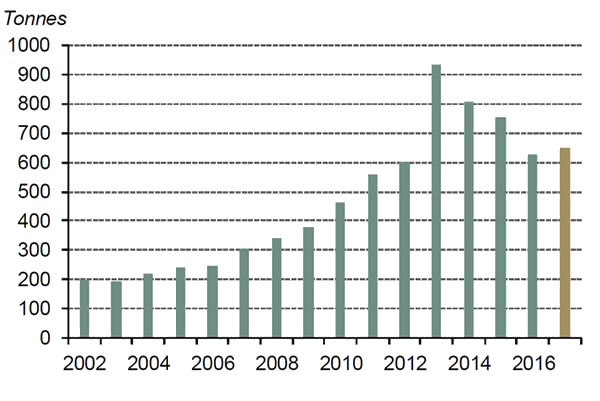

Fuelled by an expanding economy and rising wealth, China's gold jewellery demand has boomed since the early 2000s. Despite this, it has endured some challenging years: jewellery market research shows demand shrank by one-third between 2013 and 2016. But 2017 saw modest growth, following a period of reinvention.

Jewellers’ efforts to modernise their product mix, improve design, and seamlessly blend customers’ online and offline experiences are starting to bear fruit. It is our view that China’s jewellery market has turned a corner. We believe a more consumer-focused industry, combined with China’s rising wealth, will support global gold demand and gold’s long-term performance.

China jewellery market responds to changing consumer behaviour

Demand for gold jewellery in China more than tripled over the past 15 years as the economy expanded and individual wealth grew. It is now the largest consumer of gold in the world, with China’s jewellery market accounting for 30% of global demand.

It hasn’t all been plain sailing. The 2013 boom – when tumbling gold prices sparked a buying frenzy – saddled the sector with a record number of stores, excess capacity, and fierce price wars. The industry was forced to go through a painful period of reinvention. Rather than relying on traditional consumers buying jewellery purely for its gold content, goldsmiths now undertake extensive jewellery market research to get to know their customers better. They increasingly try to meet the needs of modern consumers by offering a more diverse product mix, designing more appealing jewellery and optimising sales channels.

Greater focus has been placed upon increasing the adornment value of jewellery and fulfilling the desires of China’s gold market consumers who wish to express their identity, gain social recognition and embrace change.

These efforts have delivered encouraging results: 2017 was the first year of growth in jewellery demand since 2013. With continued innovation and efforts to reinvigorate the industry, we believe the rise in 2017 may mark the return to sustained growth.

Chart 1: China's jewellery market recovered in 2017

Source: Metals Focus; GFMS, Thomson Reuters; World Gold Council

Chinese preferences for gold differs by region

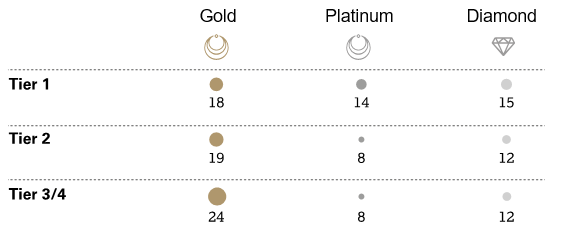

China’s evolving middle class is contributing to a shift in the consumer landscape. The jewellery market needs to adapt to the changing profile of China’s jewellery consumers. In 2016 we conducted a detailed piece of jewellery market research in which we asked 2,000 women which jewellery product they would purchase if they were given RMB 5,000. One key takeaway from this was the difference in consumer preference between regions.

In recent years, gold jewellery has faced stiff competition from other items of jewellery and luxury goods in Tier 1 (T1) cities. According to our consumer jewellery market research, 18% of women in T1 cities would choose to buy gold jewellery when given RMB 5,000, compared with 14% and 15% who would buy diamond or platinum jewellery respectively.

The competition is not as fierce in lower tier cities: consumers in T3 and T4 flock to buy high carat, heavy gold jewellery for wealth preservation purposes. As the chart shows, 24% of women surveyed in T3 and T4 cities would choose gold, compared with 8% choosing platinum and 12% choosing diamond jewellery. But in all tiers preference for gold is higher than for platinum and diamond, hinting at gold’s continuing stronghold over Chinese consumers.

Chart 2: Percentage of women in China who, if given RMB 5,000, would choose a specific jewellery product

Source: World Gold Council

Read more in our report: China’s jewellery market: new perspectives on consumer behaviour