Our monthly central bank statistics have been updated today, to include initial February data reported by the IMF and respective central banks. Collectively, central banks tipped back into net purchases during the month: 8.8t were added to global gold reserves. Buying from India (11.2t), Uzbekistan (7.2t), Kazakhstan (1.6t), and Colombia (0.5t) outweighed the only notable sale of gold by Turkey (-11.7t).1 Year-to-date, this puts total global central bank net sales at 16.7t, the weakest start in over a decade.

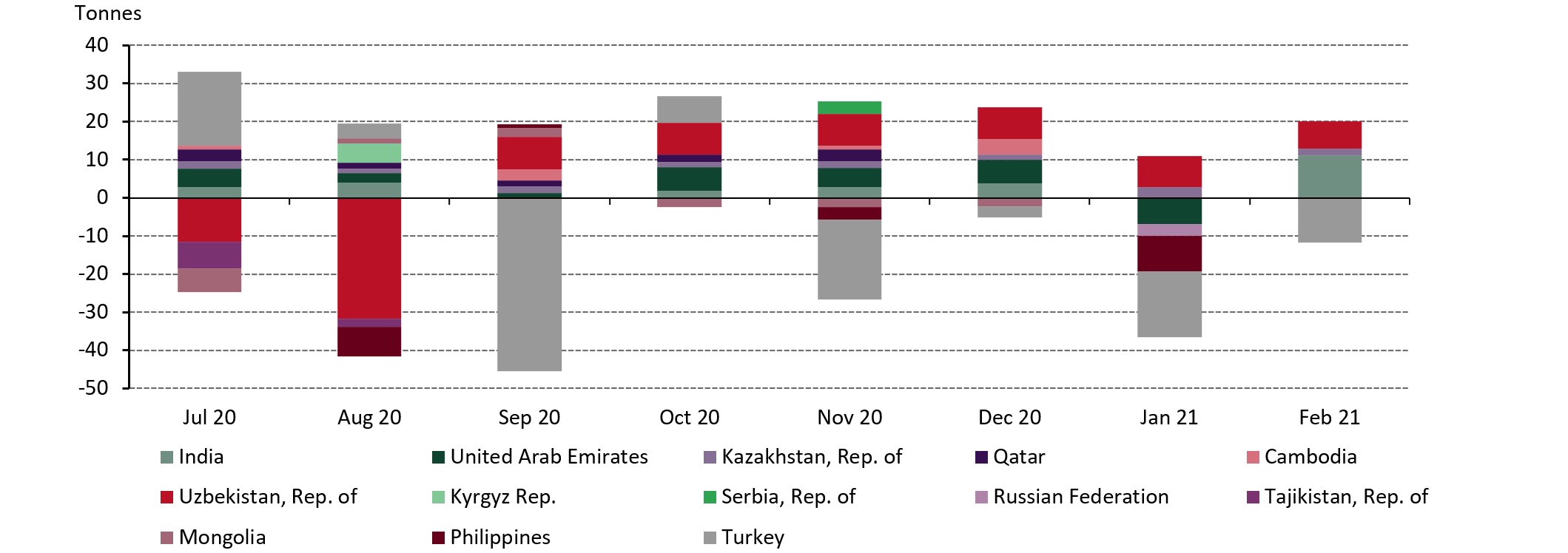

The picture for central bank demand remains somewhat uncertain, with the sector bobbing between net sales and net purchases in recent months. As a reminder, central banks sold a net 25.5t of gold in January, as combined sales from Turkey and Russia outweighed buying elsewhere.2

Taking a broader look at central bank activity, we do not believe that these recent net sales should be conflated with a change in sentiment towards gold as a reserve asset, for two key reasons:

- Selling has predominately come from a small group of central banks whose chunky sales have tipped the balance in certain months. And, as we have discussed before, these sales have been driven by several different factors, such as economic hardship caused by the pandemic, heightened local gold demand, and coin-minting programmes.

- We continue to see consistent moderate net buying from other countries, albeit that these have been similarly concentrated amongst a small number of constituent banks.

Sporadic large sales have tipped the balance in recent months

Central bank net purchases/sales by country*