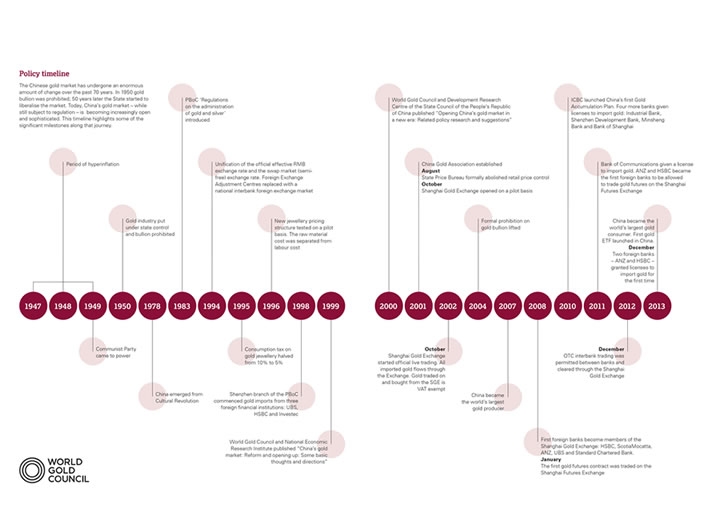

The report examines the factors that have driven China’s rise to become the number one producer and consumer of gold since the market began liberalising in the late 1990s and consumers were first allowed to buy gold. It also highlights why despite this steep growth in demand, the market will continue to expand, irrespective of short term blips in the economy.

Albert L. H. Cheng

The report examines the factors that have driven China’s rise to become the number one producer and consumer of gold since the market began liberalising in the late 1990s and consumers were first allowed to buy gold. It also highlights why despite this steep growth in demand, the market will continue to expand, irrespective of short term blips in the economy.

Albert L. H. Cheng, Managing Director, Far East

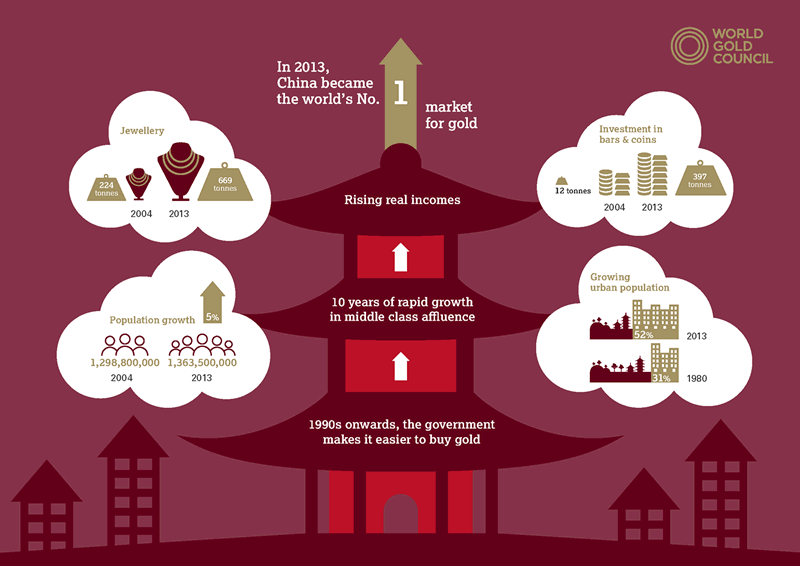

A major report published by the World Gold Council "China's gold market: progress and prospects" suggests that private sector demand for gold in China is set to increase 20% from the current level of 1,132 tonnes(t) per year to at least 1,350t by 20171. Following the record level of Chinese demand in 2013, which saw the country become the world’s largest gold market, the report suggests that while 2014 is likely to see consolidation, the succeeding years are likely to see sustained growth.

1 Precious Metals Insights

China report video

Albert Cheng, Managing Director, Far East, talks through the findings from the China's gold market: progress and prospects report.

黄金报告视频

远东地区董事总经理Albert Cheng介绍中国黄金市场动向:进展及预期报告。