Investor confidence in Germany recently jumped to a 21-year high, cheered by an acceleration of the domestic coronavirus vaccine programme and concomitant slowing of the domestic third wave of coronavirus. But while optimism for an economic upturn runs high, it brings with it growing fears of rising prices among inflation-wary German investors.

Google searches for ‘inflation’ in Germany – having been on an upward trend since October last year – surged in February after Eurozone annual headline CPI was reported to have jumped to an 11-month high of 0.9%, since when it has only accelerated.

And with comments from both domestic and European central bankers further fanning the flames of inflation expectations, gold has been very much on investors’ radars. Our Gold Demand Trends data shows that Germans bought more gold bars and coins in 2020 than in any previous year, by some margin. And so far in 2021, they have maintained a pace of investing that far outstrips the historical average, even when compared with the heady levels reached during, and in the aftermath of, the Global Financial Crisis.1

Inflation expectations in Germany reached a 5-year high in March

ZEW monthly indicator of inflation expectations

Investment in gold Exchange Traded Products was similarly resilient in Q1. Compared with the sizable outflows from funds listed in the US or elsewhere in Europe, German funds registered only moderate losses, and have maintained steady – albeit small – inflows since early April. German ETPs now hold €18.4bn in AUM, second only to the UK in Europe and close to the July 2020 peak of €21.8bn.2

We know that German investors value gold as a means of protecting against inflation. In our extensive 2019 consumer research survey, 64% of German retail investors agreed that gold is a good safeguard against inflation/currency fluctuations and 61% felt that it would never lose its value over the long term.3

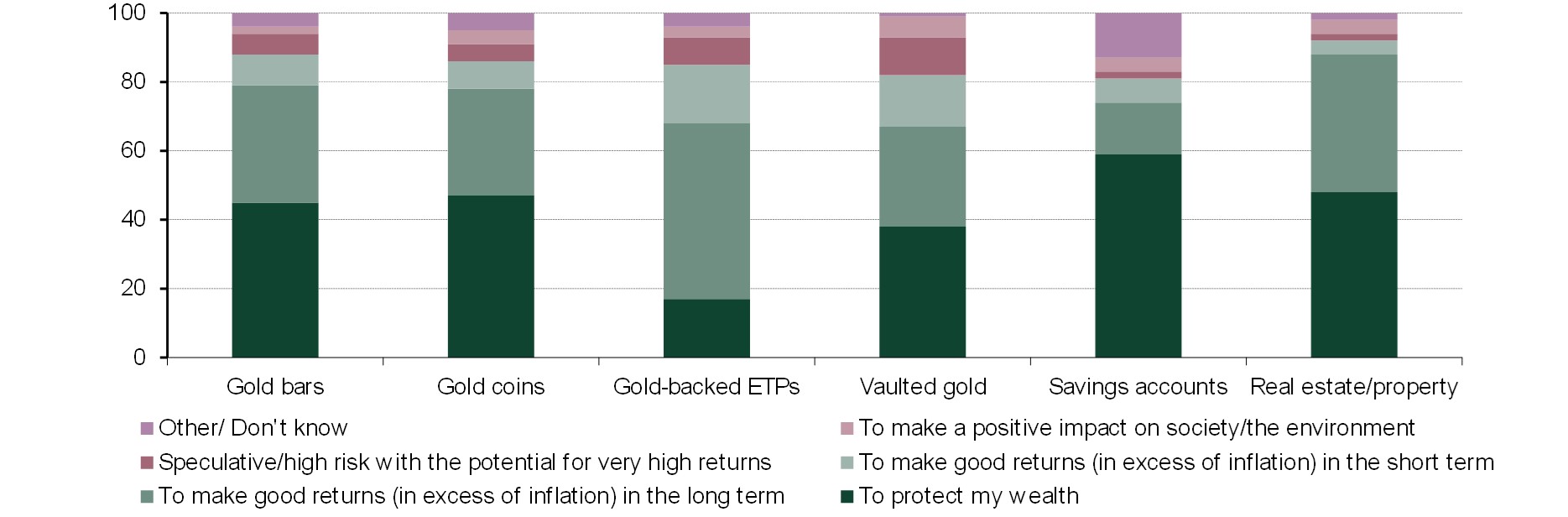

Almost half of the investors that owned gold bars or coins said that the main role of the investment was to protect their wealth. Real estate/property was similarly associated with wealth protection. But savings accounts were yet more likely to be seen as fulfilling this purpose – three in five investors said this was the main role of savings. While negative rates continue to plague Germany savers, investors may continue allocating their wealth to gold and property, rather than see it eroded.

German retail investors see wealth protection as key role of gold, savings and real estate

Almost 50% of respondents said gold bars and coins play this role in their portfolio

% of those surveyed that selected each option.

For survey details, see footnote 3.

Results are responses to the question ‘How would you describe the main role of this investment?’. Respondents selected one of the seven options: To protect my wealth; To make good returns (in excess of inflation) in the long term; To make good returns (in excess of inflation) in the short term; Speculative/high risk with the potential for very high returns; To make a positive impact on society/the environment; Other; Don’t know. Base: currently own each investment product – gold bars (232), gold coins (371), gold-backed ETPs (98), vaulted gold (150), savings accounts (1341), real estate/property (411)

Source: Hall & Partners, World Gold Council

These findings are supported by the results of a study commissioned by Reisebank, which found that ‘value preservation’ and ‘protection against inflation’ were two of the key reasons cited by German investors for wanting to hold on to the gold investments they’ve made in the last two years.

But, rather than just ‘holding on to’ their current gold holdings, German investors have indicated that they are willing to buy more. Our most recent German survey, conducted in November last year, revealed that of those retail investors who had bought gold in the past, 40% said they were likely to buy more over the subsequent 12 months as a direct result of the coronavirus pandemic.4 Interestingly, that intention to invest was strongest among Gen Z and Millennial investors, which also tallies with Reisebank’s findings that more young adults (18-26 yrs) bought gold during the pandemic than older respondents (23% v 16%).

Whether or not escalating inflation in Germany is purely a temporary phenomenon, it seems unarguable that it is preying on investors’ minds. And that tends to go hand in hand with maintaining gold’s appeal. While 2020 set a very high bar that may prove challenging to repeat, German investment is likely to stay elevated for at least the remainder of this year.

Footnotes

2020 annual gold bar and coin investment of 157t was 10% higher than the previous 2011 record of 142.4t. In Q1, German bar and coin demand reached 39t, compared with average quarterly buying of 32.1t between Q1 2008 and Q4 2011.

Values calculated using our ETF tonnage holdings and the LBMA Gold Price PM (EUR).

As of August 2019. Results from a quantitative survey carried out by Hall & Partners of 12,371 men and women across six countries: India, China, Germany, the US, Canada and Russia. The online survey captured the responses of active retail investors – classified as people who had made at least one investment in the past 12 months, excluding those who had only added money to a savings account and had only ever invested in a defined list of non-core investment products. Fieldwork took place in Q2 and Q3 2019.

We conducted a follow-up 10-minute online survey, carried out by Hall & Partners, of 1,000 men and women in Germany, which replicated some of the previous questionnaire, as well as asking specific questions around the impact of the COVID-19 pandemic on investment behaviour and intentions. The screening criteria for active retail investors were the same as for the global 2019 questionnaire and fieldwork took place in November 2020.