- The risk of stagflation has increased materially since we addressed the topic last year

- Europe appears to be at greater risk than the US, due to higher exposure to soaring commodity prices and a weaker economic position, but alarm bells could soon ring across the Atlantic, too

- Year-to-date, gold has performed well, arguably reflecting the Ukraine crisis and the ongoing reflationary environment

- But should stagflation become widespread it could provide further support for gold as a diversifier and risk hedge

Last year, we wrote a report on the risk of stagflation. At the time of writing, we didn’t envision a return to 1970s stagflation – low growth, rampant inflation and high unemployment – but a milder version, absent high unemployment but where household and corporate ‘margins’ are still squeezed by soaring costs and lower income. That view seems now optimistic.

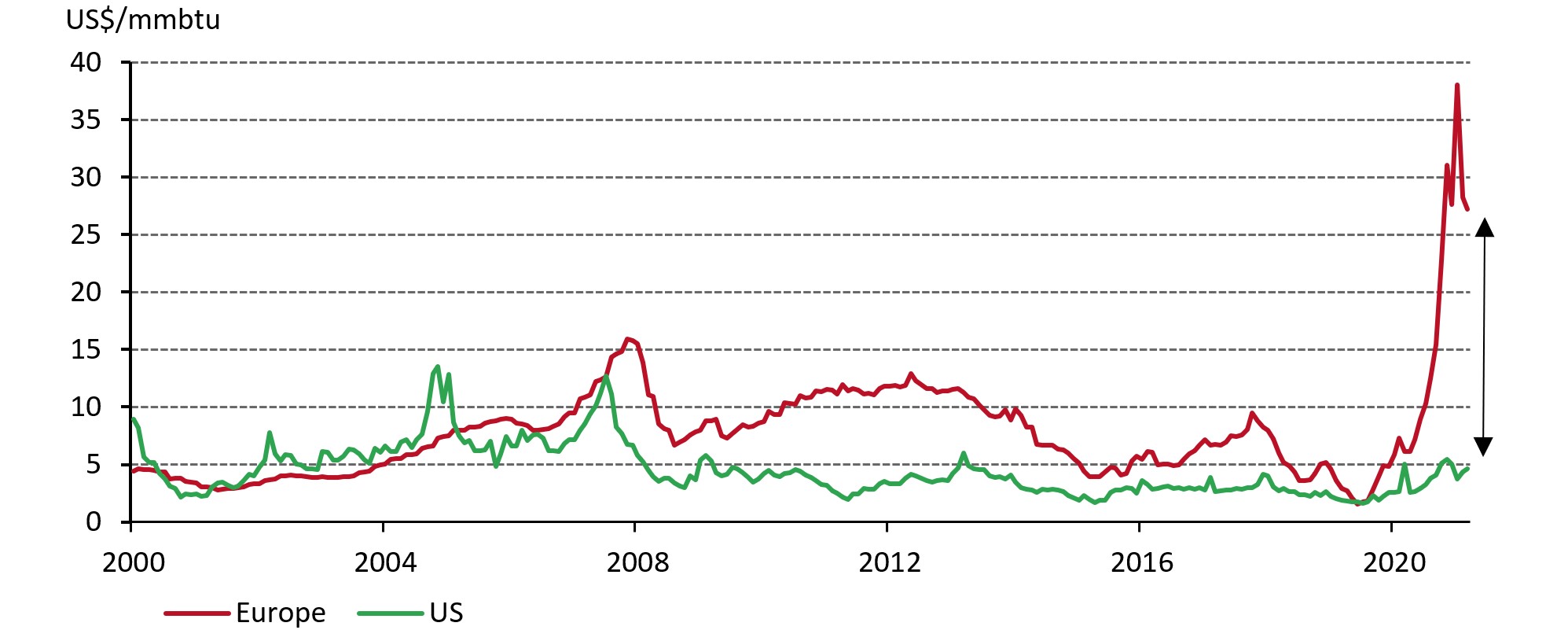

Economic risks appear more acute, particularly in Europe. The durable goods-driven recovery has morphed into one powered by service spending – less beneficial to the region, given its high reliance on manufacturing. Money supply growth has also slowed markedly, often a reliable harbinger of weaker business confidence and activity. This has been exacerbated by the Ukraine crisis causing a surge in the price of essential commodities such as natural gas (Chart 1). At its most recent meeting, the ECB actually discussed the possibility of a stagflationary shock, even if it doesn’t expect outright stagflation.

