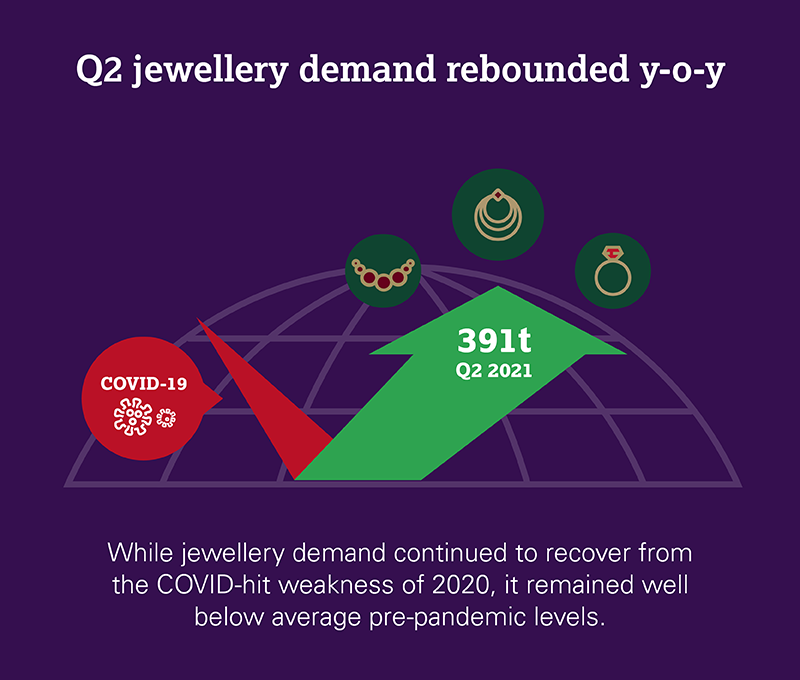

Q2 jewellery demand (390.7t) continued to rebound from 2020’s COVID-hit weakness, although remained well below typical pre-pandemic levels, partly due to weaker Indian demand growth. Demand for H1, at 873.7t, was 17% below the 2015-2019 average.

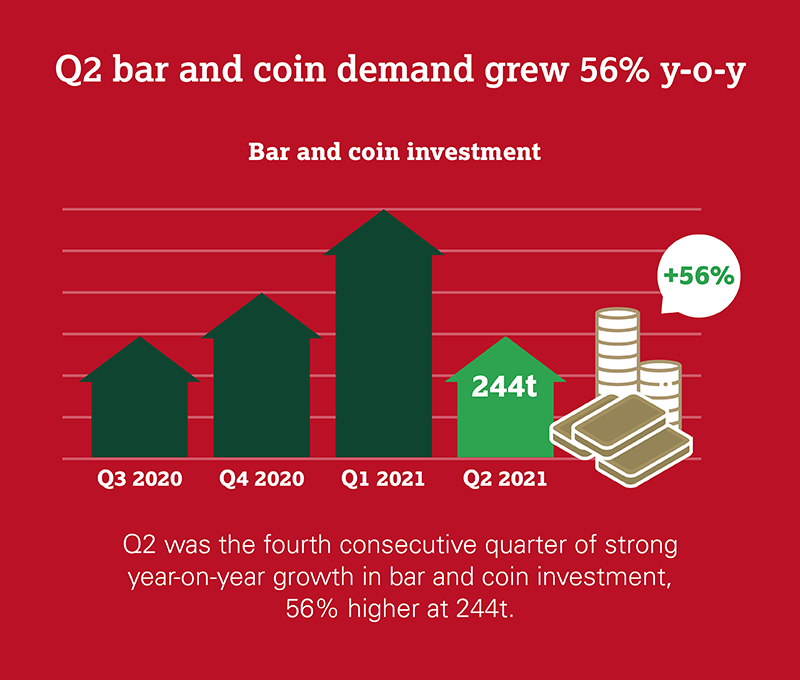

Bar and coin investment saw a fourth consecutive quarter of strong year-on-year gains: Q2 demand of 243.8 resulted in a H1 total of 594.t, the strongest since 2013.

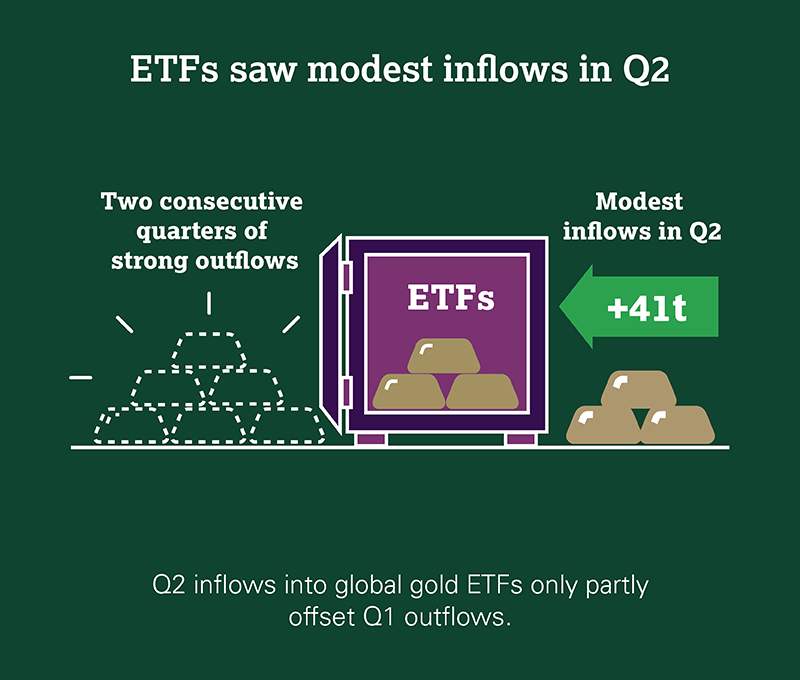

Modest Q2 inflows into gold-backed ETFs (40.7t) only partly offset the heavy outflows from Q1; consequently, ETFs saw H1 net outflows (of 129.3t) for the first time since 2014.

Central bank buying continued in Q2. Global gold reserves grew by 199.9t, which took H1 net buying to 333.2t – 39% higher than the five-year H1 average, and 29% above the ten-year H1 average.

Gold used in technology continued to recover from the 2020 lows: Q2 demand was 18% higher y-o-y at 80t – in line with average Q2 demand from 2015-2019 of 81.8t. H1 demand (161t) was fractionally above that of H1 2019 (160.6t).