Our latest Gold Demand Trends report takes a detailed look at the global gold market in the third quarter.

The fact that gold demand so far this year is down 9%, while the average gold price over the same period was 4% higher, exemplifies gold’s diversification benefits, thanks to its varied roles as an investment, consumer good and a reserve asset.1

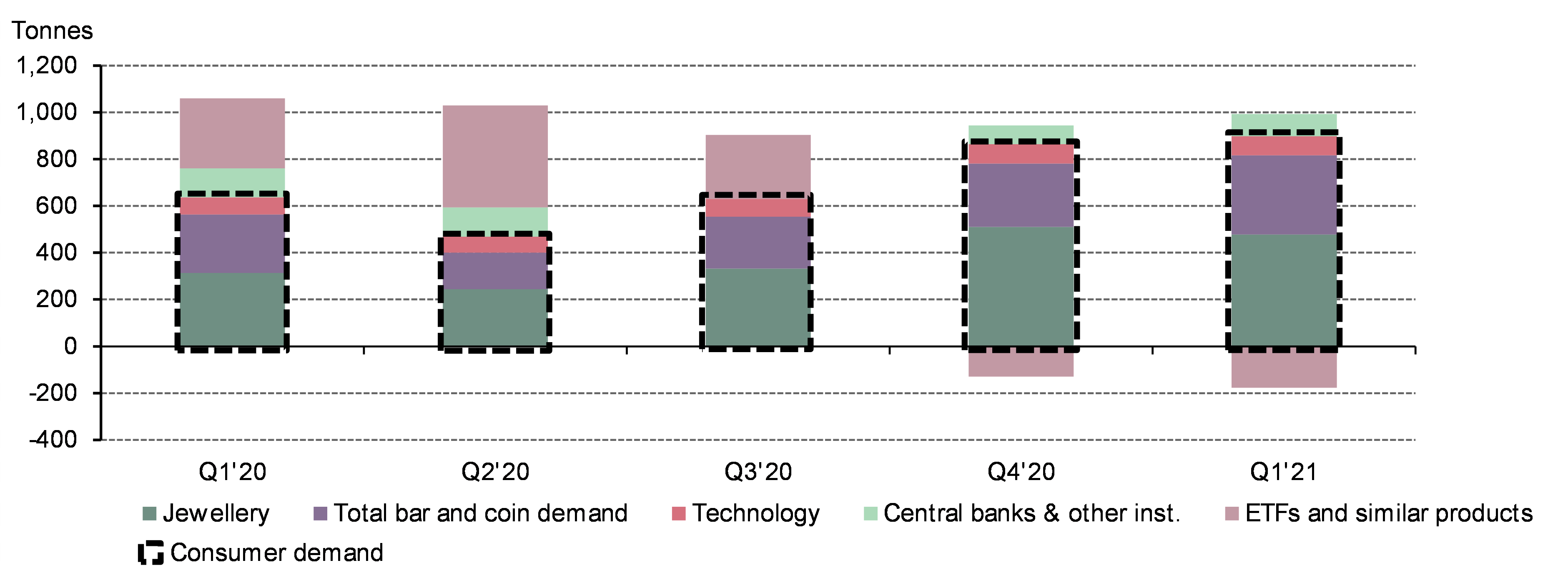

Gold demand (excluding OTC) for Q3 was 871t, compared with 894t in Q3 2020. That 7% drop was primarily due to ETF outflows, which had a disproportionate impact owing to last year’s record inflows. Bar and coin investment partly compensated, reaching record levels in some markets. Consumer-led sectors saw demand continue their sharp recovery from last year’s weakness, although jewellery has yet to return to pre-COVID levels. And central banks continued to buy at a healthy pace. On the supply side, another sharp y-o-y contraction in recycling supply outweighed a rise in mine production to a record quarterly level.

These broad shifts demonstrate why gold’s performance can benefit from its unique demand structure, as gains in some areas of the market often offset declines in others.

Q3 gold demand: ETFs switched to outflows, in contrast with growth across other sectors

Jewellery surged

On the consumer side, gold jewellery buying was spurred by economic recovery from last year’s pandemic-induced downturn – although the shadow of COVID kept spending in check in some markets. Demand in India was revitalised as retailers opened back up after the Q2 second wave. And the outlook for the end of the year is bright: the trade expects a strong Q4, kicking off with Diwali festivities this week.

Investment diverged

The gold investment market witnessed diverging flows in Q3: ETF outflows were in contrast with bar and coin investment, which was up by 18% y-o-y.

One explanation for this apparent dichotomy in investment could be that retail investors buying bars and coins tend to be more focused on the inflation environment than investors driving flows in gold ETFs. This is backed up by our global market research, which shows that retail investors tend to view gold bars and coins as mainly playing a wealth protection role – more so than physically-backed gold ETFs. ETF investors, meanwhile, are likely to be somewhat more focused on the interest rate environment and may have adjusted their holdings as they position themselves for forthcoming tightening measures.

There is also a likelihood that ETF outflows are finding their way into other, less visible, areas of the gold market, such as vaulted allocated accounts. The fact that the gold price held up relatively well in Q3, despite the combination of reduced COMEX net longs and ETF holdings, is supportive of this view. Our monthly commentary, released later this week, provides a little more detail on this possible shift.

Looking forward: full-year continuation pattern expected

The closing months of the year are likely to see a continuation of gold’s varied roles balancing one another out. Strong consumer and central bank demand will encounter weakness in ETF investment and growth in mine output.

Risks to this outcome come mainly from China, where slowing growth might weigh on gold consumption and any further power rationing could create supply bottlenecks in the gold industry, as well as headwinds in the Technology space from continued chip shortages and near-saturation of demand generated by working from home.