Chart 1: Europe has faced significantly higher energy prices compared to the US

Monthly natural gas price*

*Data to 28 February 2022.

Source: Bloomberg, World Bank, World Gold Council

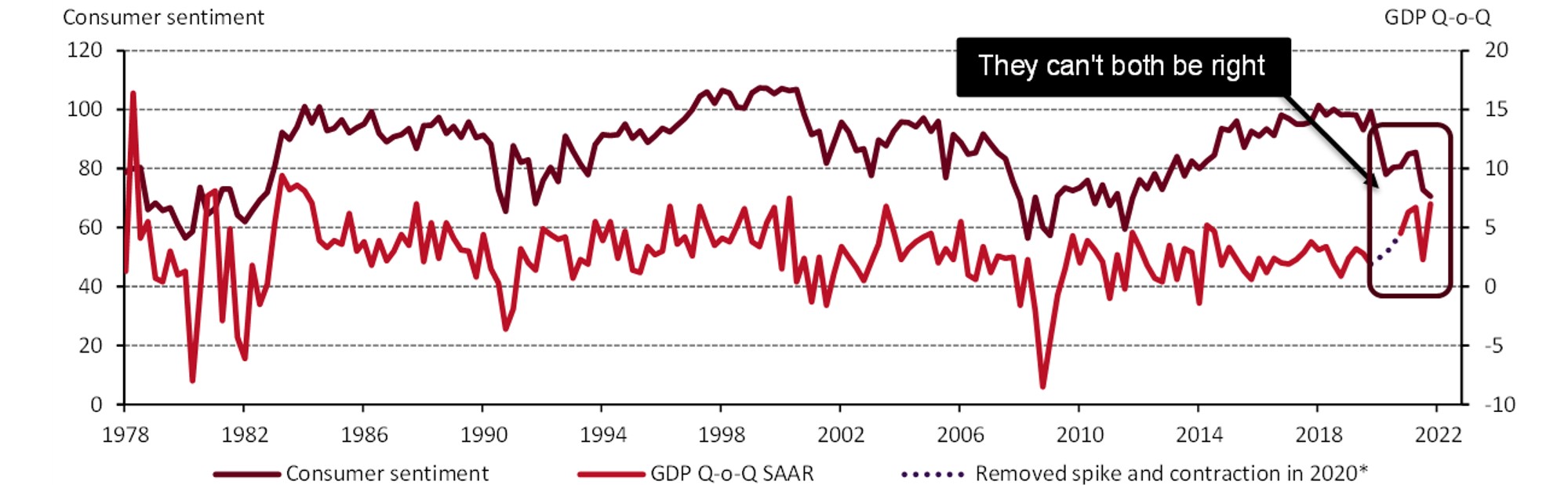

Contrast this with the US. Although inflation has been setting successive multi-decade records for nigh on a year, both hard and soft economic data are still firmly in expansion territory. This is still a reflationary environment. But events can unfold quickly and some indicators point to the risks of a slowdown alongside soaring prices: The US Treasury yield curve has been flattening at an alarming rate across a number of tenors and consumer sentiment is at a ten-year low (Chart 2). In addition, the Atlanta Fed’s GDP now estimate puts growth at 0.5% in Q1 2022.1 Should current conditions drag on, the risk of a stagflationary squeeze will rise materially.

Chart 2: Sentiment and GDP are not telling the same story

*Data to 31 December 2021

Source: Bloomberg, World Gold Council

‘Stagflationary’ environment painful for risk assets… gold to the rescue

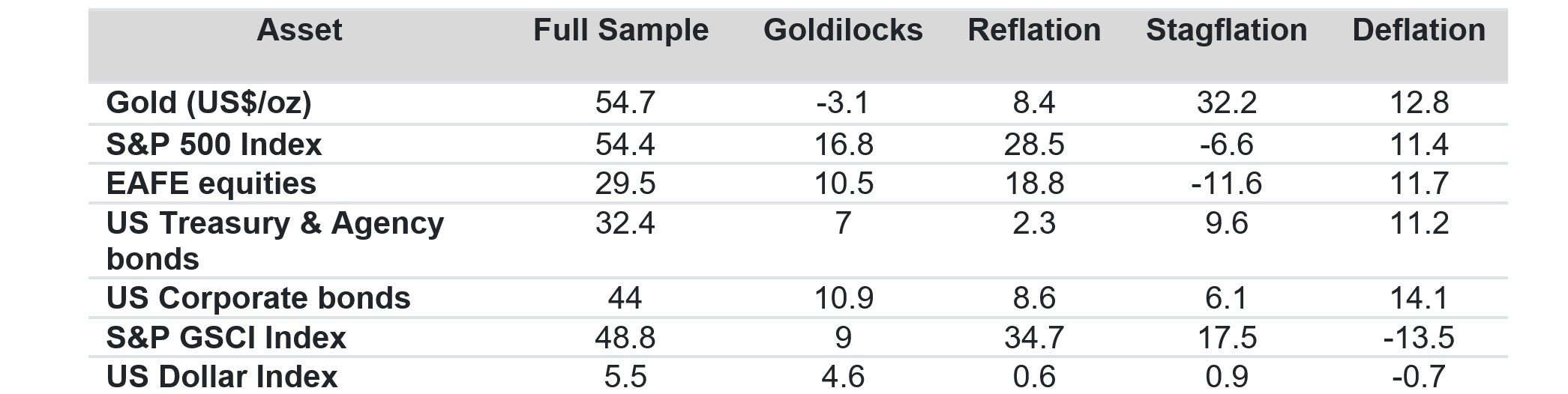

Of the four business cycle phases since 1973, stagflation is the one that is most supportive for gold and conversely the worst for risk assets (Table 1).

Table 1: Gold in USD has been the best stagflation performer since 1973

Annualised average adjusted return (AAAR)2 since Q1 1973 (all figures in %)*

*As of Q2 2021. Please refer in the appendix of 'Stagflation rears its ugly head' for a detailed descriptions of the methodology.

Source: Bloomberg, World Gold Council.

Gold’s strong performance year-to-date might be following its historical track record in reflationary environments, lagging commodities initially but eventually catching up. The Ukraine crisis has undoubtedly focused more attention on gold’s hedging credentials. Whatever the motivation for the current widespread interest in gold, it is doing exactly what an effective diversifier and portfolio hedge should: providing protection when other assets are faltering.

What may also be benefiting gold here is the lacklustre performance of bonds. Consistent with reflationary periods, bonds have struggled since the start of the year. A broad index of US government bonds has fallen 6% so far and even the Russian invasion of Ukraine failed to muster more than a brief uptick before the downdraft resumed.3 If growth slows significantly and stagflation materialises, history suggests bonds should rally (and yields fall).

There are strong tailwinds for gold at the moment: equity weakness, geopolitical risk, soaring inflation. Weakness in bonds is adding further support, and we are still in a reflationary environment. Should this morph into something more stagflationary – the risk of which is rising – then history suggests it could be even better for gold.

Footnotes

GDPnow is a running estimate of a current quarter’s GDP estimate using available information.

This measure is based on quarterly returns and is used to weight these returns according to the severity of the stagflationary phase. Please refer in the appendix of 'Stagflation rears its ugly head' for further detail.

ICE BofA US Government and Agency Total Return Index